Questions to ask a financial advisor or planner

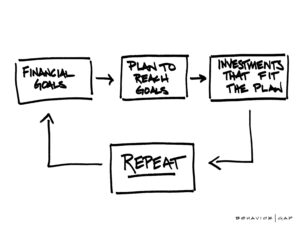

The role of a financial advisor or planner is to help you and your family figure out how to best save earnings, protect what you have, retain value, grow your wealth, maximise your tax efficiency and meet short, medium and long-term financial goals.

Advisors should provide short- and long-term expectations with the same portfolio, which can be quite an undertaking.

The value of the advisor is that he or she provides the client an objective opinion of where best to put assets that will have the greatest likelihood of financial goal success.

Understanding the Role of a Financial Advisor or Planner

Many people confuse a financial planner with a stockbroker, and then they find themselves trying to time the market and playing the public market in ways that work against their goals. Further, planners are not public accountants; whilst maximising tax efficiency is part of their role it is not their job to manage tax filings.

Because a planner acts as a professional adviser, they are often seen as filling in a grey area between the tax accountant and the brokerage trader.

Some financial planners are also bridging the gap between accountants and traders by offering investment management, tax solutions and full-service financial planning. That said, there are ways to make sure a planner is qualified to do the work needed for proper asset and wealth management. Here are seven questions that you should be asking your existing advisor or when hiring a new financial advisor/planner.

Question #1: How Long Have You Been Practicing?

While most planners are qualified, finding someone that you trust with your savings as the future of your financial path is incredibly important. Everyone needs to get a start somewhere, but finding someone with experience is key. It may be helpful to know that for an advisor to be eligible for a CERTIFIED FINANCIAL PLANNER™ (CFP®) designation, they need to have at least three years of experience*

Click here for details on our experience

Question #2: What Are Your Credentials?

Choose a financial planner who possesses the appropriate professional qualifications to meet your needs, such as the CFP® credential. The CFP® is widely considered the world’s most prestigious financial planning qualification. To become a CFP®, the planner must pass testing that demonstrates they meet regulated educational requirements and professional standards.

Other credentials you may want to look out for include:

- Specialist Investment Adviser (SIA)

- Retirement Planning Adviser (RPA)

- Qualified Financial Adviser (QFA)

Question #3: Do You Have a Niche?

Some financial advisors and planners may choose to work with a niche clientele – pre-retirees, doctors, educators, women, etc. Alternatively, some planners are more accommodating to helping everyone who meets some general criteria – regardless of age or profession.

Finding a planner who works with others like you is a great way to make sure they will understand your specific needs and be familiar with options available to you.

Click here for details of who we work with

Question #4: What Are Your Retirement Planning Projections & Assumptions?

How much money will you be able to spend each year from now through your life expectancy?

This is based on assumptions about:

- The rate of return of your assets

- The pace of inflation

- Your spending habits

You’ll want to work with an advisor who is able to help you think in the long term and offer realistic expectations of what retirement may look like. They should be able to help you balance your ability to live comfortably today while preparing for a sound retirement.

Question #5: How do you design investment recommendations?

Is there a robust research process behind what your advisor does or is it simply based on the best past performance of funds? Different investment managers provide different things, some managers generate better returns with higher volatility (risk and return are related), some generate steadier returns with lower volatility. At Fortitude Financial Planning we have a robust research process and track the key metrics of investment funds and managers over the long term and our investment recommendations are guided by our investment philosophy.

Want to find out more about our investment philosophy – click here!

Question #6: How Are You Compensated?

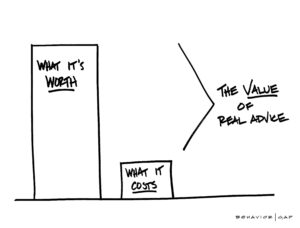

Transparency is important. Make sure your planner explains the fees clearly so you have a solid understanding of what you’re expected to pay and the services you will receive. A financial planner who is good at what they do and puts their clients first and receives commission can still provide an unbiased view and provide you with value but it’s important that remuneration is transparent and it’s disclosed fairly and clearly to clients.

When it comes to planning for your future, a strong financial planner is an important part of your process. Working with a trustworthy financial advisor or planner is something to take seriously. Asking your prospective advisor these questions is an important step towards working with the right person for you and your family.

If you would a general chit chat about how we provide our advice and the value we can bring to you, click the link below to schedule a call.

Schedule your call today with us here

Francis McTaggart CFP® SIA RPA QFA

Production

Production