2025 In Review

As we enter December, with one month still to go in 2025, there is already much for investors to reflect on.

The year began with the inauguration of President Trump, capping a year of elections that saw significant political change across the globe.

What followed was a period of uncertainty and theatre around US tariffs that sent markets into a month of turbulence.

Elsewhere, peace deals have begun to de-escalate conflicts that dominated headlines for years, while the AI revolution has continued to reshape industries and capture imaginations.

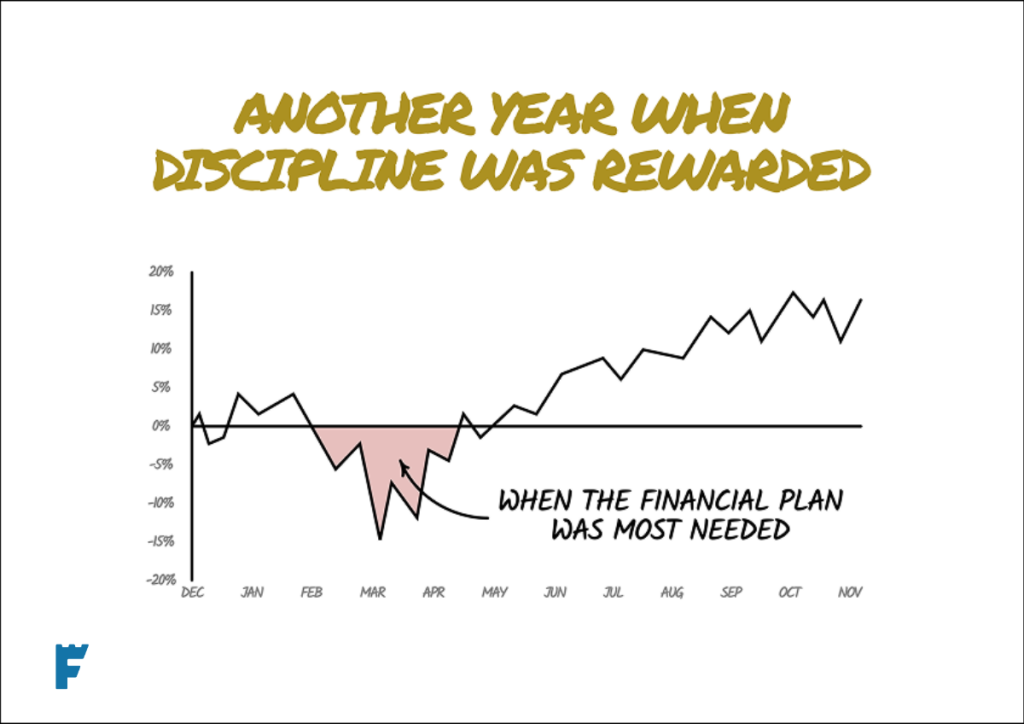

Despite periods of genuine chaos (including a sharp market decline that saw global equities fall by around -19%), it looks likely that 2025 will deliver another year of above-average returns for equity investors. This follows two excellent years of returns in 2023 and 2024.

I know from my conversations with clients that the period from March to April was an uncomfortable period for many.

While these periods of decline and uncertainty are always unpleasant at the time, they remind us of the patience and discipline required to become successful long-term investors. The anxiety of early April has been rewarding for those who stayed invested.

While markets are forward-looking and already concerned about what 2026 could bring, there is value in pausing to look back. The events of the past year offer three lessons that can serve us well in the years ahead.

#1 Overvalued Markets Can Still Grow

At the start of this year, many commentators warned that global markets looked expensive by historical standards. Yet markets (a collection of the great companies and businesses of the world) have continued to deliver returns, reminding us once again that valuation tells us little about timing.

It can be tempting to wait for a better entry point or to reduce exposure to equity assets when prices seem stretched. But markets can remain expensive for years while still rewarding patient investors.

Timing the market requires being right twice: when to get out and when to get back in. History suggests this is a game very few win (if any).

#2 Knowing What Will Happen Doesn’t Tell You How Markets Will React

The tariff announcements in early April provided a striking lesson in the limits of information.

On 2 April, the Liberation Day tariffs announcement confirmed what many had expected: sweeping tariffs were on the way.

Markets, which had been declining in March, fell sharply as uncertainty took hold.

Yet just a few days later, on 8 April, with uncertainty arguably at its peak and no clear resolution in sight, the market quietly found its bottom and began to recover.

Those who knew tariffs were coming had no advantage.

The information was widely available. What nobody could know was how and when the market would respond. This is why we focus on planning rather than predicting.

#3 Long-Term Planning Beats Short-Term Prediction

It is rare for the world to undergo a shift as significant as the one we are living through with artificial intelligence. It is genuinely difficult to imagine what daily life will look like in five years, let alone how businesses, industries, and economies will adapt.

However, we’re confident that the human ingenuity that has seen us adapt and prosper through previous technological revolutions will do so again.

The knock-on effects for financial markets are equally unknowable. And yet, this uncertainty is not new; it is the permanent condition of investing.

Fortunately, the long-term game we are playing is not the short-term game being reported on by financial media.

A solid financial plan (an appropriate asset allocation, a margin of safety, and the discipline to stay invested through volatility) remains the foundation for long-term success. Let us resolve to hold onto this truth, especially when the future feels more uncertain than usual.

Thank You

In summary, 2025 has reinforced a timeless principle: we cannot predict, but we can prepare. These lessons, earned through a year of turbulence, will steady you when markets next test your resolve.

As we approach the end of another year, let us continue to focus on what we can control: maintaining robust financial plans and practising patient, disciplined investing.

I wish you a restful holiday season and hope the coming weeks bring time with the people who matter most. Whatever 2026 has in store, we will navigate it together.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production