What does ‘time in the market’ actually mean?

At the time of writing, investment markets are down year to date (YTD).

In the USA the S & P 500 is down approximately 17%.

Furthermore, the Dow Jones is down approximately 12%.

The NASDAQ is down approximately 27%.

A bit closer to home the DAX is down approximately 12%.

Clearly, never an easy time for investors.

Even so, what we do in times like these (indeed at all times!) is continue with basic investment principles.

One such principle is ‘It’s all about time in the market’.

I’m sure you’ve heard this bandied about.

If you’re a client of mine you will most definitely have heard it.

Nevertheless, what does it mean?

What is investing?

Basic recap, what is investing?

Right, think of saving as putting money regularly into the bank or credit union.

On the other hand, investing is simply allocating some money to strategies with the expectation of generating a return.

These could be personal investments.

Alternatively, it could be a defined contribution pension.

Basically, investing is strategies used to generate return on our money.

Why do we need to invest?

Now, why do we need to invest?

Particularly, the simplest reasons at the moment are low-interest rates available from banks.

Inflation is another.

Tie inflation with low returns from banks, the value of our money in the bank decreases.

I don’t like losing money.

Leaving too much in the bank is the same as putting money down the drain.

You can understand the money illusion here.

Investing allows us to generate returns by benefitting from the power of compound interest.

Interest growing on interest.

Furthermore, investing helps us meet other financial goals.

Goals such as purchasing a house, getting married, building an emergency fund, future holiday plans and retirement.

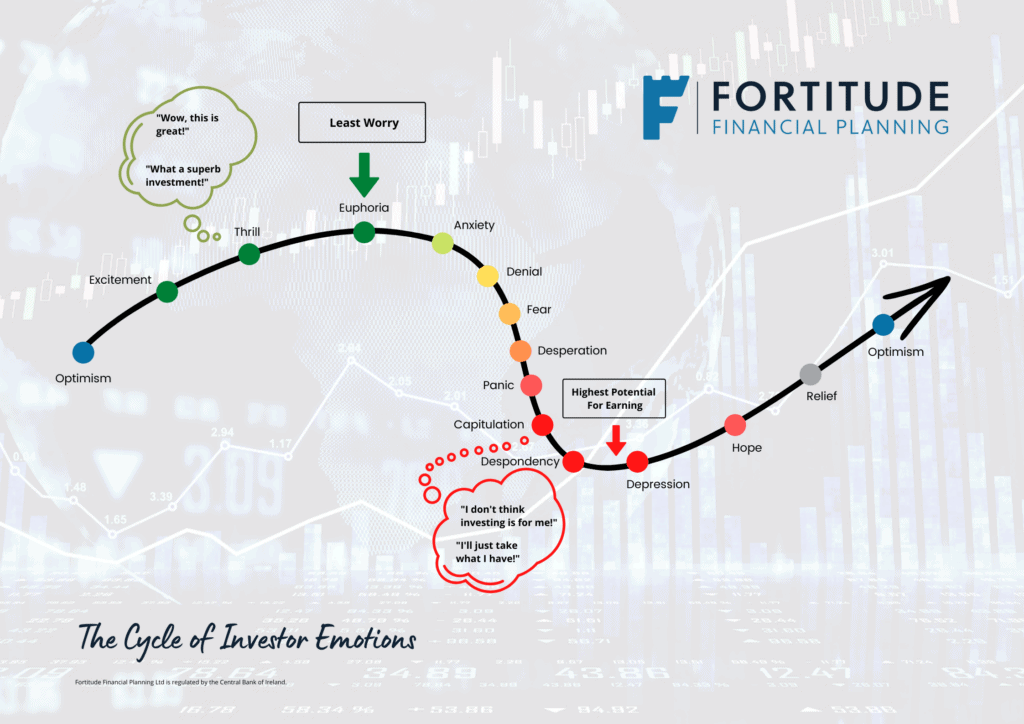

Emotions

Without a doubt, emotions can play a part when we invest.

Sometimes they can even take centre stage.

It’s our money, after all, we’ve worked for it.

Our resolve can be tested during market declines.

When emotions take over, they can lead to decisions that are not conducive to good investment outcomes.

With investing, it can sometimes feel wrong that doing nothing is best.

Our investment values are declining, we have to do something!

We need to buy, sell, move, change, just do something to change the tide!

But doing nothing, once you’re invested in line with your long term strategy, is best.

Time in the market

Time in the market is really a simple concept.

It means remaining in the market for a continuous period of time.

Through the downs as well as the ups.

And not letting our emotions take over when markets are on a downward curve.

When markets turn south, the value of your pensions and investments decline.

Note I clearly said the value declines.

You’re assets haven’t actually lost anything.

That devaluation only becomes a loss if you let your emotions take over and do something like withdraw your investment or switch to cash.

So, indeed, ‘time in the market’ simple means keep investing for a period of time – irrespective of what happened recently.

Experience

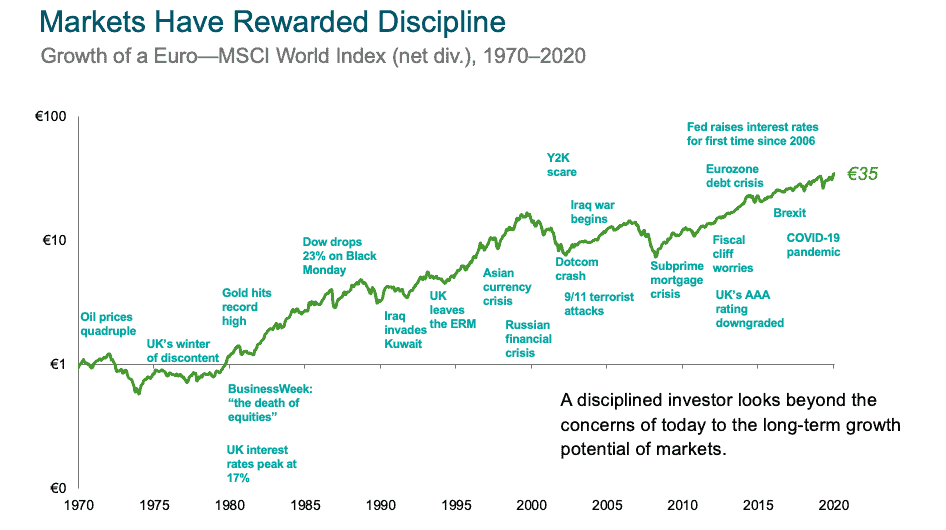

Experience tells us ‘Time in the Market’ is the correct thing to do when investing.

Time in the market means ignoring short term market movements and predictions.

Let your investment run its course.

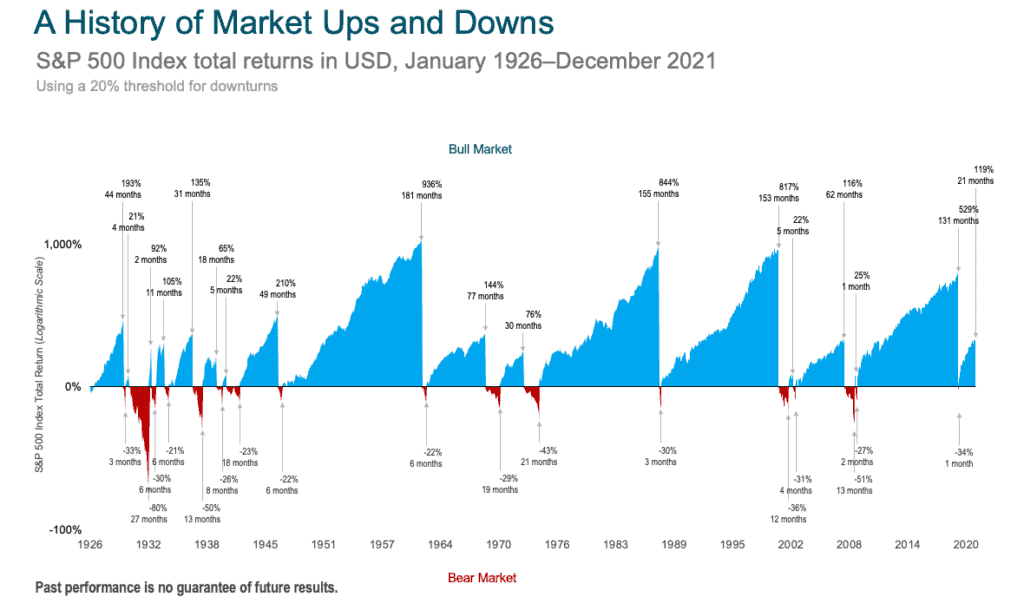

Experience tells us markets will always be volatile in the short term and carry corrections.

P.S – nobody should be investing for the short term in any case!

Markets can carry some scary declines.

Nevertheless, from a historical perspective, it will bottom.

And then continue their long term upward trend.

Looking at 2008, it was the end of the world apparently, everyone was broke.

We’d never recover.

However, since 01/01/2008 markets have returned approximately 130 % (depending on what index you look at).

Time.

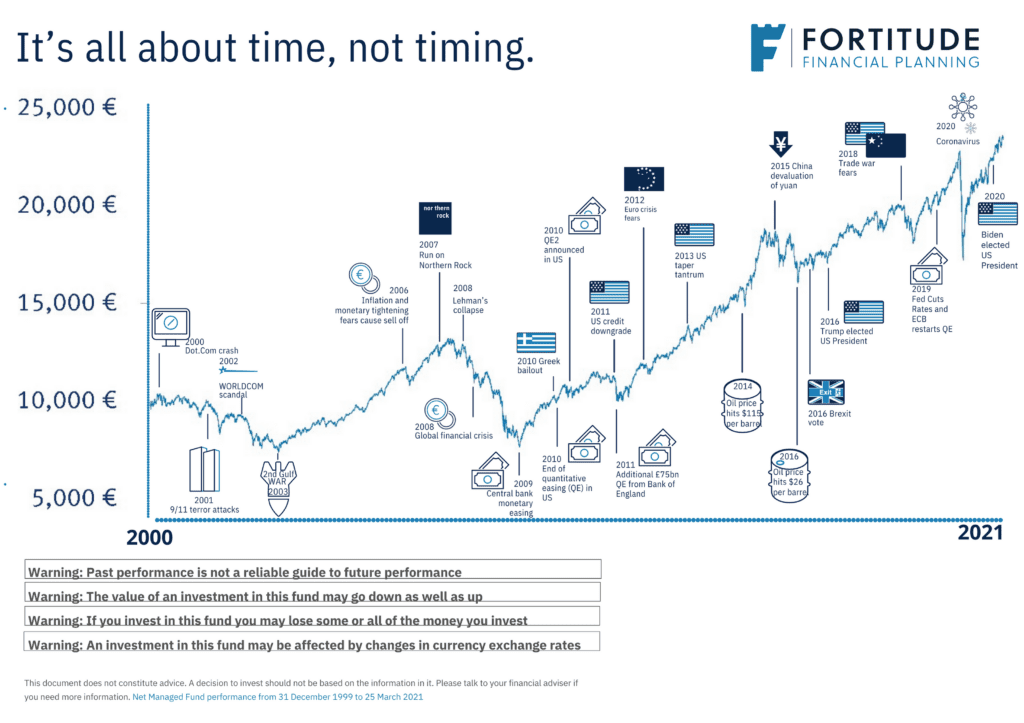

Can’t I just buy low and sell high?

Ah, the old theory, ‘I’ll time the market’.

I’ll buy low and sell high. Easy!

No one has a crystal ball, you can’t tell the future.

I can’t tell the future.

So how does one know when the market is high and is going to turn?

Or is going down and is at the bottom and going to resume upwards?

One may get lucky once, even twice, but buying low and selling high is an unsustainable investment strategy.

As well as that, when the market is at the top, a bell doesn’t ring.

Likewise, when it’s at the bottom, a bell doesn’t ring.

By the time you’ve sold or bought in, you’re already on the way down or up.

Technically, you need to get two, not one, calls correct.

Time in the market versus buy low and sell high

Long term wealth, the secret, time in the market.

Time in the market avoids short term predictions.

This strategy is proven that time and patience are key.

By remaining invested, the investor rides out natural market cycles.

And emotions are not allowed to take over when the natural down part of that cycle is taking place.

Thinking Long Term

When investing, it’s clearly important to think long term.

5 years plus down the line.

Invest in line with your financial and life goals.

It’s really important to live for today, lfe is not a rehearal.

But also plan for tomorrow.

I acknowledge, tomorrow may never come but the odds are it will.

Ask yourself this, if you are age 32, do you still plan on being here at 37, 40, 42?

Of course you do.

If you are 40 do you still plan on being here at 45, 48, 51?

Absolutely.

If you have a 4 year old child do you plan on seeing their 14th birthday?

100%.

Think short, medium and long term, you’ll be better for it.

Summary

Obviously, I hope I’ve given you a bit of insight into what this means.

No one invests for the short term.

Importantly, no one should be investing for the short term, markets can be too volatile.

Once you’re investing in line with your own individual goals and objectives, let the markets do their thing for you.

Remain in the market for a period of time and don’t base decisions on what happened yesterday.

I hope I’ve given you confidence, that if you have a pension or investment, currently devalued, giving it time will work to your advantage.

How we Help

There’s genuinely no better time to take charge of your finances.

Maybe you have current investments or pensions and are overwhelmed by the constant news on markets.

Are you one of the many households with funds sitting on deposits earning zero return and being eaten by inflation?

Maybe you are young and want to start growing your wealth, planning fora mortgage, have kids to educate in future.

With a little bit of forward planning, we can give you the confidence you’re doing the correct thing.

We work for you and with you and will educate you to the point you are comfortable and confident in this type of stuff.

Peace of mind.

Get in touch

Let’s have a chat.

Email me, francis@fortitudefp.ie or request a callback.

Or give me a call on 086 0080 756.

Access our diary here and book a call at your convenience.

We can see what your query, concern or issue is and ascertain if we can help you.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production