Online apps and platforms mean it’s easier than it’s ever been to buy and sell stocks on your own.

However DIY investors can fall foul to common mistakes that increase risk, cause stress, cause financial loss and as a result see them fall short of their financial goals.

Are you frustrated with the level of growth you experience when you attempt to invest on your own?

Do you feel left out when your friends or your coworkers talk about how much money they are making in the market while the value of your portfolio barely budges?

Ireland’s deposit levels are at all-time highs will deposit rates are at all-time lows. Are you concerned about getting no return on your money and watching inflation erode the true value of it?

If the answer is yes to any of the above, it is probably a good time for you to take the next step in your investing journey and ditch DIY investing and consider working with a financial planner.

A financial planner can help you bring your portfolio to a higher level.

7 Reasons to Stop DIY Investing

We can help you navigate the many pitfalls DIY investing carries including:

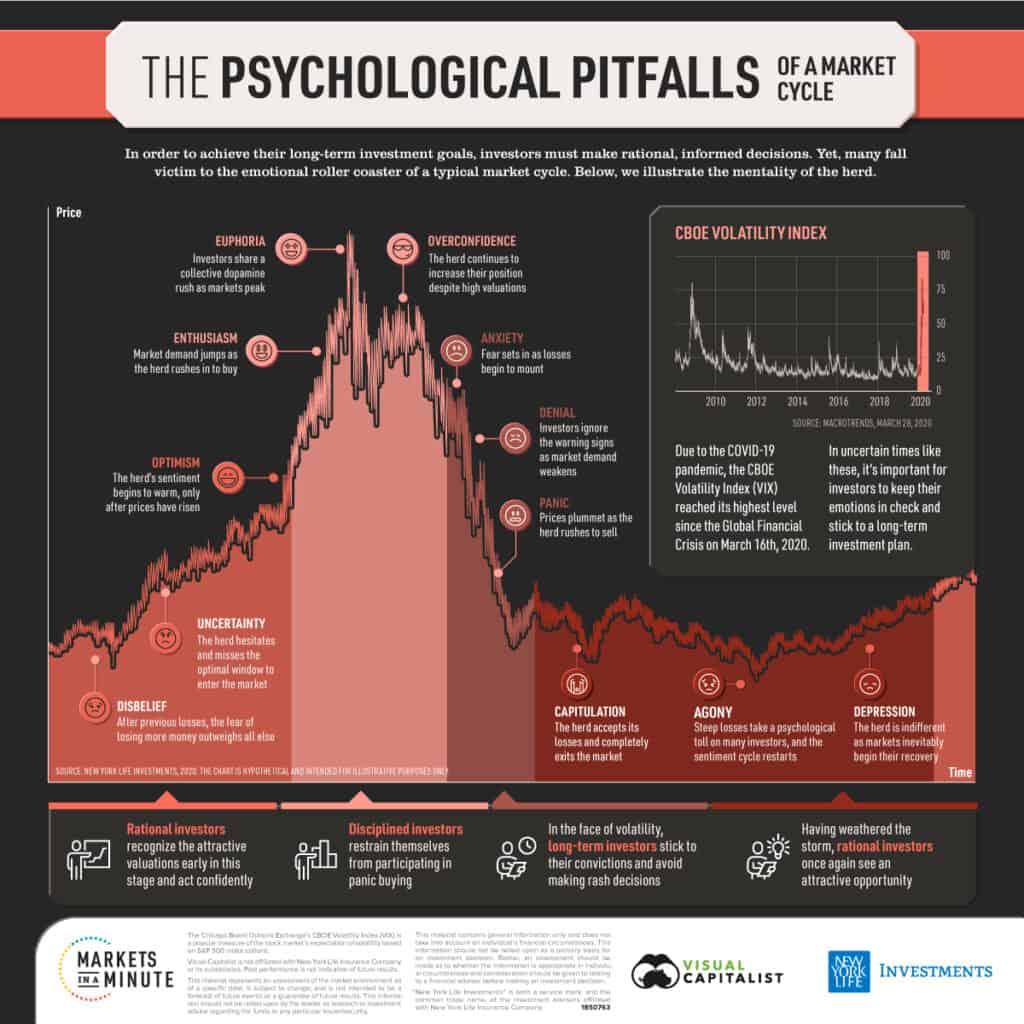

1. Removing the Urge to Trade on Emotions

Investing is an emotive activity.

You’ve probably become more than a little emotional when you think about your money and financial decisions.

And when it comes to investing, listening to these emotions more often than not can end disastrously.

It takes a particular type of person to be able to put aside feelings and make the correct decision every time.

A financial planner is free of any emotional attachments and is able to choose whatever action is best for you and your wallet.

*Source www.visualcapitalist.com

2. Failing to Employ a Disciplined Process

Hunches and tips rarely work out in the long run, but choosing and sticking to a proven investment strategy does.

We have years of investment experience to use as a guide, and will never risk your money over a gut feeling or a rumour.

You can read more about our process here.

3. Avoiding Rebalancing a Portfolio

Selling a well-performing asset to buy another financial instrument that is underperforming is crazy, right?

Well, not if you know what you are doing.

Most DIY investors are reluctant to make such seemingly counter-productive moves, but sometimes it makes sense to take the risk.

4. Putting All Your Eggs in One Basket

Do you own shares of the company you work for?

Do you love buying rental property?

The old adage, ”Only invest in what you know,” sounds like good advice, but if you don’t have experience with several types of financial assets, your portfolio probably isn’t diverse enough to offer you very much stability.

We ensure that your investment strategy is well diversified to minimize down markets.

5. Selling When the Market Gets Scary

The number one mistake investors make that causes them to lose money.

The market is down for the second week in a row, and the value of your portfolio is dropping like a stone.

Are you going to have the stomach to stick to your investment plan?

Most DIY investors don’t and wind up not only selling their investments for a loss but missing out on the very lucrative rebound.

We don’t get scared by adverse market conditions, It’s part and parcel of the investment journey.

Our clients are in the market to take advantage of the rebound.

6. Trying to Call Tops and Bottoms

You have heard it a thousand times, “buy low, sell high,” but attempting to call the tops and bottoms of a volatile market can cause you to lose out on a good profit.

You need to get not one, but two decisions correct. When to get out and when to get in.

It may work occasionally but it is not a consistent, repeatable approach.

It’s about time in the market, not timing the market.

7. Sleepless Nights

Investing on your own can be stressful. If the market is up, you are worried about whether you should ride the wave as long as possible or take your profit now.

But if the market is down, it is even worse. You are terrified your investments will never recover.

Why do that to yourself? Why make investing harder than it has to be?

Work with a CERTIFIED FINANCIAL PLANNER™, stick to the plan they create for you and then rest easy.

Take your life back and build a stronger, more robust portfolio for your personal and retirement assets today by speaking with us today.

Summary

As Warren Buffet famously said “Investing is simple but not easy”.

Anything that can provoke emotions is rarely straightforward.

If you have investments or retirement funds already we would be happy to review them for you.

We will match them to your tolerance and capacity for risk and your investment objectives and provide you with an honest summary of their suitability.

That is what our second opinion service is for or download our free guide to 5 simple and effective investment principles.

Give me a call on 086 0080 756, request a callback or drop me an e-mail.

Francis McTaggart CFP® SIA RPA QFA

Disclaimer: All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production