How to understand (and avoid!) the money illusion & inflation.

It’s no surprise that a Euro today isn’t worth the same as a Euro was 20 years ago.

This is the result of inflation.

Inflation plays a major role in financial planning whether you are conscious of it or not.

Whether you wish to acknowledge it or not, it’s there.

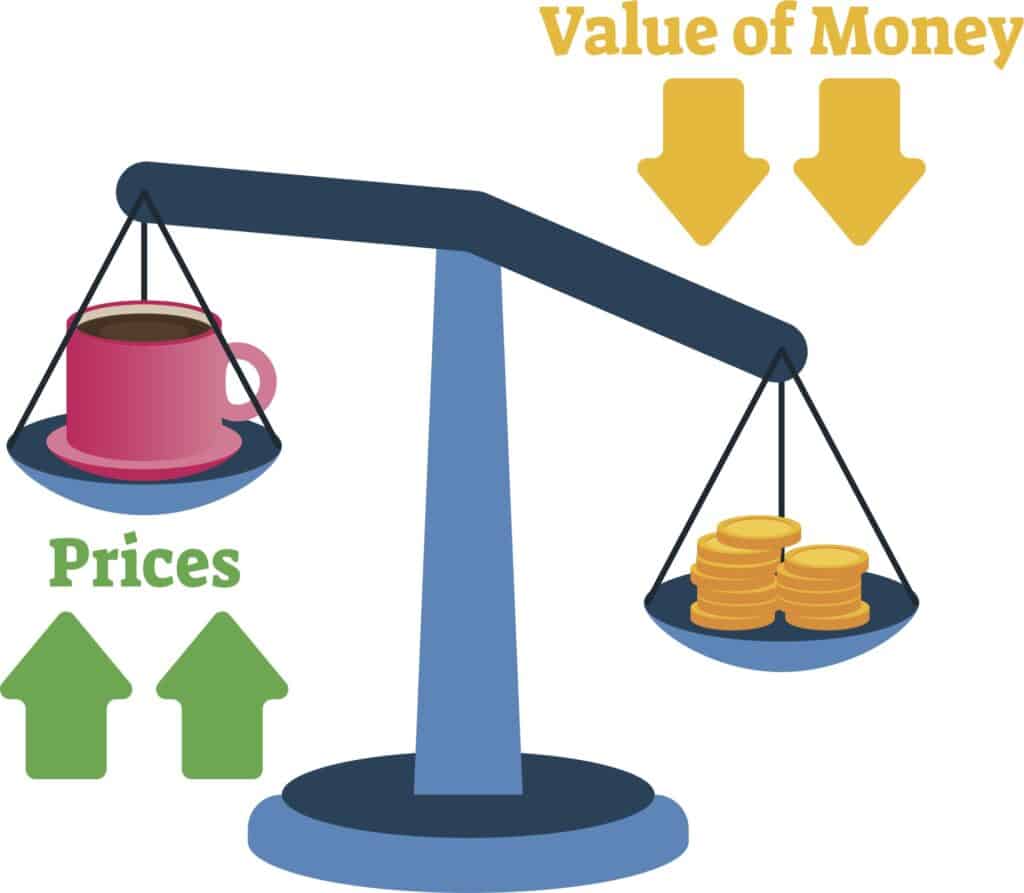

The money illusion refers to a cognitive bias that fails to take inflation into account.

Let’s dive into what the money illusion is, how it can impact your long-term finances and ways to combat the money illusion.

What is the ‘Money Illusion’?

According to Seeking Alpha, money illusion (or price illusion) is the tendency to think of your income in nominal values versus real terms.1

When you think of something in nominal terms, you fail to consider external factors such as inflation.

Nominal value is not the same as real value.

For example, the real value of two shirts might be the exact same because they cost the same to manufacture, but one might sell at a higher price point due to demand, marketing, reputation, and brand name.

These external factors contribute to the real cost of the shirt.

The same is true for your money.

If you get a 5% raise at work, but inflation is 7%, you are at a net loss of 2% in terms of real value.

There are a few reasons why the money illusion continues to play a role in the way we think about financial planning.

The first comes down to a simple lack of financial education.

Many people don’t know the rate of inflation or don’t understand how it impacts the real value of their income.

The second is price stickiness.

Price stickiness occurs when goods and services remain the same price despite other economic factors.2

These rigid prices may colour our view of inflation and make it seem like we can buy the same things today as we could in the past for the same amount, even if this isn’t reflective of the overall economy.

Example

Probably the most simple example I can give of the money illusion is this.

Let’s say we have €10,000 in the bank today.

One year from now you still have €10,000 in the bank.

Well, one year from now you still have €10,000 in the bank in terms of the number of zeros attaching.

In reality, you have less.

Inflation has reduced the actual value, purchasing power of that €10,000.

Something that costs €50 today is likely to cost more than €50 one year from now.

That’s inflation.

Yet, your €10,000 remains the same number.

What is inflation?

In its simplest form, inflation is the decline of the purchasing power of your money.

It is reflected in the price of goods and services over time.

The rise in prices, often reflected as a %, means your Euros buy less than they did previously.

Do you ever walk into a store and think ‘I remember that used to only cost X amount?’

Do you notice how the Sky TV or digital media bill increases?

The energy bills increasing.

That’s inflation at work.

Yet, our hard earned Euros remain in the bank, credit union and post office earning little or no return to keep pace.

Traditional saving options

Traditionally, in Ireland, people use the bank. credit union or the post office.

The old favourites because they feel secure.

People feel the banks are safe despite 2008.

Banks, depending on the account type, are offering little or no return.

Credit Unions offer little or no return.

An Post is the best of a bad bunch, they offer 1% return over 3 years.

Kick that out to 4 years it goes up to 2%, for 5 years 3%.

Not only are the returns in An Post still poor, but they are also mostly back-ended, ie the return accumulates at the end of the term.

However, let’s say inflation is 2% per annum, that return on offer still doesn’t cut it.

Inflation just eats away at the value of your money.

Without a doubt, whether you have a lump sum sitting in one of these institutions or save regularly into them, the effect is the same.

How The Money Illusion May Impact Financial Planning

As you can see, the money illusion is a tricky cognitive bias that, over the course of your long-term financial planning, may put you behind your goals.

If you think to yourself that you need €1 million to retire comfortably in today’s real terms, what does that equate to in 10, 20, or 30 years when you are actually ready to retire?

You will likely need more than €1 million to retire comfortably as you race inflation.

How to Combat The Money Illusion

Without acknowledging inflation and the real buying power of your income, you will slowly fall behind on your financial goals.

But, by building out a solid financial strategy and understanding our current economy, you can combat the money illusion and understand how much money you actually need to pursue your long-term goals.

One way to do this is to understand how inflation works and the current rate of inflation.

This will help you understand how much you have to make to keep up your buying power.

Another way to do this is to not make risky financial decisions without understanding the market as a whole.

As we talked about, price stickiness might be deceiving when you look at what you can afford.

Sure, you might be able to afford a new home or car, but with rising rates of inflation that item might be more expensive than it’s advertised.

You can work with us to create an investment plan that hedges against inflation.

How we help you

The average rate of return of the S&P 500 index is about 8% per year3 and the annual rate of inflation in the US hit 6.2% in October 2021.4

This means that if you invest, your investments will help you minimize the impact of inflation over the long term.

We will work with you to create a plan specific to you and your family.

Not just an investment plan, a financial plan.

Part of your financial plan will be an investment plan.

An investment plan that will help you combat the effects of long term inflation.

It will be tailored to your own families long term goals and objectives.

We believe in liquidity, keeping cash available at short notice.

We don’t recommend you invest every last Euro.

Importantly, everyone needs funds available to access at short term notice.

Without a doubt, we will ensure you have cash available, particularly in case of emergencies.

Then we will take the time to clearly explain how investments work, get you comfortable and outline the strategy behind our recommendations.

We don’t invest you in a single stock or share where you can lose anything, if you want to invest in the next best thing, we are not the firm for you.

Importantly, we create diversified portfolios, specifically for your own individual objectives.

Clearly diversified across asset class, region, sectors and investment strategies smoothing your investment journey.

Get in touch

Let’s have a savings and investment review.

We can discuss inflation, traditional savings options and alternatives available to you.

It’s important to get your money working for you as inflation is not going away.

You can:

- Request a callback

- Email directly, francis@fortitudefp.ie

- Give me a call, 086 0080 756

- Or access our diary here and book a call at your convenience.

We are happy to have a no obligation chat with you initially at our expense.

We can discuss our process and what we require from you.

Visit our content library.

Over 40 articles on various subjects learn more about our experience and expertise.

A wealth of free information on hand, covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

- https://seekingalpha.com/article/4206486-money-illusion

- https://www.investopedia.com/terms/p/price_stickiness.asp

- http://www.moneychimp.com/features/market_cagr.htm

- https://www.pewresearch.org/fact-tank/2021/11/24/inflation-has-risen-around-the-world-but-the-u-s-has-seen-one-of-the-biggest-increases/

Production

Production