7 Quick Tips to Improve Your Financial Literacy

Did you know that April is Financial Literacy Month in the USA?

Financial Literacy Month is designed to bring more financial education to everyone.

Whether you’re a financial wiz or just learning the ropes, there are so many ways exist to improve your financial literacy.

This in turn improves your overall wellbeing.

I’ve mentioned in previous articles the proven link between finances and mental wellbeing.

Here are seven things to help get you started.

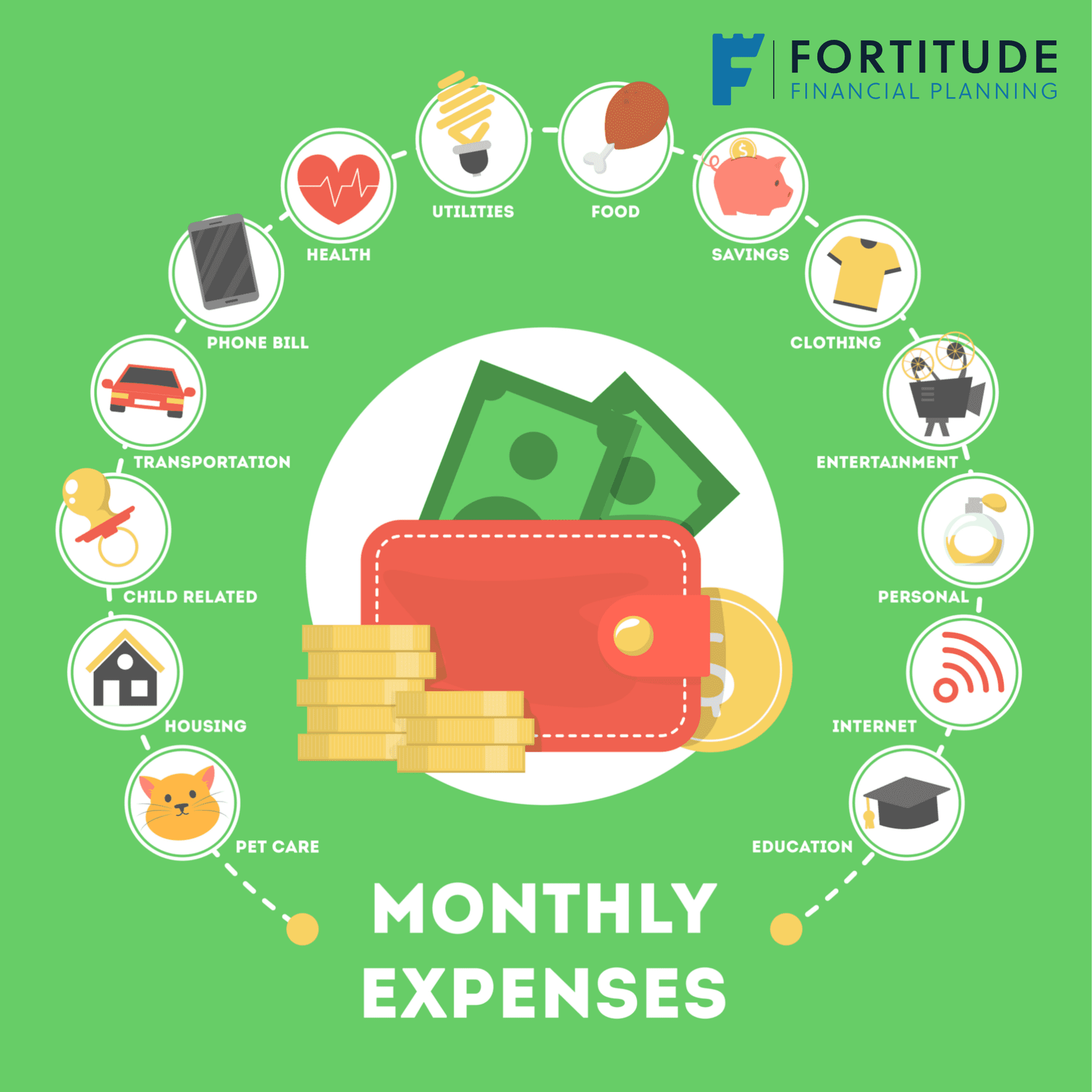

#1 Make a Monthly Budget

As boring as it sounds, one of the most important steps in ensuring financial success is creating a monthly budget.

This may sound simple, but a budget is your financial strategy’s foundation.

Creating a monthly budget doesn’t have to be complicated.

Here’s how to ensure you’re setting yourself up for financial success:

- First, calculate your gross monthly income. This could include your salary, investment income, state benefits, child support, freelance work, or other income sources. Remember to calculate your net income as well, which is how much is left after taxes and other deductions.

- Speaking of priorities, consider your financial priorities and allocate your budget accordingly. In addition to your regular monthly expenses, you might decide to increase your general savings or earmark money toward a large purchase such as a home or car. The important point is to decide what’s important and to make sure your budget reflects those values.

- Finally, create expense categories for where your money is spent and track each and every expense. It’s important to differentiate between wants and needs. You need to pay the rent or mortgage payment, but you want a new pair of shoes or a nice dinner out. By tracking your spending, you can determine whether your budget is aligned with your priorities or if you should make adjustments to meet your goals.

Make this even simpler.

Download our free, interactive budget template here.

#2 Take Stock of Where You Are

If you don’t know where you are then you don’t know what you can do to improve.

This advice applies to all walks of life, including finances.

Creating your budget, outlined in #1 above, will help you considerably.

You will learn exactly what is coming in and more importantly what is going out.

And where it’s going.

This will then allow you to take small incremental steps to improve your position.

#3 Check Your Credit Rating

If it’s been a while since you checked your credit score, now is a great time to see where you stand.

Your credit score is an important metric when considering your financial health and will play a larger role when you apply for loans, especially mortgages and car loans.

If you have a higher credit score, you may qualify for lower-interest debt, which will save you money.

You can check your credit rating on the Central Credit Register.

Reviewing your credit report is important to ensure there aren’t any mistakes or incorrect accounts assigned to you.

If you notice something on your credit report that doesn’t look accurate, such as a loan or credit card you don’t remember opening, contact your financial institutions immediately.

You can apply for your credit rating report here.

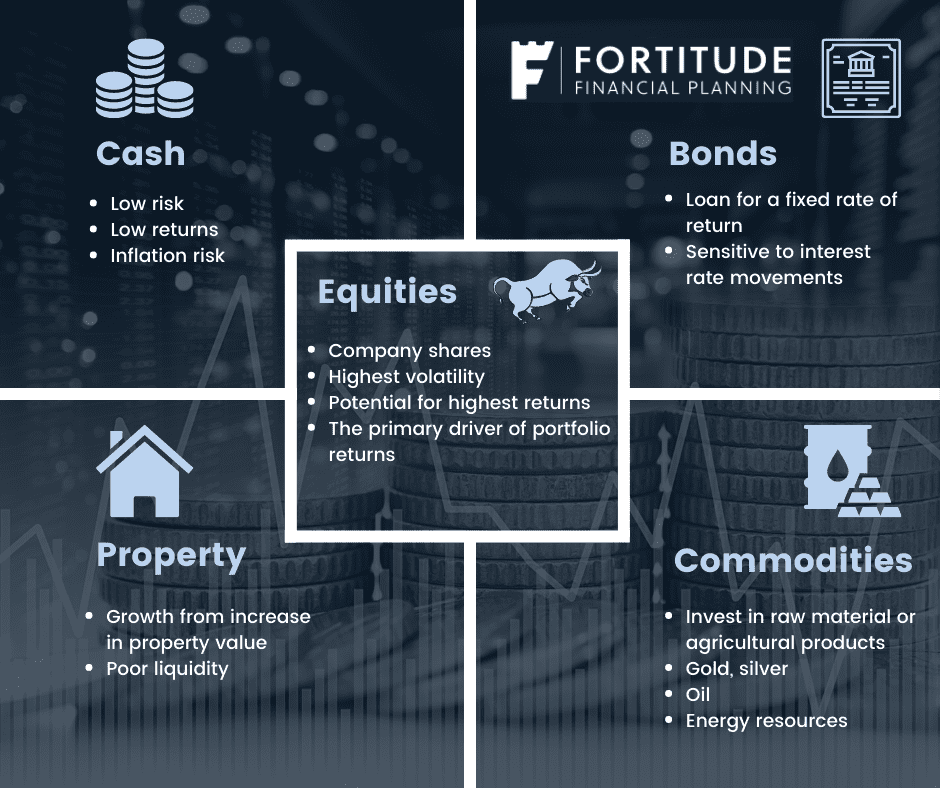

#4 Understand Your Investment Options

The simplest way to grow your wealth – invest.

As you become more financially literate and feel comfortable talking about finances, you should consider looking into investments that are aligned with your goals.

There are different types of investments and working with a financial planner like us can help you understand your options.

You should also educate yourself on some of the most common investment types, including:

- Stocks

- Bonds

- Alternatives

- Funds

New to investing? Check this Investing for Beginners article.

Never invest without speaking to a fully qualified financial professional.

Schedule Your Investment Consultation

#5 Don’t Be Afraid to Ask Questions

Talking about finances can be intimidating, but we all must start somewhere.

Money and finances can very much be a taboo subject.

This Financial Literacy Month, make it a goal to learn one or two new facts about finance.

You can turn to ourselves and financial publications to get your questions answered without feeling naive or silly.

Trust me, there’s no such thing as a dumb question when it comes to finances.

Financial literacy doesn’t come from making big leaps but rather from taking one step at a time.

Please, don’t be afraid to ask questions, just pick up the phone.

#6 Pay Yourself First

You’ll find this concept in lots of books and publications.

It’s just like saving up for your future like you usually do, but in this case, change your perspective.

What most people do is as soon as they get their salary, they start by paying the bills, the rent or mortgage.

All that boring stuff.

The key to being on the correct road financially is to pay yourself first.

Put a particular amount aside as savings or investments to benefit yourself.

After all, you’re working for yourself, not for someone else.

#7 Set defined money goals

Where do you want to be financially at the end of this year?

That’s the most dreaded question for every beginner, but it does give some self-realization.

Do you really know where you stand?

Or, if what you’re doing right now is good, bad or indifferent?

What you are doing now, will it benefit you?

You won’t know any of that unless you make a definite goal for yourself.

It doesn’t matter whether you achieve it or not.

Don’t obsess over your plans.

If you have goals, at least you’ll be able to compare achievements to your expectations, and who knows, maybe you end up exceeding them?

Also, once you start achieving your financial goals, don’t reward yourself by spending a hefty amount.

Instead, upgrade your goals for the coming year to keep testing your limits.

How We Can Help You

Are you serious about improving our finances?

That’s what we do.

We can take you through our financial planning process.

You will learn exactly where you are financially.

What’s good, bad, indifferent.

We will also advise you on achievable steps you can take to improve your financial picture.

Both in the present and into the future.

We will plan with you.

Then protect what you have.

And then grow your wealth for you.

Get in touch

Let’s talk.

We give everyone an initial call or meeting at our expense.

Here we can talk about our process and what you can get from it.

More importantly, how it works and how you’ll benefit.

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our content library.

Last but not least, we have over 50 articles on various financial subjects and learn more about our experience and expertise.

A wealth of free information on hand, covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production