“It turns out my job was not to find great investments but to help create great investors,” writes Carl Richards, author of “The Behavior Gap.”1

From increasing our budget mindfulness to taking a steadier approach to investing, Carl has drawn attention to the way our unexamined behaviours and emotions can be our detriment when it comes to living a happy and financially sound life.

We’re biased when it comes to our own money.

As a result, in many cases, we make poor financial decisions when experiencing panic or anxiety as a result of personal or widespread events.

The current Coronavirus pandemic is one such event.

This has affected nearly every industry and home as people and governments took and continue to take action to keep themselves and their communities safe.

The stock market volatility of 2020 began on Monday, March 9.

This was history’s largest point plunge for the Dow Jones Industrial Average.

On March 16, 2020, the Dow hit a new record.

It lost 2,997.10 points to close at 20,188.52.

A clear demonstration of the market volatility and financial effect of this health crisis.2

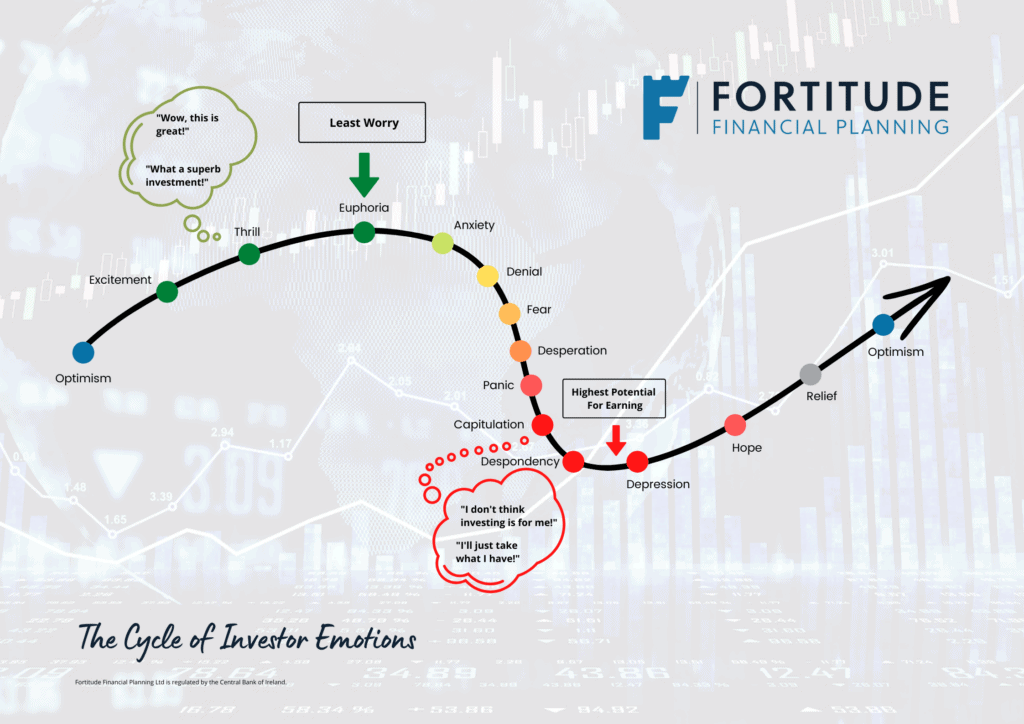

Whether facing a devastating event or an exciting advancement, people frequently make money decisions as a response.

Emotional bias.

Below we discuss the common financial behaviours driven by such circumstances.

The Behaviour Gap Explained

Coined by Carl, “the behaviour gap” refers to the difference between a smart financial decision versus what we actually decide to do.

Many people miss out on higher returns during market volatility because of emotionally driven decisions.

This creates a gap — “the behaviour gap” — between their lower returns and what they could have earned.

4 Common Emotions that Can Create a Behaviour Gap

#1: Excitement When Stocks Are High

Whether in a bull market or witnessing the hype from a product release, many investors may feel tempted to increase their risks or attempt to gain from emerging investments when stocks are high.

This can lead to investors constantly readjusting their portfolios as the market itself experiences upswings.

An investor who follows such patterns is likely to do the same with declines during market volatility and may end up trying to time the market time and again amidst its inevitable, unpredictable movement.

#2: Fear When Stocks Are Low

As a response to the Coronavirus, the market has seen losses as many investors feel the need to choose more secure investments and avoid uncertain or seemingly unsafe investments.2

When stocks are low, a common response may be to sell and effectively miss out on potential long-term gains.

#3: Engagement in the Search for Alpha

People yearn to make money and take action to do so.

Throughout our lives, this emotional desire is likely a constant one.

As such, many seek the help of a financial advisor to procure above-average returns, otherwise known as “alpha.”1

However, in this search for “alpha,” our humanness — our emotions and our behaviours — may lead us astray.

Ironically, studies done by DALBAR have calculated the “average investment return” as compared to investor returns and have shown that investor returns are lower.1

The underlying emotional desire and pursuit of money is exactly the recipe for unwise behaviours in response to emotions — but only if left unchecked.

#4: Short-Term Anxiety and Focus

As humans, viewing aspects of our lives through the lenses of current circumstances is normal.

One emotional response to any event, however, is letting the moment consume us, especially if faced with grave consequences.

This can be from our personal health being compromised to the loss of loved ones to financial decisions during periods of market volatility.

Many may find it difficult in these times to both think long-term and to remember logic.

However, making a rash decision can inhibit the long-term benefit that comes from maintaining a balanced perspective without reactionary behaviour.

About Carl Richards

Carl is a CERTIFIED FINANCIAL PLANNER™ (like myself!).

He is also the creator of the sketch guy column, appearing weekly in the New York Times.

You can learn more about Carl here or even follow him or connect with him on LinkedIn here.

Carl also has a really good book available for less than €15 called the ‘One Page Financial Plan’.

This is a book I would highly recommend and you can pick up a copy on Amazon.

How to Lessen the Behaviour Gap for Your Financial Health

At any given point, the market can go up, down or it can remain the same.

While many aspects of the current pandemic are out of our control, one thing we can control right now is how we handle our financial strategy.

We can control our behaviour.

We can take charge.

In the past, the market has recovered in response to epidemics with an average of 17.17% over time.3

While no two situations are alike, remembering the likelihood of recovery over time — and the market’s nearly inevitable up-and-down movement — can provide a more logical angle to calm the nerves.

If you’re experiencing financial anxiety in response to the coronavirus, take a breath and also remember the potential for long-term gains.

Of course, you can and should always reach out to us for further clarification and advisement.

We continue to guide our clients through uncertain times and our doors are always open, new clients are always welcome.

If you are in any way concerned about your finances or investments or simply if you would like a general chat at our expense you can arrange a callback here or contact me directly on 086 0080 756.

Alternatively, access my diary here and schedule a call at your convenience.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production