In your Mid 20’s or 30’s? 5 actions to take for your future wealth creation

Are you in your mid 20’s or 30’s?

Do finances feel boring?

Well pay attention, take it from an old (I feel like it anyway) dinosaur, you’re missing a trick!

I wish I knew 20 years ago what I know now.

Unquestionably, you will have heard the term ‘Grow Your Wealth’.

However, what does it mean?

Don’t just save in the bank, start investing, smartly.

Generate growth on your money.

Investing is a proven way to grow money and in turn your wealth.

Before Investing

Before investing, it’s important to check a few boxes.

Firstly, ensure you have an emergency fund built up.

We recommend between three and six months of net after tax take home pay.

Hold this in a short term no risk structure like the bank.

Secondly, pay off any short term bad debt.

Stuff like credit cards and loans, high interest stuff.

Once you check those boxes, you are ready to consider how to build your future wealth.

Action #1

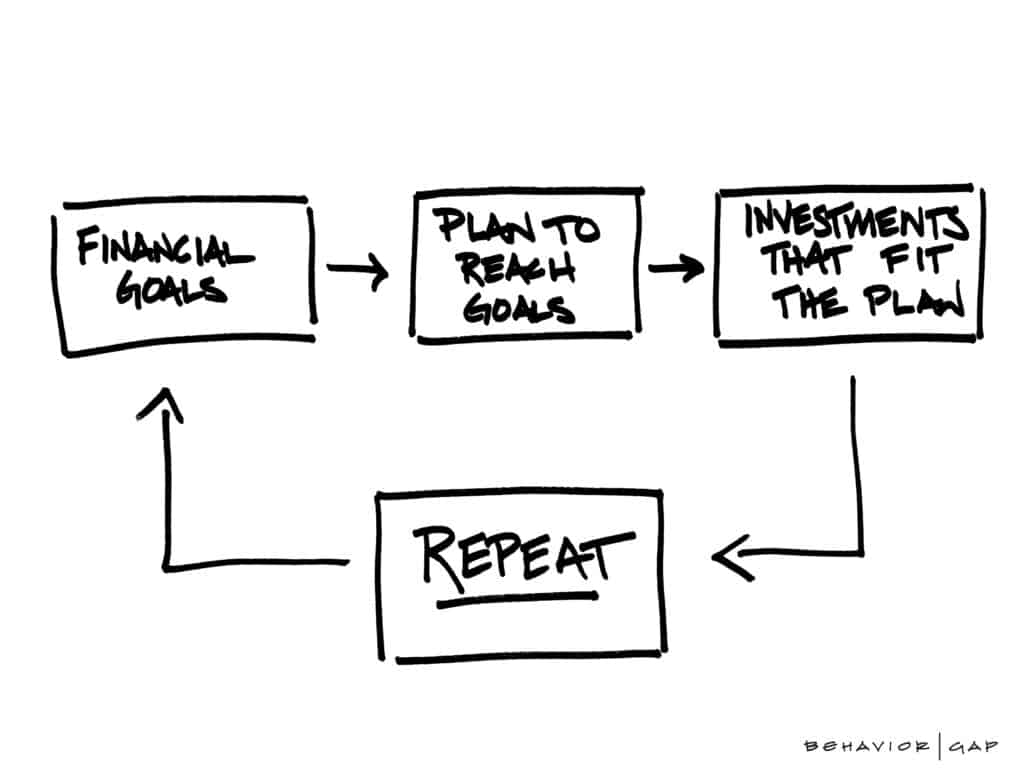

Now, try and start with the end in mind.

Get a clear understanding of what your investing goal is.

What are your objectives?

What do you want to achieve?

In addition, how much risk are you willing to take on?

Furthermore, what is the timeline?

Is it retirement, many years away?

Alternatively, is it shorter term like getting on the property ladder?

Undoubtedly, with clear goals, you can create a clear plan.

Importantly, this means you can create the correct strategy for your plans.

Action #2

Right, importantly you’ve now got your goals and objectives.

Secondly, think about what assets will help you achieve them.

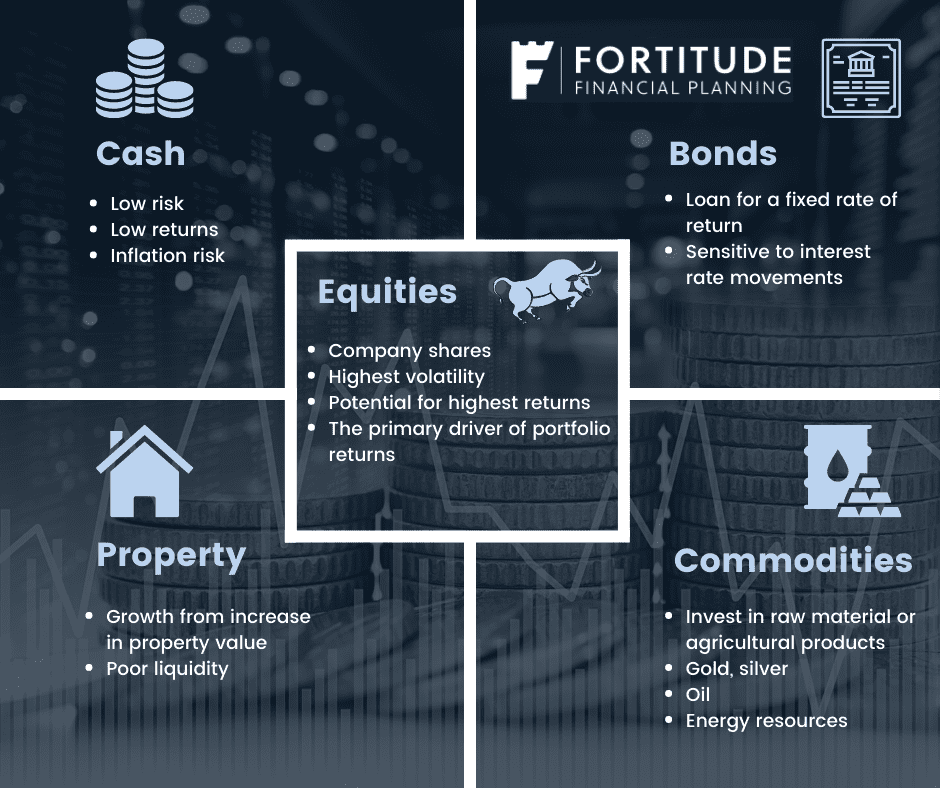

The main assets are equities, bonds, cash, alternatives and property.

How you allocate across these assets is usually dictated by the level of risk you wish to take.

Equities are without a doubt the main driver of portfolio returns.

On the other hand they carry the greater risk and volatility.

The greater exposure to them, the ‘riskier’ the portfolio.

Your asset allocation should be dictated by three elements:

- Your risk tolerance

- Your capacity for risk (of which your investment time horizon is an element of)

- The actual objectives of your investment

Usually, if you are comfortable with more risk and want more return, you’ll have a higher exposure to equities.

Action #3

Thirdly, diversification.

If you are a regular reader here, you will have heard about it.

To repeat what I previously say, diversification is essential.

Do not put all your eggs in one basket.

Therefore, spread your investment across different asset classes.

This clearly helps you manage the risk and ensures you are not over exposed to one area.

Furthermore, diversification takes on many forms.

For example, within your equity component, you can spread the risk.

Across different sectors and geographical regions.

In addition, investment strategy.

Lump sum versus regular contribution.

Even so, diversification is not a silver bullet.

Your investment will still go up and down but diversification makes the journey smoother.

Action #4

Review your investment regularly.

Unquestionablyy this will keep you up to date with your performance.

As well as that it allows you to identify any changes you may need to make.

Changes like are you paying enough money in?

Life changes. Marriage, divorce, babies, receiving an inheritance.

Regular reviews ensure any changes to be made can be picked up.

Action # 5

Finally, maintain your disciplineand be patient.

Investments do not run in a straight line.

Nor are they a get rich quick scheme.

There will always be a market drawdown.

Despite this, it’s super important to stick to your plan.

Don’t let your emotions take charge.

Market volatility, in the short term, is the price you pay to participate in market returns.

Summary

5 actions for wealth creation.

Anyone can create their own wealth by following the correct course of action.

Investment markets will allow you this opportunity.

Nevertheless, it’s important to do it correctly and smartly.

Take advice.

How we help

At Fortitude Financial Planning we work with many clients in their 20’s and 30’s.

We’ve identified them as a cohort who can be left behind by this industry, unfairly.

Left behind because they don’t have the large assets that ‘advisors’ want.

Nonetheless, we want to help this cohort to create these assets.

Book a call with us.

Get in touch

Either email me, at francis@fortitudefp.ie or request a callback.

You can get me on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production