Reasons why financial protection is important when financial planning

When you think of financial planning you may think of pensions.

Savings, investments.

Tax even.

However, protection for your finances is often overlooked.

Financial protection means insurance.

We generally don’t like talking about insurance. House insurance, car insurance, pet insurance.

And we most likely don’t like talking about life cover.

Or income continuance or specified illness cover.

To discuss these means we have to consider our mortality.

Or the fact we may get sick or injured and unable to work.

Also, insurance costs money.

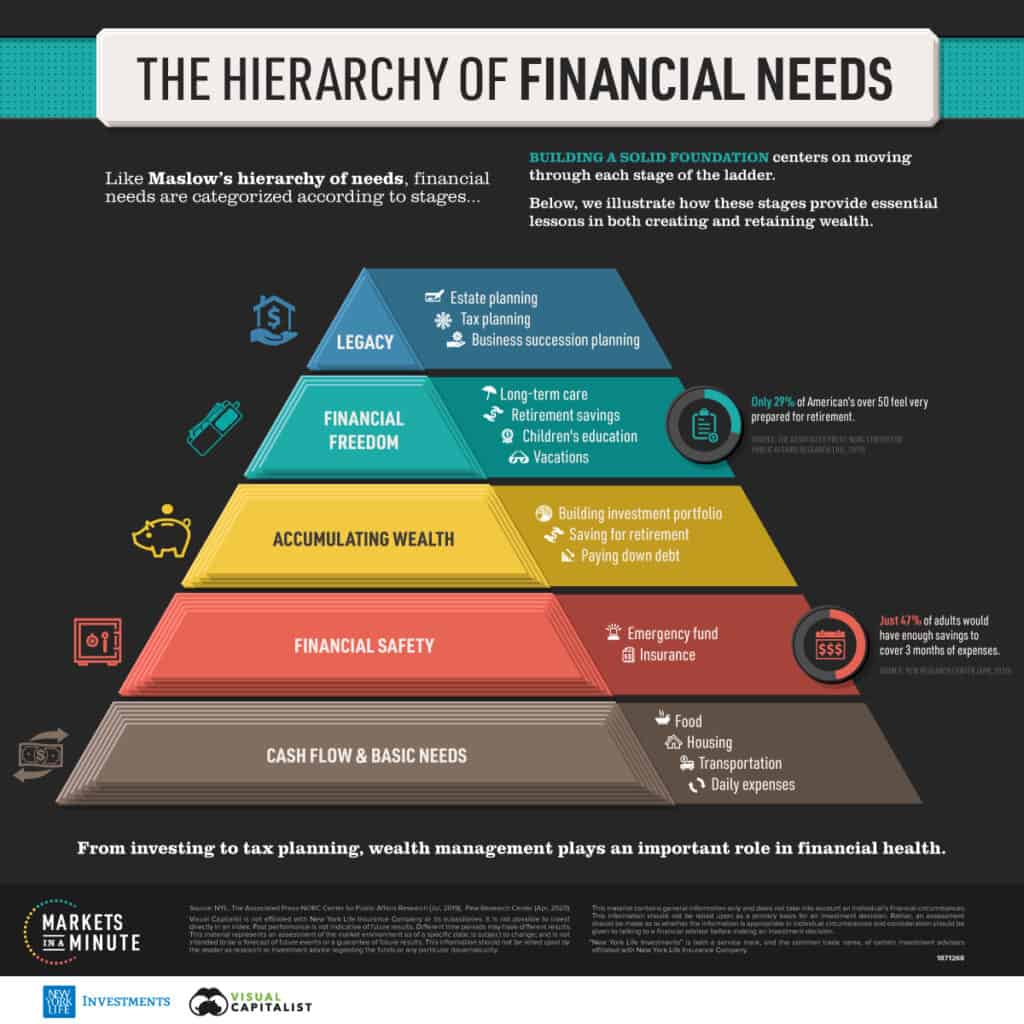

However, protection for your finances is the solid foundation of any financial plan.

Rule number one, protect what you have.

Protect your main asset, your income, future income and your ability to earn it.

What is financial protection?

So, what exactly is financial protection?

The term ‘financial protection’ basically refers to a range of insurance cover.

Insurance cover that protects your finances.

And give you financial security.

Some of the most common types of financial protection cover (in no particular order) are:

Life Cover:

Life cover generally pays out a lump sum on the death of the insured individual.

This provides financial relief for the insured’s family at a time of severe emotional distress.

Are you reading this as a young adult?

If so, check out this article.

Specified Illness Cover:

This cover pays out a lump sum on the diagnosis of a specified illness.

A specified illness as specified in the policy conditions.

The top three reasons for a claim in 2020 were cancer, heart-related and stroke*.

Undoubtedly, this type of cover provides financial relief at a difficult time.

Many people under estimate the financial impact a diagnosis of a serious illness has on a househoold.

Income Continuance:

Without a doubt, we all carry a risk of being unable to work due to illness or injury.

No matter how healthy we feel.

Income protection will provide you with a regular monthly income if you are unable to work due to illness or injury.

Importantly, different from specified illness, income protection also covers injury preventing you from being unable to work, not just serious illness.

Read here on income continuance and who should have it.

5 reasons why financial protection is important

#1 Peace of mind & confidence

When financial planning, you should be considering ‘what if’.

What if I was to get injured or sick that prevented me from working and earning?

How would it affect our families monthly income?

What if I was to pass away unexpectedly? Financially, how would my spouse and kids be?

The correct financial protection arrangements will provide you with peace of mind.

Undoubtedly, peace of mind and the confidence of knowing that no matter what happens to you, financially, the impact on your family will be minimal.

#2 It acts as a safety net

We can make as many plans as we want.

However, it should be noted, they don’t always stay on the correct course.

If something unexpected happens we can become vulnerable financially.

Without a doubt, financial protection acts as a safety net.

For example, if you lost your income for a period of time due to illness or injury, income continuance can provide that safety net of a replacement income.

If you were to be diagnosed with a serious specified illness, specified illness cover will provide a cash injection to alleviate financial stresses and allow you to concentrate on the most important thing, getting fit and healthy again.

#3 It gives you time

In the unfortunate event an illness or injury stops you from working, it can be tempting to get back as soon as possible.

Understandably, due to the reduced income you will be receiving.

Clearly though, getting back asap may not be the best thing for you.

This can then harm your recovery.

Income continuance & specified illness cover give you breathing space.

Importantly you have the financial safety to put your mind at ease and allow you to focus on recovery.

#4 Financial protection for our families & financial dependents

Unfortunately, people pass away, young and old. It’s a fact of life.

For those that pass, we may leave behind financial dependents like a spouse and children.

Another fact of life is that life continues for those that are left behind.

Take me as an example with two young kids.

The bottom line, my kids would still have to be educated if I passed away.

They still have to be raised but, importantly, with one less income coming into the household.

The correct financial protection would remove any financial stress on my spouse.

#5 Debts and Expenses

Do you have any loans or debts?

Mortgage, car loan, bank loan, credit card?

What about future funeral expenses? Funerals are expensive!

The correct financial protection ensures your family are not left with any unwelcome repayments or expenses still to be catered for.

Who needs financial protection arrangements?

Everyone (assuming you earn an income).

This is because your income is your most important asset.

Let us use income continuance as an example.

If you don’t have any, and you can’t work due to illness or injury, the Government benefit is €10,816 per annum.

That’s €900 per month. Compare that to your current monthly salary.

So, if you earn a salary of €40,000, that is a 73% reduction in your income.

The state illness benefit is only there to cover basic living costs.

Therefore, anyone who earns an income requires income continuance at least.

Reasons for life cover can vary.

Some of the more common demographics of people who effect life cover are as follows:

- Couples who have recently got married

- Parents or expectant parents

- People with financial dependants

- Households where there is one main earner

- Business owners or self-employed

- Adults with loans or any form of debt

- Anyone taking out a mortgage (mortgage protection)

An important point to note is that the above list is a guideline and not restrictive.

Take a look at this real life client case study which incorporated financial protection into a financial plan.

The reasons (and myths!) people don’t put financial protection in place

Clearly, at times, there is inertia towards financial protection arrangements.

I come across it in practice, weekly if not daily.

Some people simply refuse to acknowledge the need for it.

They feel they are bulletproof.

Though why anyone would insure their house, car or pet before their income escapes me.

Without their income they couldn’t pay for these insurances.

Here are some of the reasons we see people not putting financial protection in place:

- It costs too much – it costs money alright but not necessarily too much. Protection can be matched to any budget and tax relief is available on income continuance.

- It won’t happen to me – 45,000 people in Ireland get cancer every year**. Closer to home, look around. Unfortunately, we have all heard of someone who has suffered a serious specified illness or a premature end. It can happen to us.

- Insurance companies don’t pay claims – again incorrect. Importantly Aviva paid 92%*** of income protection claims in 2020 with one of the main reasons for non-payment of claims being non-disclosure by the insured.

- I have savings – yes you do however once we run a cash flow analysis they will run out pretty quickly, guaranteed.

- My employer provides sick pay – A lot of employers do but this is generally only for a few months (typically 6). After that, no employer will pay you once you are off sick as you are not doing anything for them.

There are others but the above gives a good idea of some of the challenges we see towards financial protection.

Discuss Your Protection Requirements

Is it expensive?

In my opinion no.

Example No 1

A 46 year old male, non-smoker can get €250,000 (quarter of €1m) life cover to age 65 for less than €50 per month.

Included in this, at 65 they can take out a new policy with no medical underwriting, irrespective of their state of health.

Example No 2

Using the same 46 year old.

We will assume a salary of €45,000 per annum.

€23,000 income continuance can be sought to age 65, the cost would be €95 per month before tax relief.

€57 per month after tax relief.

€57 per month to cover 75% of this individuals salary (including the state benefit) for the next 19 years.

Furthermore, if it is forthcoming, the claim will increase in payment to combat inflation.

Summary

There are a number of reasons why financial protection is an important part of financial planning.

I’ve only outlined 5 above.

More importantly, everyone should have some form of financial protection in place.

For instance, most people reading this, if not retired, will be earning an income of sorts.

Therefore there is an immediate need for income continuance.

Above all insurances, income continuance is the single most important cover anyone can have.

That is above life cover, specified illness cover, house insurance, car insurance, pet insurance etc.

Unquestionably, if we get injured or sick and can’t work to earn an income, our income reduces.

The need for life cover or specified illness cover can vary but the rule of thumb, if you work and earn an income you have a need.

How we help

Avail of the Fortitude Financial Planning financial protection review.

Learn more here about why you should review your existing life cover policies.

We will analyze your requirements and your current arrangements in place.

Then, we will determine the correct level and type of cover for you and make any recommendations.

Firsts and foremost, we believe in affordability.

You won’t be recommended anything from us you can’t afford.

We will utilise our budget calculator.

As an illustration, if you can afford €50 per month, we put it in.

Then we determine what covers you can get for the €50.

It may not be your full requirement but some protection is better than none.

We will make sure you are not under or, just as importantly, over insured and paying too much.

Our recommendations will be as cost and as tax-efficient as possible.

We will cover your family financially, giving you peace of mind.

Schedule Your No Obligation Chat

Get in touch

Take the first step to kick off your protection review, request a callback.

You can also drop me an email directly, francis@fortitudefp.ie give me a call, 086 0080 756 or even access our diary here and book a call at your convenience.

We are happy to have a no obligation chat with you initially.

We can discuss our process and what we require from you.

Visit our content library.

Over 40 articles on various subjects learn more about our experience and expertise.

A wealth of free information on hand, covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

*Source: Irish Life 2020 claims statistics.

**www.cancer.ie

***Source: Aviva 2020 claims statistics

Production

Production