6 potential ways to reduce your inheritance tax bill (legally!)

Last week on this page we touched on inheritance tax and in particular Section 72 Inheritance Tax Life Insurance.

After paying taxes our whole lives, on death, we can leave behind a significant tax bill.

Capital Acquisitions Tax (CAT), also otherwise known as inheritance tax.

The rate, is a whopping 33% on lifetime inheritances and gifts received.

Clearly nearly one-third of our estate.

It should be noted, it can be very difficult to completely avoid inheritance tax liability.

Nevertheless, with careful planning, one can (legally!) reduce the amount of inheritance tax their beneficiaries can end up paying.

What is Capital Acquisitions Tax (CAT)

CAT, also known as inheritance tax, is a tax payable on gifts and inheritances we receive in our lifetime.

As mentioned, the rate is 33% over certain thresholds.

Who has to pay inheritance tax?

Inheritance tax affects anyone receiving gifts or inheritances over certain tax-fee thresholds.

Firstly, the person giving the gift/inheritance is the disponer.

Secondly, the person receiving the gift/inheritance is the beneficiary.

The threshold amount is based on the beneficiaries’ relationship to the disponer.

How much gifts and inheritances are tax-free?

When it comes to determining the tax-free threshold, there are three groups the relationship of the beneficiary and the disponer will fall into.

Group A: €335,000

This group applies to:

A child (including an adopted child and stepchild) or a minor child of a deceased child of the disponer

Group B: €32,500

This group applies to a brother, sister, niece, nephew, grandparent, lineal ancestor or lineal descendant of the disponer.

Group C: €16,250

This group applies in all other cases.

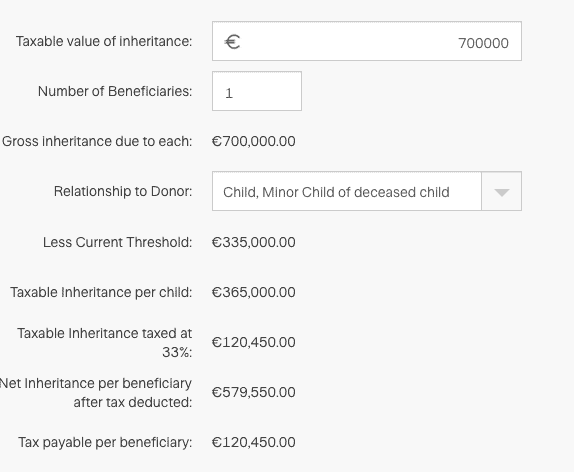

Example:

Briefly, let us look at a working example under Group A.

We will assume Johnny is an only child and inherits the following on the death of the second of his parents:

- Family Home valued at €500,000

- Cash assets of €200,000

To summarise, Johnny has to use €120,450 of his cash inheritance to pay tax, thus reducing his cash inheritance to approx €80,000.

Therefore, if you are the disponer, you’ve gifter €120,450 to Revenue.

Let’s assume there was no cash and just the family home at €500,000.

Johnny’s tax bill becomes €54,450 (€500,000 less €335,000 x 33%).

Consequently, if Johnny doesn’t have €54,450 to pay the tax, he then has to either sell the family home or borrow, neither a desireable outcome.

Inheritance Tax Exemptions & Reliefs

Here are 4 reliefs you can potentially use to lower your inheritance tax liability:

Business Relief

If you inherit a business, you may qualify for business relief.

Business relief can allow the value of the qualifying business to be reduced by 90% when passed to a beneficiary.

Consequently, significantly reducing the amount of inheritance tax payable.

Importantly, the beneficiary must retain the business for a minimum period of six years and must ensure certain conditions are met.

Otherwise, there may be a clawback.

All conditions to qualify for Business Relief can be found here.

Dwelling House Exemption

Undoubtedly, a key exemption in estate planning is ‘Dwelling House Exemption’.

As a result of this exemption, the beneficiary who inherits a house under the dwelling house exemption will not be liable for inheritance tax.

The rules of this exemption are as follows:

- The home must be the residence of the person who passed away

- Furthermore, the beneficiary must have lived there for three years before the homeowners’ death as their main or only home

- In addition to this, the beneficiary must remain living in the home for six years after it is inherited

- Finally, the beneficiary must not have an interest in any other property, including any property received as part of the same inheritance

However, it should be noted the above do not apply if the beneficiary is over 65 at the time of the inheritance, is required because of an employment to live elsewhere or is required to live elsewhere because of their physical or mental state as certified by a doctor.

Agricultural Relief

Similar to ‘Business Relief’ where the value of the agricultural property can be reduced by 90%.

In this case, to qualify for ‘Agricultural Relief’, your agricultural property must pass the ‘Farmer Test’ as outlined by Revenue.

This is where the value of your agricultural property must consist of at least 80% of your total property value on the valuation date.

You can learn more about ‘Agricultural Relief’ here.

Favourite Nephew or Niece Relief

A beneficiary may qualify for Favourite Nephew or Niece relief if they receive a gift or inheritance of business assets.

The relief allows the use of the Group A threshold, subject to conditions.

For the purpose of this relief, the beneficiary is a nephew or niece if they are:

- the child of the disponer’s brother

- the child of the disponer’s sister

- the child of the disponer’s brother’s civil partner

- the child of the disponer’s sister’s civil partner.

In order to qualify for this relief, the beneficiary must have worked for the disponer for five years immediately prior to receiving the gift or inheritance.

As well as that, you must have worked for more than 24 hours per week at the place of business or 15 hours per week at the place of business where the business is carried on exclusively by you and either the disponer or the disponer’s spouse or civil partner.

You can find more about ‘Favourite Nephew or Neice Relief’ here.

Small Gift Exemption

Everyone should avail of the small gift exemption when estate planning.

The ‘Small Gift Exemption’ allows anyone to gift up to €3,000 per year to anyone without them being liable for tax on the gift and it doesn’t count towards inheritance tax thresholds.

Section 72 Inheritance Tax Insurance

We covered this one last week, you can read it here.

A Section 72 insurance policy is simply a life insurance policy that is exempt from inheritance tax once it helps pay toward a disponer’s inheritance tax bill.

I like to think of them as a form of savings policy for clients.

For instance, clients pay a premium now that will then be used to help pay an inheritance tax bill when they die.

Otherwise, the cost of the Section 72 will remain on the clients balance sheet and be assessable for tax on death.

So, either get the money off the balance sheet, it’s not assessable for tax and is used to clear tax (tax efficient) or leave it on the balance sheet where it inevitably becomes assessable for tax (definitely not tax efficient!).

Summary

To summarise, no one likes tax.

Income tax, USC, VAT, Capital Gains, Capital Acquisitions.

It’s unlikely, depending on the size of a disponer’s estate, to eliminate a future inheritance tax liability completely.

However, by engaging in the estate planning process, it is possible to reduce any potential tax liability.

Yes, I understand the argument ‘the kids will have enough’ or ‘the kids can deal with it, we had to make our own way in life’.

On the other hand, as yourself this:

‘When I pass away, who would I prefer to get a % of my money, my family or the tax man?’

How We Help

Disclaimer, we are not tax planners.

However, we work with them on our clients’ behalf.

Between us, we get a cohesive, all round plan in place for our clients.

Ensuring that clients leave as little to the tax man as possible.

Are you concerned about a potential CAT bill you’ll leave behind?

We can help talk you through these issues, what you should be considering and get you kick started to planning your estate tax efficiently.

Get in touch

To discuss further email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production