Income Protection Insurance – the most important insurance or financial product anyone can own.

A 30-year-old female, non-smoker, retirement age 65, has a 64% chance of being unable to work for one month or more due to illness or injury.*

If they smoke this increases to 81%.*

Illness or injury can stop you from working.

That’s nearly a two-thirds chance.

This then creates a disruption to your ability to earn an income.

There is a risk of illness or injury at some point during your prime working years.

It’s foolish to not address it.

It’s important to consider the role income protection insurance plays in providing a replacement for lost or reduced income.

How important is income protection

Very.

People get sick or injured. We all know someone.

If we get sick or injured, our income decreases, or even stops, depending on your circumstances.

Your expenses don’t decrease or stop.

They likely go up due to increased medical bills!

Assuming you are on a salary of €50,000 and you can’t work due to illness or injury.

Your income drops to €10,556 provided by the Government (more below).

That’s an 80% drop in your income.

But not an 80% drop in your expenses.

Social Welfare Benefit

Many people look to state benefits as a way to meet their income needs when illness or injury occurs.

They think the Department of Social Protection (DSP) provided benefit will be sufficient.

The DSP pays a benefit to those who satisfy PRSI conditions.

This benefit is €10,556 per annum or €879 per month.

How adequate is this?

The truth is for most households it’s not.

If you are renting or have a mortgage, it likely wouldn’t even meet this cost.

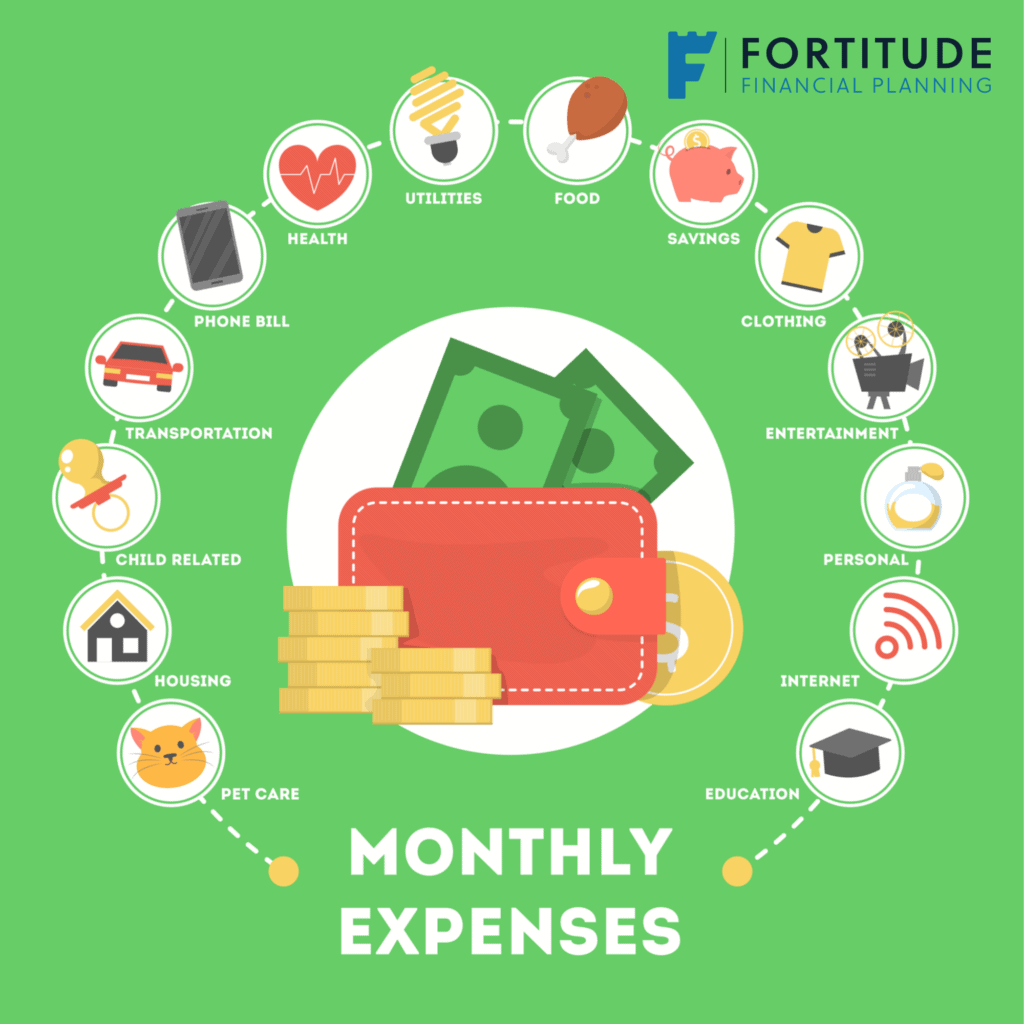

Factor in other monthly household expenses.

Food, utilities, kids education, loan repayments, car and transport and a likely increase in medical expenses.

Whilst it’s something, it’s not adequate.

We previously wrote an article ‘Can you live on €10,556 per annum?’

2 Ways to Obtain Income Protection Insurance

Income protection benefits are obtained in two ways:

- Employee Benefit: An employee benefit provided by your employer. Typically kicking in after your employer’s sick pay scheme ceases.

- Individual Income Protection: Protection you buy to cover injury, illness or sickness which may occur both on and off the job.

Employee Benefit

One way to avoid the issue of relying on DSP benefits is if your employer provides income protection.

This is a big bonus as it typically comes at no cost to you.

Your employer will maybe have a sick pay scheme, lets say 3 months.

If you can’t work due to illness or injury, you get 3 months full pay.

Then, if your employer operates an income protection scheme, the income protection insurance kick in.

This is usually (but not always), two thirds of your salary less the DSP benefit.

You are then paid until the earliest of you going back to work or retirement age.

Important: Do not mix up your employers sick pay benefit with income protection.

This is a regular train of thought amongst people I speak to.

Individual Income Protection

Individual income protection is the cover you purchase to meet the challenge of earning income in the event that you become ill or injured.

The cost of this income protection qualifies for tax relief at your marginal rate.

So if you pay 40% tax, the premium is €100 per month, the actual cost to you is €60.

This policy is set up to pay a portion of your monthly income up to a stated percentage (such as 50%, 66% or 75%).

Typically the DSP benefit would be discounted from the % of cover.

Business Owners

The landscape for business owners is slightly different.

If we can’t work due to illness or injury, the DSP pay us nothing.

For showing entrepreneurial spirit we get no reward if we can’t work.

Then if we can’t work, it’s likely the income into our business is significantly reduced or ceased.

A business owner is then faced with drawing down on cash assets to pay themselves.

Reducing the value in the company they’ve worked so hard to build up.

The Solution – Executive Income Protection

Executive income protection is pretty much the same as personal income protection.

The only difference being is the company covers the cost.

Your company provides this to you as an employee benefit.

Furthermore, the cost is tax-deductible.

This is a quick win for business owners.

Protect your most valuable assets, your income and your business.

Write the cost off against tax.

Is there a maximum allowable benefit?

Yes.

The maximum allowable benefit is 75% of your salary.

The reason why you do can’t receive 100% of your income is to prevent “malingering,” which is a disincentive to recovering from an injury or disability and returning to work because benefits received are the same or more than working.

Why would you want to go back to work if you could earn the same salary at home?

Can I get tax relief on the cost?

You can claim tax relief on the cost of a personal income protection plan.

As highlighted above, this is at your marginal rate.

So if you pay 40% tax, you get 40% relief.

A slight change has occurred recently in how you get this.

Previously, you had to pay the gross cost and claim the relief at the end of the tax year.

Now you can assign a tax credit, essentially giving you the relief at source.

Income protection insurance is viewed as such an important benefit, Revenue will actively cover some of the cost for you.

It’s the only insurance benefit you will receive tax relief on.

As also highlighted above, business owners can offset the cost through their business against corporation tax.

Anything else I should know?

Income protection is a complex product.

There are a number of variations.

Reviewable or guaranteed premium, deferred period, index-linked, index-linked in payment, guaranteed increase option.

They are only a few things to consider.

Claims history is another.

You require a provider with a strong claims history.

The last thing you need is to submit a claim and it is declined.

It’s important you receive impartial advice from someone like Fortitude Financial Planning on this.

Summary – Who Should Have Income Protection?

Everyone.

The probability of being unable to work due to illness or injury is enough for everyone to give serious consideration to income protection.

If you are fortunate to work for an employer who provides this benefit, great!

Understand, however, that this may not be enough to provide you with the income you need to meet your financial obligations while you are out and you may require a bridging policy.

If you do not have a group benefit available to you, the cost of individual coverage is a worthwhile expense to protect your income.

An accident at or away from work, or an illness, can leave you without the ability to provide for yourself or your family.

Income protection helps you protect against this risk.

It’s the cornerstone of a solid financial plan.

Your most valuable asset is your income.

Most people insure their car, home, even a phone and their pet.

Yet most people don’t consider or refuse to insure themselves.

Your health is your wealth.

How we help

Fortitude Financial Planning are highly experienced in the income protection market.

We can tell you how much you require and how best to structure it.

We will show you how to claim the tax relief.

You’ll get the correct level of cover at the correct cost and structure suitable to your needs.

If you would like to discuss income protection or your existing arrangements, request a callback.

Otherwise, give me a call on 086 0080 756 or email me francis@fortitudefp.ie.

We have over 30 articles we’ve written on various subjects and they can be accessed here.

A wealth of free information covering all aspects of saving, investing, financial planning, protection and pension advice.

*Source – Aviva risk calculator

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production