2025 Mid Year Review

The halfway point of any year is a good time to pause, reflect, and learn from what we’ve experienced. As we’ve often reminded you, studying the lessons from market history is essential preparation for future challenges.

The first half of 2025 reminded us of the timeless patterns of investing.

The more we can internalise these patterns, the more confidently we can say when the next crisis arrives: “It’s never different this time.”

What’s Happened

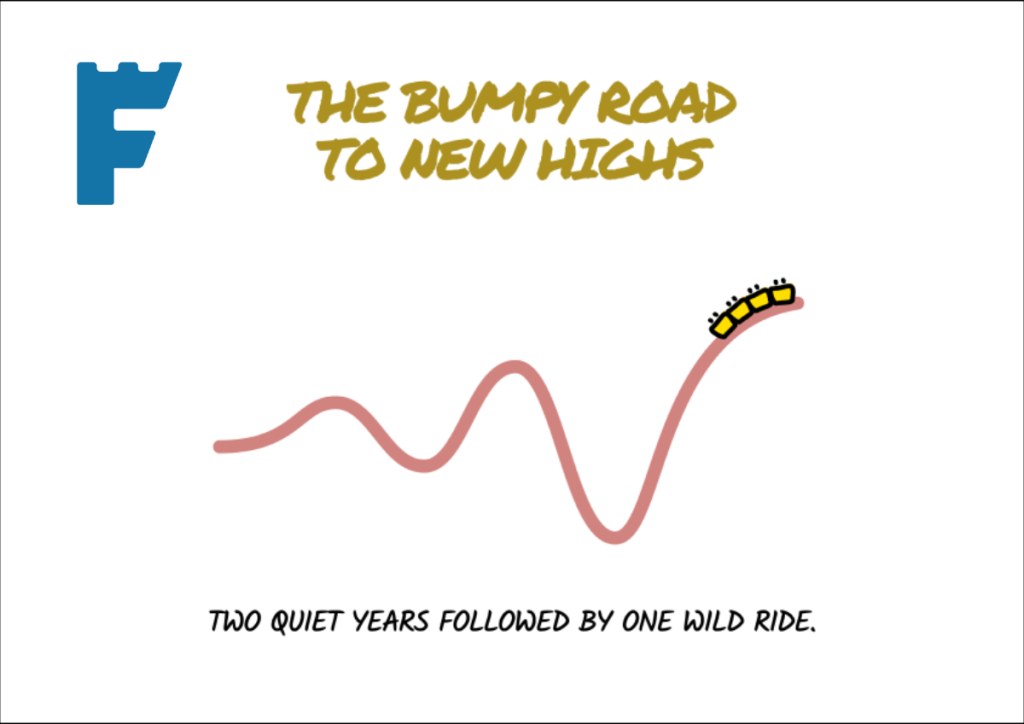

The first half of 2025 demonstrated a return to normal market volatility.

Following exceptional returns in 2023 and 2024, which were accompanied by unusually low volatility, markets reminded us that calm periods never last.

Adding to the generally positive backdrop at the start of the year, inflation (which had been a persistent concern over the last few years) started approaching target levels in most major economies.

This removed one major source of uncertainty that had weighed on markets and investor sentiment.

However, geopolitical tensions continued to simmer, with new tensions between Israel and Iran adding to other ongoing conflicts. As history shows us, such geopolitical concerns are a constant feature of the investment landscape.

After reaching new highs in February, markets began to decline due to concerns about the valuations of technology companies. This decline accelerated on April 2nd, when President Trump announced sweeping tariff measures targeting virtually all trading partners.

The market’s response was swift and severe. Some markets fell more than 20% from their previous highs, officially entering bear market territory. If you felt unsettled watching the daily news during those weeks, you weren’t alone.

Yet markets began recovering in late April as tariff policies were scaled back.

What We’ve Learned

What’s happened so far in 2025 was unique, but it reminded us of timeless investment truths. Three lessons stand out:

1. Markets often overreact to headlines.

The tariff announcement on “Liberation Day” sent markets into a tailspin, only for much of the policy to be scaled back within weeks. This reminded us that markets are composed of people, and people tend to react emotionally to alarming headlines. The initial panic, followed by swift recovery, showed how sentiment can swing wildly while the underlying fundamentals remain largely unchanged.

2. Market timing remains impossible.

The first half of 2025 demonstrated once again that the only way to earn the market’s full return has been to remain invested at all times. During the depths of the decline, many experts predicted further falls and advised caution. Yet the recovery began precisely when fear was at its peak.

Did you feel tempted to make portfolio changes during those uncertain weeks? Those who tried to avoid the volatility not only locked in losses but also missed any recovery.

3. Volatility is a normal part of the investment journey. Make it your friend, not foe.

The correction, followed by a strong recovery, reminded us that volatility isn’t a bug in the system; it’s a feature. These temporary declines are precisely what allow long-term investors to earn superior returns. Instead of fearing volatility, mature investors understand it’s the price of admission for owning the great companies of the world.

Looking Ahead

As we enter the second half of 2025, we anticipate new challenges ahead. History shows us that the future remains a chain of constant surprises, and we expect this pattern to continue.

The volatility of the first half reminds us that market corrections occur roughly once a year, and investors should not be surprised when markets do what they have always done.

Whether it’s trade tensions, geopolitical problems, or something completely unexpected, we will face them with the same core beliefs that guided us through the first half: patience, discipline, and focus on the long term.

Remember, lifetime investment success comes from acting continuously on your plan, not from reacting to current events.

We understand that staying disciplined during volatile periods can be challenging. However, it’s a privilege to support you through these unavoidable challenges, knowing that every cycle you navigate successfully brings you closer to your long-term financial objectives.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production