Why your financial advisor should have an investment philosophy

When it comes to investing, you may have heard the term ‘investment philosophy’.

However, what is it?

What does it mean?

When you are taking advice from a financial planner or advisor, it’s important they (or their employers) have an investment philosophy.

So, why is this important?

Let’s dig a bit deeper into what an investment philosophy is and why your advisor should have one.

What is an investment philosophy?

Firstly, let’s look at what an investment philosophy is.

Simply speaking, an investment philosophy is a set of principles and beliefs.

Principles and beliefs that guide investment decisions and recommendations.

It provides an outline as to how your advisor will handle your money.

An investment philosophy will factor in an investor’s goals, risk tolerance, time horizon, and help manage expectations.

It can also factor in different areas of investing, like active or passive, ESG and sustainability issues, and value or growth investing.

Why is an investment philosophy important?

“Risk comes from not knowing what you’re doing” – Warren Buffet.

Investing is never straightforward.

Markets go down as well as up.

In fact, they go up more than they go down.

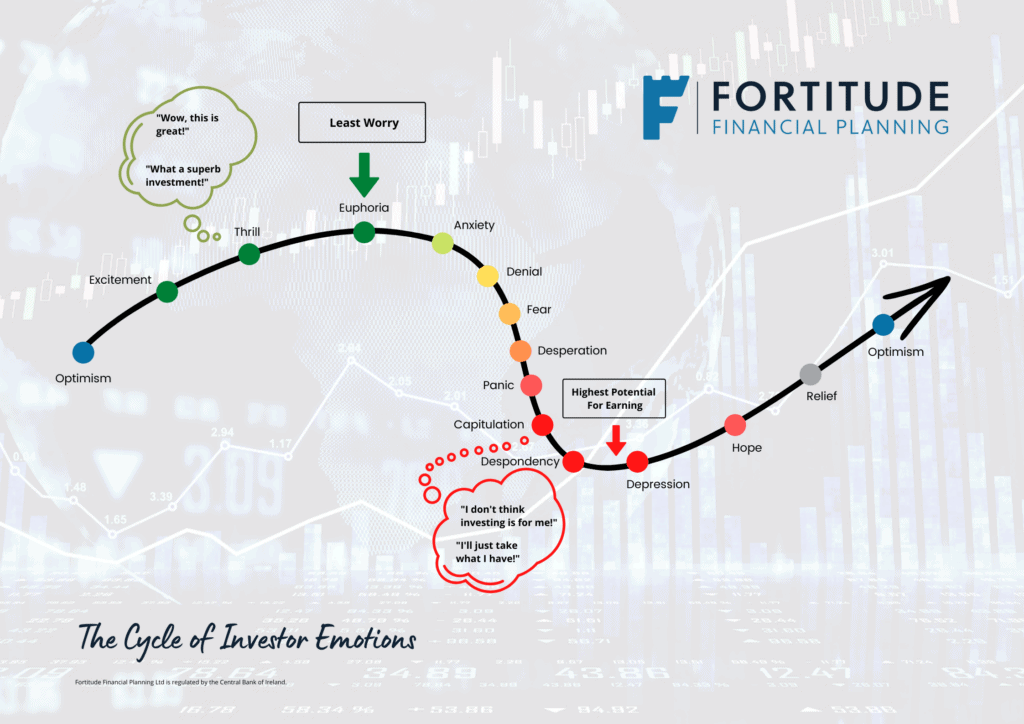

Unfortunately, when markets decline, investors suffer anxiety.

It’s a known fact that the pain of losing is psychologically about twice as powerful as the pleasure of gaining.

Investing is an emotive act.

Therefore, when markets decline (see current 2022), investors’ anxiety increases, sometimes significantly.

As a result, it’s important the investor and their advisor have their philosophy to guide them.

Why should your advisor have an investment philosophy?

An investment philosophy is essentially a map of an approach to investing.

Imagine driving to a destination, you don’t know the route and you have no roadmap (1990’s) or GPS.

In fact, all you have are signs that appear from time to time, telling you how far away certain towns are.

What you really need is that map (1990’s) or GPS.

Your investment philosophy is that map or GPS you turn to when making investment decisions.

Importantly, it makes sure you’re heading in the correct decision on the correct track.

In the same way, a map can’t predict unforeseen weather like a road closure or bad weather, an investment philosophy can’t predict a down market.

It can’t predict a financial crisis or market volatility.

However, it can help you manage your response to these events (as market volatility is a given at various points on the road).

A clear, well-prepared, and supported investment philosophy helps investors to stay on track for long-term goals when short-term events conspire against them.

An advisor (or their employer) without an investment philosophy is essentially like a boat without a rudder.

They don’t have an evidence-based set of beliefs about how to invest and just drift from one idea to another (typically ideas that pay high commissions).

An inconsistent investment approach is a common cause of capital loss.

Advisors that don’t have a philosophy, how do they work?

Randomly.

Unfortunately, that’s the simple answer to that question.

As mentioned above, they typically just drift from one idea to another.

Commonly, it could be commission based. i.e. who is paying them the highest (or high) commission.

They tend to put the investment before the client.

Minimum work on getting to know the client and then just any investment.

Again, unfortunate, and this way doesn’t put the client’s interests front and centre.

Alternatively, it could be performance based.

I had a conversation with another adviser in the past and they told me they make recommendations for fund managers who have performed best in the past 5 years in different risk categories.

My challenge to that was they may have had a good 5 years, but who’s to say that will continue?

What if the two year numbers drop? Do you change your strategy? Change your recommendation? Switch the fund manager?

No consistency.

Picking funds based solely on past performance is akin to gambling, betting, and essentially taking a punt on performance.

Fortitude Financial Planning’s Investment Philosophy

You can view our investment philosophy by clicking here.

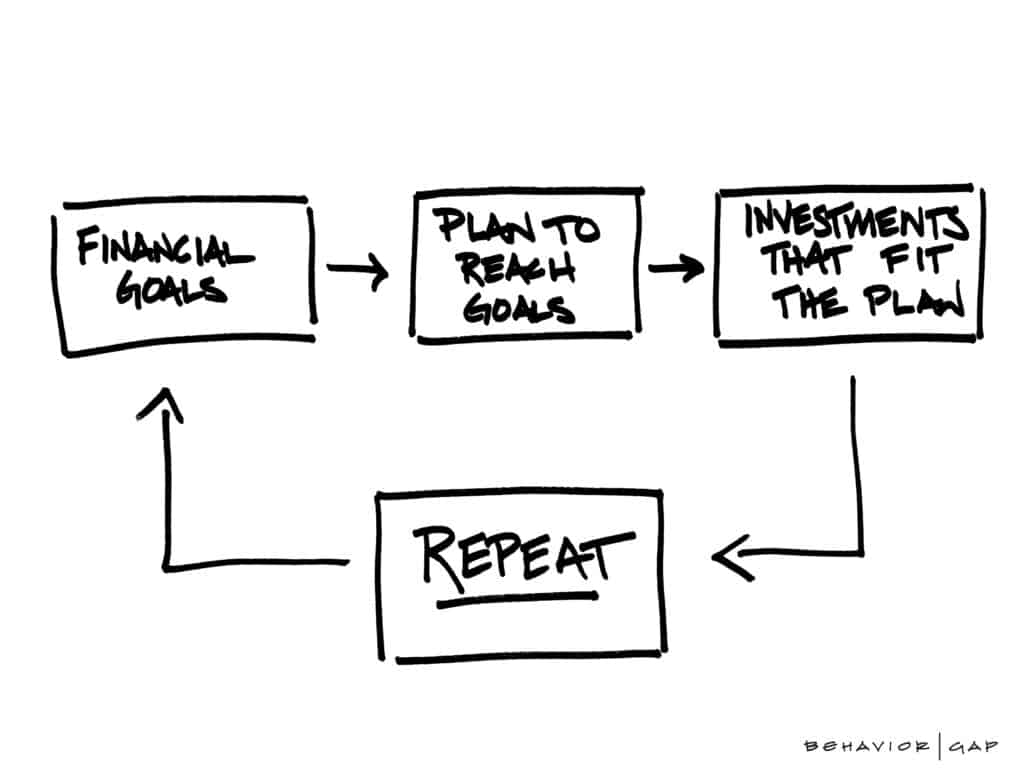

Firstly, our financial planning philosophy starts with your clients.

What they need and want to achieve.

Our investment philosophy then comes in and it’s principles are based on knowledge and evidence that markets work.

- Short-term markets can’t be predicted

- Timing the markets doesn’t work

- Risk and return are related

- Diversification is essential

- Investors’ discipline and behaviour are crucial

Want to learn more detail about each principle? Click here.

One of our key elements is to eliminate human error, and let markets work for you.

It always intrigues me how advisors (and individuals, some even clients), think they can beat the market when fund managers earning six figure salaries cant.

We educate our clients and prospects on each of them, and if you disagree, for example, you feel markets can be timed or want the quick high return win, we can’t work with you.

Summary

In conclusion, it’s super important whoever is giving you advice, has an investment philosophy.

Long term, markets work, but they’re never straightforward.

There will always be volatility (see 2022 as an example).

As a consequence, it’s important you and your advisor have a plan and philosophy to turn to.

To guide you through volatile markets.

Ask your adviser ‘What is your investment philosophy?’

How we help

Do you have an advisor already for an investment, pension, or Approved Retirement Fund (ARF)?

Ask them ‘what is your investment philosophy?’.

Guage the reaction, how does it make you feel?

We’re always on hand, even for a second opinion.

We’ll happily discuss our investment philosophy with you in detail and how it guides us and our clients, and most importantly works for our clients.

If it fits with your values, we can talk some more.

Get in touch

To discuss further email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production