Investing At A Young Age: A Real Client Example

In the past, I have created content for the younger generation.

I strongly feel that it’s a demographic that is missed by our industry.

This is due to them not having sufficient investible assets that most companies require to take a client on.

However, the younger generation are missing out on a significant opportunity in life.

There is a great opportunity for them to grow their wealth via investing.

Grow their wealth and outpace inflation.

You’re in your 20’s or 30’s – should you be investing?

A great example, everyone knows how difficult it can be to get on the mortgage ladder.

Assuming you will get a mortgage mid 30’s, start investing early-mid 20’s.

Grow your wealth, and make it easier to hit your mortgage goal.

Saving in the bank just loses you money due to inflation.

No better way to outline this opportunity than a real case study.

Below is an outline of a client’s situation that we recently took on.

The Situation

Our client was late 20’s and had been saving in the bank for a considerable amount of time.

Indeed, he had been saving a good amount monthly and had accumulated a fund sitting in the bank.

Clearly, the media have been going on about inflation, the buzzword of the moment.

Our client also read our insight on the money illusion.

This got him thinking about getting his money working harder for him as opposed to losing value in the bank.

He also thought there was a way to better utilise it to help him with his long term goals.

The Journey

Discussion

We met with our client and we discussed his thoughts on what was going on.

Not only did we meet once, but we also met a few times.

It’s important to us that we meet as often as is required to get our clients comfortable.

Unlike the method of meeting clients once and trying to cram everything into one meeting.

We’re definitely happy to meet as many times as it takes.

We discussed his knowledge of investing, investments and savings.

Importantly, we covered in depth what he was looking to achieve.

Both in the short term and the long term.

What’s for saving and what’s for investing.

Gathering the information

Our client kindly completed a financial planning questionnaire.

A financial planning questionnaire is to provide us as advisors with as much information as possible.

The more accurate information we have, the better the advice we can give.

This was done online through our secure portal for their convenience.

Importantly for us, our portal is something we have extremely positive feedback on.

This allows clients to go in and out at their leisure and update their details and information.

Preparing the Analysis

We now had all of our clients’ information and our meeting notes.

The financial planning questionnaire was reviewed and any inconsistencies were clarified.

Importantly, we identified some key issues for discussion as follows:

- Our client didn’t appear to have any salary protection

- He doesn’t have any dependents yet so has very little need for life cover

- There are the funds accumulated in the bank earning zero return

- At a young age he had little knowledge of investing or how to grow wealth and assets

- Importantly he had a good saving habit by contributing to savings every payday

- He did not have a pension but one was available through his employer

Discussing the findings

Following completion, we sent a report and summary.

We met again and reviewed the findings.

It was highlighted to the client there were other issues to consider.

Along with his investment objective, he had never considered a loss of income through illness or injury.

Or had never considered the benefits of joining his employers’ pension scheme.

Pensions were something he thought, based on hearsay, were a “waste of time”.

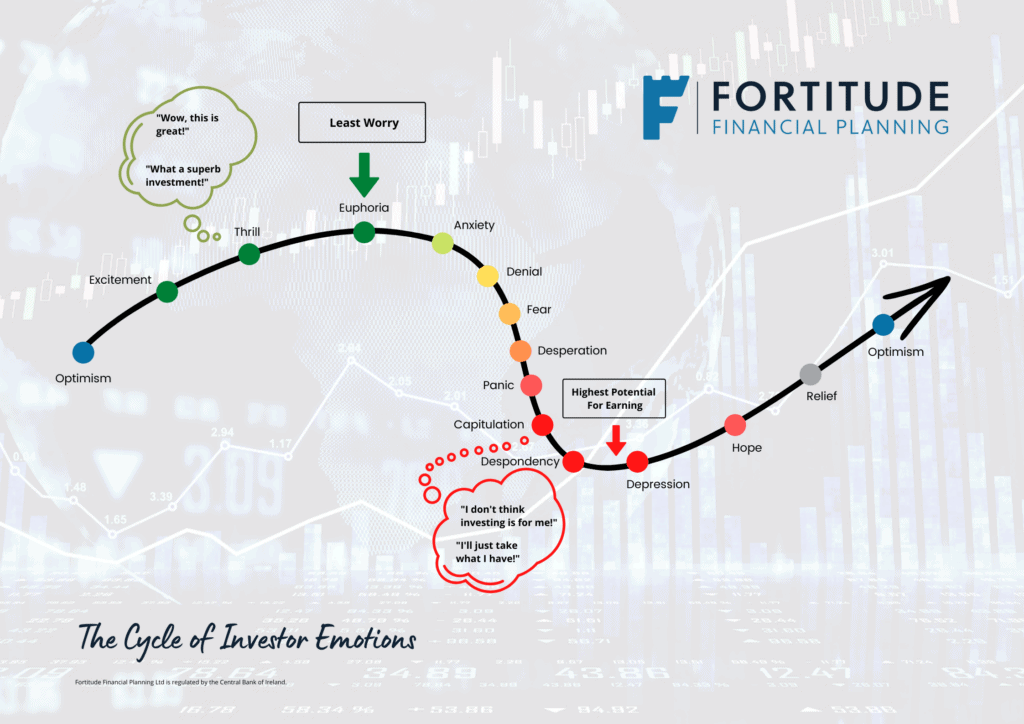

At length, we discussed the power of investing via the stock market, and the emotions investors can feel.

We arranged his goals, financial and personal, into the short, medium and long term.

Importantly, as part of our client-centric process, we worked back from our client to our recommendations.

We put the cart before the horse, not the other way around.

This allowed us to work back to recommendations for our client, specifically suited to him.

Importantly we could now allocate his resources accordingly.

Firstly, protect his income.

Secondly, generate growth on his savings.

Grow wealth.

Thirdly, continue to save in the bank as well, keep building cash reserve and review it again in 12 months.

Most importantly, our clients’ lifestyle doesn’t change.

It’s important to us that our clients still live for today as ultimately life is not a rehearsal.

We are about allocating clients’ resources more effectively, not stopping them from living!

Implementing the strategies

Once we agreed on the issues, the following solutions were implemented:

- Protected the client’s income against illness or injury – otherwise, if he got injured or sick long term, he would only be entitled to the state illness benefit

- Retained a portion of his built-up savings in cash

- He continued to top up his cash with a portion of his regular monthly saving

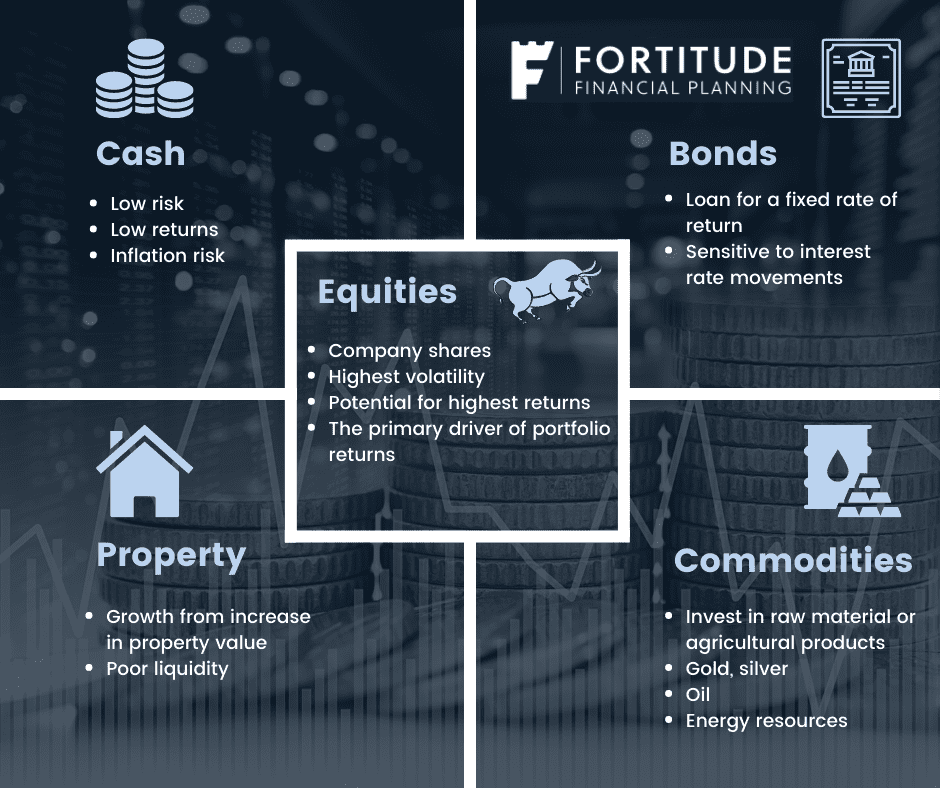

- As well as that, an investment strategy was implemented for the remaining cash to generate growth and offset inflation

- Furthermore, the remainder of his regular monthly saving was directed to his investment strategy

- Finally, he enrolled in his employer’s pension scheme and availed of his employer’s 5% pension contribution

The benefits to our client

Following completion, our client now has a set and optimized financial strategy.

Most importantly his salary is protected against illness or injury (the cost of which can be offset against tax).

He now has peace of mind if he can’t work long term, 75% of his salary will be paid and not just €10,816 Government benefit.

When it comes to saving, he has his emergency fund in the bank, fully available.

We typically recommend 3-6 months of expenses or ideally after-tax income.

Furthermore, he retains additional money in the bank as a cash buffer and for spending and enjoying himself.

This is being topped up with his regular saving each month and we will review it annually.

It’s important to us that our clients retain a degree of cash at hand.

Importantly, he is now also fighting inflation by investing at a young age.

A portion of his built-up savings is now in the market working for him.

Growing over time in a well-diversified investment strategy specifically to him.

Benefitting from the power of compound interest.

Moreover, he is contributing every month to this, availing of Euro/Cost averaging.

He is now contributing to his pension along with his employer.

As well as that, his own contributions are tax-deductible so he is reducing his own tax bill whilst planning for his future.

Furthermore, as he’s investing from a young age in his pension, this will also reap the rewards of compound interest.

Summary

To contact us, our client had a pain point, a single money issue.

He had been reading about inflation.

By going through our process, our client now has a set financial plan and solid structure and foundation.

Both for the present and into the future.

Not only that, due to our ongoing service, we will review and update in 12 months’ time.

Importantly, he’ll still be living his best life today.

This is also important as life is not a rehearsal.

We have to get it correct first time.

Schedule Your Investment Consultation

How We Can Help You

Do you want to get better with your finances?

Dictate to them, not the other way around?

We are always looking to work with clients who want advice.

Don’t let your finances dictate how you live.

Don’t let inflation beat you.

Live your life today and give yourself the power to live your financial life in future on your terms.

We don’t charge for an initial meeting, it’s important to find out if we can help you.

Get in touch

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production