5 Mistakes You Can Make During Stock Market Volatility

2022, stock market volatility has returned.

We’re into a bear market.

Furthermore, interest rate rises have ensured bonds have taken a hammering.

The perfect storm some might say.

No safe haven.

Investing through market volatility is clearly challenging.

What should you do?

Go to cash?

Remain invested?

Emotions take over.

Below are 5 mistakes investors can make during stock market volatility.

Mistake #1 Switching to Cash

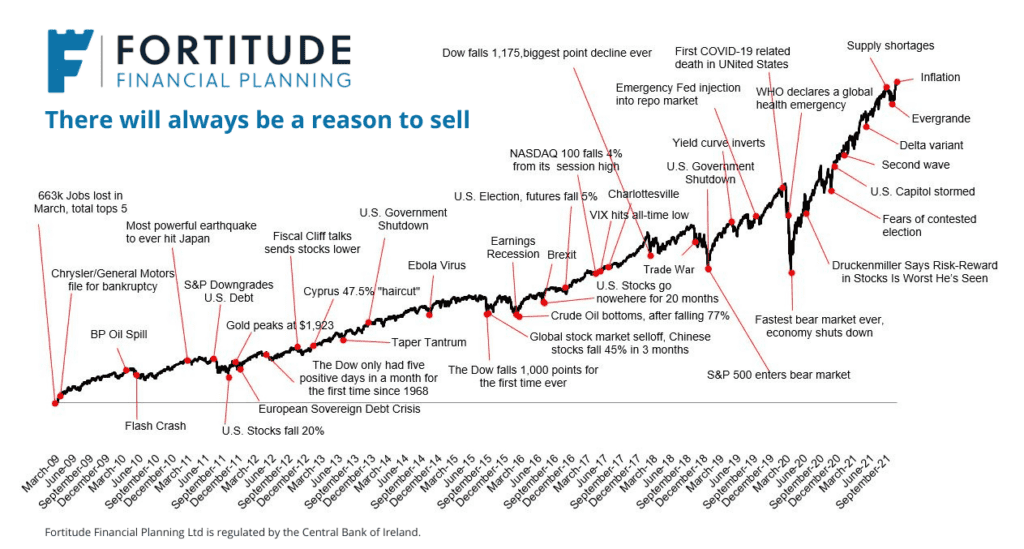

When markets fall, there can be more than an inkling to go to cash.

It’s safe and secure.

Switching to cash may seem like a smart move.

On the other hand, cash doesn’t grow. Inflation does.

It’s impossible to not only time your exit from the market.

But also your re-entry.

You’ll sit in cash and miss the inevitable market upturn.

Therefore you’ll miss out on the subsequent growth that will follow a decline.

Mistake #2 Not putting extra cash to work

When we go shopping, we all love sales.

Maybe you like to get that new golf club at a discount.

Last weekend McGuirks had 10% off clubs, 20% off bags.

Clothing sales, wherever you shop, are always welcome.

Without a doubt, everyone loves sales.

Except when they happen in the financial markets!

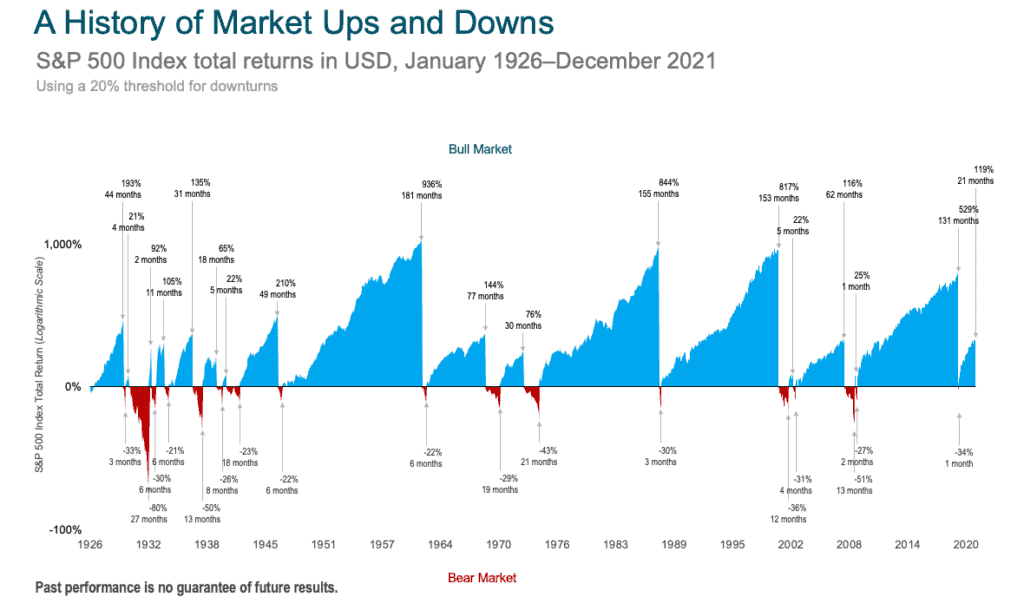

Short-term stock market volatility (and that’s what it is, short-term), breeds fear.

This can result in investors holding onto cash for too long.

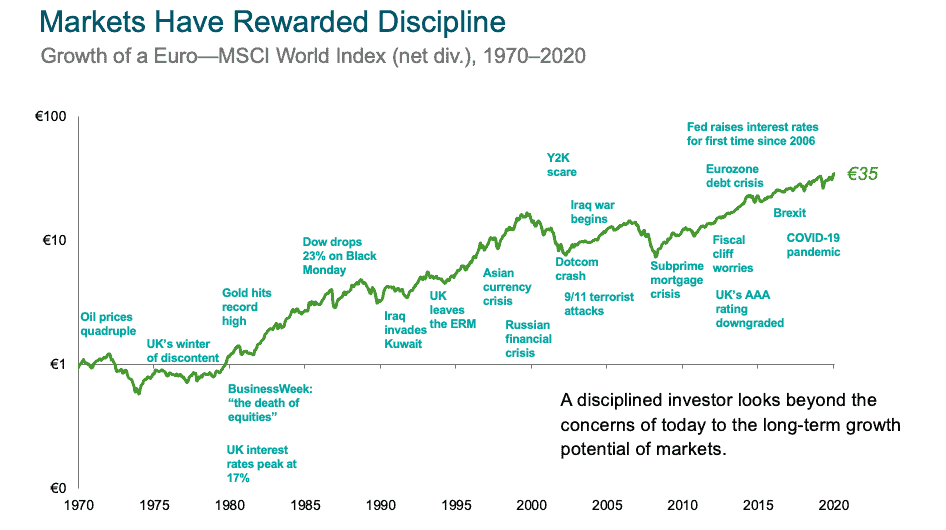

When you’re investing, you’re investing long-term.

Therefore, whether it’s a good time to invest shouldn’t be influenced by market conditions.

Once you check these boxes:

- Emergency fund

- No high-cost debt

- Multi-year investment horizon

Then the best time to invest is when you have the money.

Waiting for the market bottom isn’t an investment strategy.

A bell doesn’t ring at the bottom, there are no smoke signals.

It’s about time in the market, not timing the market.

Markets move up more than they go down over time.

Mistake #3 Failing to Diversify

We’ve covered previously the benefits of diversification.

A diversified portfolio is essential.

However, it’s not magic.

Nor is it a silver bullet solution.

Some methods of diversification are as follows:

- Diversify by asset class

- By fund manger

- Investment strategy – lump sum versus regular contribution

- Geographical region

- Sector

Diversification is essentially spreading your risk.

With the goal being to make the investment journey over time smoother.

Helping you negotiate the stock market volatility.

However, diversified investments will still go up and down.

Just not to the extremes of say, a single stock concentrated investment.

Mistake #4 Failing to review your portfolio

Combining falls in values with the constant negative news, it adds to the anxiety of the investor.

Reach out to a financial planner and review your portfolio during the stock market volatility.

We will provide an objective view.

It’s fact we are biased toward our own money.

A financial planner will provide you with a view that removes that emotion.

Top tip: the best time to review your portfolio is when markets are not volatile.

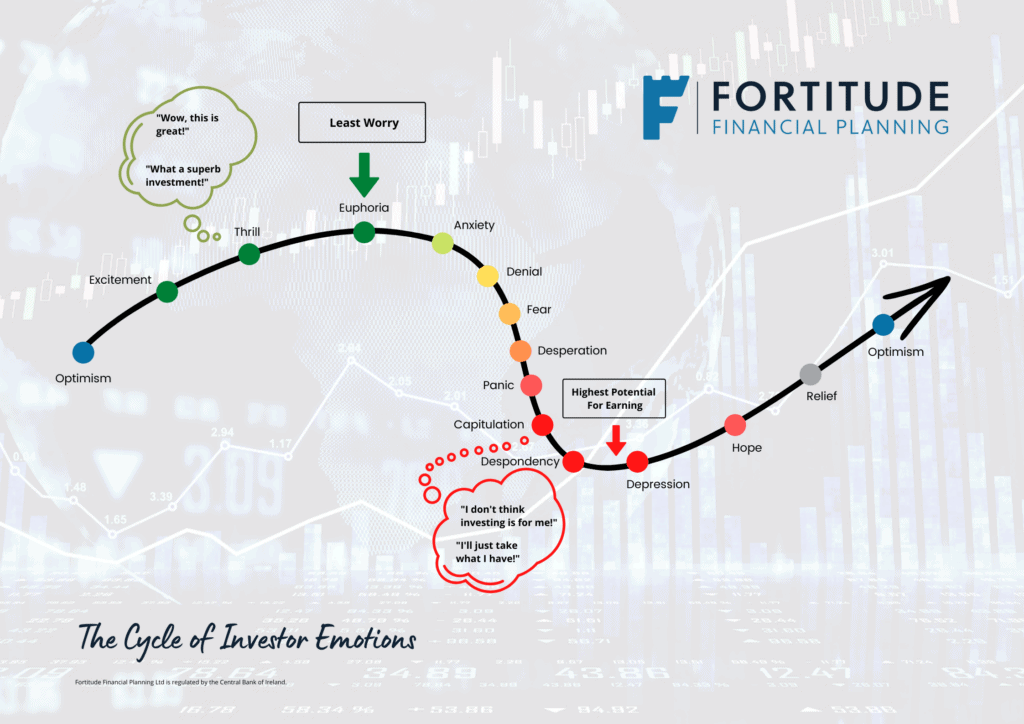

Mistake #5 Letting Your Emotions Rule

Investing is emotive.

As highlighted, we’re biased towards our own money.

Emotions can also be the #1 killer of investment returns.

Investors should not let fear or greed influence their decisions.

Indeed, they should focus on the bigger picture.

Short-term returns can vary, even wildly.

Alternatively, history tells us patient investors are rewarded long-term.

Summary

As Warren Buffet said ‘investing is simple, but not easy’.

He should have added in ‘during stock market volatility’.

Investing is easy when we’re making money.

But that feeling does an about-turn along with the markets.

Emotions can take over and cause us to act irrationally.

Hopefully the above has given you an insight into some of the things not to do when markets are volatile.

How we help

Are you worried about markets?

Have investments or pensions you’re unsure about how they’re doing?

Or is your current advisors’ phone turned off due to current declines?

We’re always happy to see if we can help.

Give us a shout and we’ll talk it through.

If we can help you, add value, we’ll tell you.

If not, we’ll also tell you as we wouldn’t waste your time.

Maybe we can just give you a bit peace of mind.

Get in touch

Either email me, francis@fortitudefp.ie or request a callback.

Give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production