2024 In Review

As we reach the end of 2024, investors have much to reflect on and deliberate.

Global equity markets (year-to-date) have delivered returns far above average, with below-average volatility (fluctuations in price).

However, at the start of the year, none of this was easy to forecast.

From ongoing wars to numerous elections that led to regime change, 2024 has been a year that served up plenty of uncertainty.

As we wind down to a time that will, for many, be filled with family, special celebrations, and rest, let us reflect on a few lessons we’ve taken from 2024.

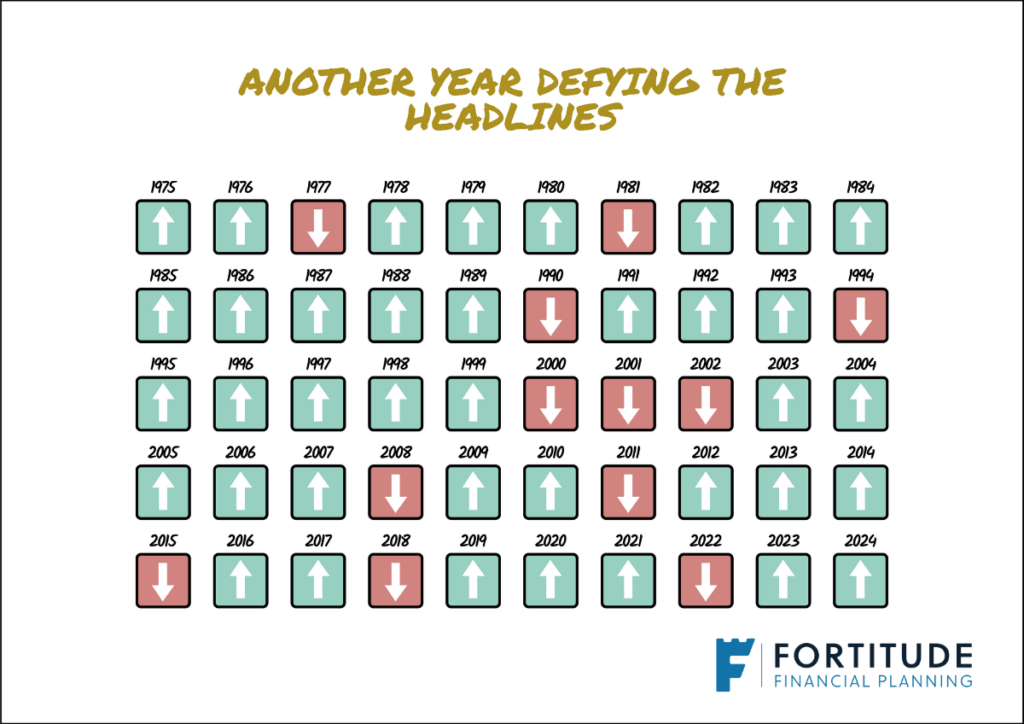

#1 – Ignoring The Noise Is Rewarded

After great market returns in 2023 and looming uncertainty, investors could have been forgiven for feeling anxious about the short-term impact on markets.

Inflation and interest rates had not yet returned to their previous levels, and in some economies, the risk of recession was ever-present.

Yet, once again, the stock market (the great companies we use in our daily lives) has reminded us that it operates independently of the daily noise.

The market is made up of real companies, selling real things, to real people.

As we leave this year behind, let us resolve to carry this message with us and remember that if we have a long-term plan, we can safely ignore most of the noise we regularly encounter, as hard as this is to do in practice.

#2 – Inflation Is Your Number One Enemy

Now that inflation is largely under control, it’s worth reflecting on its impact.

Often a silent threat that compounds over time, it reared its ugly head in a big way over the last three years. For a short period, its impact became obvious to all.

Skyrocketing living expenses have highlighted the importance of investing for longer-term growth rather than short-term preservation.

With this lesson fresh in our memories, let us remember its dangers as we plan for the future.

Fortunately for the long-term investor, an investment in the global share market has consistently provided protection from this enemy.

#3 – Good Times Do Not Last Forever

After two excellent years for global markets, it’s precisely at this time that we should remind ourselves that good times do not last forever.

Stock market history shows that, on average, one out of every four years produces negative returns.

While we do not know when the next negative year will arrive, we know it will.

We will never forecast markets, but we will always advocate for maintaining realistic expectations and being prepared for temporary market declines. Let us resolve never to be surprised when the market does what it has always done.

Summary

In summary, 2024 has been a year in which investors’ ability to anchor themselves to a well-thought-out, long-term plan has been crucial and richly rewarded.

As we head into a new year, let’s continue to focus on what we can control—maintaining robust financial plans and practising patient and disciplined investing.

Most importantly, let’s resolve to stay in our seats when we next encounter market turbulence because it will come.

As always, thank you for taking the time to read my articles and I wish you a very Happy Christmas and a healthy and prosperous New Year.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production