When a major event hits the news, it’s natural to wonder how that could impact your investments.

Should you be concerned, or is your portfolio prepared for unexpected changes?

If you’re still wondering whether or not to adjust your portfolio based on events as they happen, speak with us first.

We will help you determine what is best for addressing your long-term financial goals.

What is a diversified portfolio?

First, let’s cover what a diversified investment portfolio is.

When we invest, we invest in asset classes.

The main asset classes are equities, cash, bonds, property and commodities.

Diversification is spreading your investments across these asset classes and not being over exposed to any one asset.

Furthermore, you can diversify within the asset.

For example, within equities, you can invest in thousands of equities across different global regions and sectors.

This is an alternative to investing in one equity (stock or share), say Netflix, Facebook or the dreaded bank shares.

When you’re invested in a solitary stock or share, there is a possibility that stock or share can hit zero.

Investing heavily into property isn’t diversification.

Investment Asset Classes

What are investment asset classes?

- Cash – low risk, low returns. Investing in cash is subject to inflation risk, ie inflation will currently run higher than your cash return.

- Bonds – This is a loan for a fixed rate of return and are sensitive to interest rate movements.

- Commodities – Invest in raw material or things like gold, silver and oil

- Property – As it suggests investing in property

- Equities – Stocks and shares. Equities carry the highest volatility but are also the main driver of portfolio returns

Horror Stories

Unfortunately, there are too many horror stories out there.

It feels like a week doesn’t go by without a client or a prospect telling me one.

Historically, think Eircom shares.

Think bank shares.

We all know someone who lost (generally a lot of) money by investing in these.

This is the opposite of diversification.

Investing in one share is more akin to gambling.

That share can go to zero, so can your money.

Understanding Diversification

When it comes to diversifying your investment portfolio, it’s important to evaluate all sides of the strategy before committing to one approach over another.

While investment professionals often recommend the approach for its ability to reduce risk and volatility, it’s important to know it can temper the level of returns generated.

When determining the extent you should diversify your portfolio, consider your own personal investment objectives.

Also, consider your risk tolerance and capacity for risk.

Thirdly consider your investment time horizon. Is this a short, medium or long term investment?

As with any important financial decision, you want to first make sure you consider both the advantages and disadvantages of any approach before making a final decision.

Especially when preparing for your retirement, it’s important to have your money allocated appropriately.

While diversification is a routinely suggested practice among investors, there are pros and cons to the approach.

Pros of Diversifying Your Portfolio

As mentioned, reducing volatility is one of the key reasons you might decide to diversify your portfolio.

This is because not all asset classes move together.

By holding numerous asset classes and stocks across various regions and sectors you are reducing specific investment risk.

While risk can’t be eliminated entirely, diversifying your portfolio can help you manage your overall level of risk.

This minimizes your chances of losing large sums of money over time.

When you don’t diversify among your asset classes, you become more exposed to market risk.

Along with reducing risk, diversification also allows you to hedge your portfolio.

This is an automatic benefit of refraining from putting all of your eggs in one basket.

By investing in a variety of sectors, you even out your chances of getting positive and negative returns, as opposed to purely negative.

Practically diversification is holding assets that react differently to the same market or economic events.

It’s also a strong defence against a single asset or a single stock performing poorly.

Because diversification involves investing in a variety of stocks, bonds and funds, it may make it easier to protect the wealth you’ve already saved and accumulated.

Cons of Diversifying Your Portfolio

While diversification sounds great, there are certain disadvantages that accompany this investment approach.

For example, when you diversify, you increase the chances of investing in lower-quality stocks.

A diversified portfolio will not provide the full return of equities.

This is because it isn’t designed to do so.

The flip side however is that a diversified portfolio will not take a hit like equities in a down market.

This is due to the spread (diversification) across assets.

Finding a Balance

When it comes to proper diversification, it’s important to allocate your money accordingly by asset class.

You should also consider your own individual investment objectives, time horizon and tolerance for risk.

As your objectives and/or time frame change, the gears in your portfolio should switch and determine how aggressive or defensive the diversified portfolio is.

As an example, a longer-term investment can expose more to equities and your diversification should come within the equity component with some defensive asset exposure.

If it’s a shorter-term investment, you should look towards more defensive assets like cash and bonds.

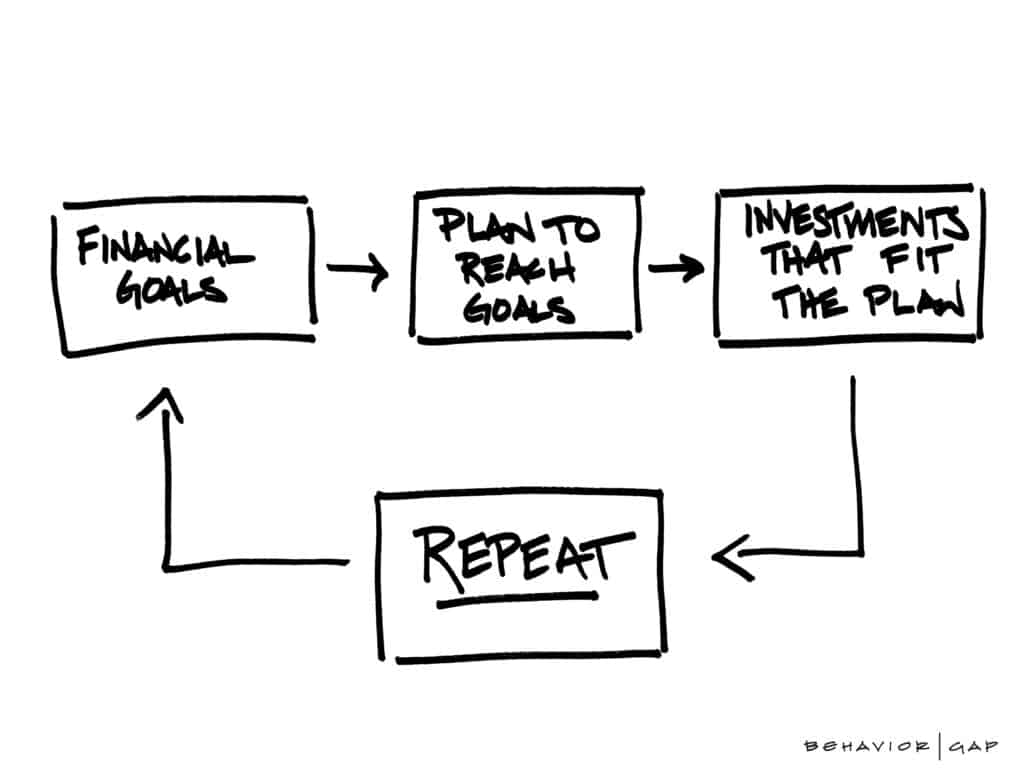

How We help

Before making your next move check in with us.

We can help you determine if any action needs to be taken on your part.

We will review your current portfolio, your attitude to risk, your capacity for risk and what your actual investment objectives are.

This is what our second opinion service is for.

When complete, we will then advise in a simple manner whether your portfolio is diversified enough in line with your own objectives and risk tolerance.

You can request a callback here or drop me an email, francis@fortitudefp.ie. Alternatively give me a call directly, 086 0080 756.

Francis McTaggart CFP® SIA RPA QFA

Disclaimer: All content provided in

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production