What to do when the stock market drops?

We’re now almost 17 months from when the markets started to recover from the short term COVID-19 correction.

Due to a cognitive bias called ‘Recency Bias’, it appears in recent times that investing is easy.

Markets are going up on what feels like a daily basis, great!

Your stock market investment is growing!

One day, you notice over your morning coffee a stern warning emanating from your television as the very serious business reporter notes the Dow opening, down one percent.

Your stock market investment is declining!

What do you do?

If you think, “Sell!” or “Panic!” perhaps you should take the advice of some of the world’s savviest investors and turn away from the stock ticker for the rest of the day – or month!

You may be envisioning euro signs flying out of your wallet and you want to get on the phone and switch to cash.

However, most experienced investors will say that if you have a wise strategy in place, it’s best to stay the course.

Billionaire Warren Buffet told CNBC in 2016 that buying or selling in a rush may not be the best strategy:

“If [worried investors are] trying to buy and sell stocks, and worry when they go down a little bit … and think they should maybe sell them when they go up, they’re not going to have very good results.”

Such a panic move could unbalance your portfolio where you are either taking on more or less risk than you should.

Here are four tips for you when that inevitable day comes and your stock market investment drops.

Tip #1: Keep a Diversified Portfolio

Having a diversified portfolio can help to balance risk and return.

You can re-balance by selling other assets like bonds or even commodities.

Then you can invest in stocks that are down in price.

It’s not a panic buy; it’s a strategic move that fits your original investment plan by taking your portfolio back to the ratio of stocks to other assets.

Tip #2: Resist Panic Selling

Typically panic selling is triggered by events that may lower the confidence level of investors causing them to sell.

When this occurs on such a wide scale sharp declines in pricing tend to occur.

Switching to a lower risk strategy or even cash to get out of a down market could have long-term implications and often cause you to miss out on some big gains when the market corrects.

When your portfolio drops in value it’s only a temporary devaluation – the markets will recover.

Moving to cash will crystallise that devaluation and create a loss.

Tip #3: Protect Your Nest Egg

If you’re really worried about things like a college or retirement fund during a downturn in the market there are a few steps you can take to protect these funds.

1. Ask your financial planner about reviewing the amount of risk you have relative to your financial goal

You’ll at least feel more confident about your portfolio if you know that you’ll have a healthy portfolio for a shorter term goal that is less affected by market fluctuations.

A good financial planner should have this boxed off for you already in any case.

At Fortitude Financial Planning we work off the 5 year rule.

2. Don’t invest money you think you may need.

Similar to the above a good financial planner should have your savings and investments aligned with your specific goals.

This is especially important for retirees who may only have investment income to rely on as they get older.

Tip #4 Focus Long-Term

When you start to see headlines of the stock market declining it can be easy to go into panic mode and wait to watch values decline in real-time.

This is only a devaluation – it’s temporary.

Temporary because the markets will move up again.

When you sell investments in a downturn you’re essentially locking in your losses.

Then, when the market eventually stabilizes you’ll likely be left chasing much higher prices.

It’s always a good idea to keep your long-term goals in mind before making any decisions in a downturn and consulting with an experienced financial planner before making any moves.

Summary

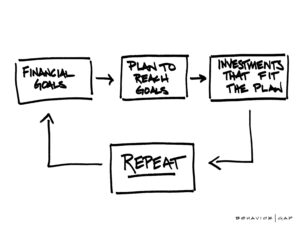

Your exposure to markets should always be aligned to your individual goals, short, medium and long term.

Your investments should be aligned with medium to long term goals.

Therefore, when the market drops, do nothing – the market will recover once you give it time.

If you have to do anything, consider buying more stocks.

Stocks in a declining market are on sale. It’s the equivalent of walking into a clothing store and seeing prices reduced.

A good financial planner will have a plan for you – stick with your plan and trust the process.

Read more about our investment philosophy and client journey to create your plan.

Free Download

Interested in 5 key principles that will enhance your chances of investment success and help you grow your assets?

Download your free guide here!

Get in touch

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production