7 Steps to Managing Market Volatility

Investing is a key component of a successful financial plan.

Whether that be personally held assets or via a pension, investing is a necessity.

However, market volatility can unsettle even the most experienced investors.

But, it also offers unique opportunities to those who know how to navigate it effectively.

Before we look at ways to manage it, let’s briefly refresh ourselves on some of the background details.

Firstly, what is market volatility?

Volatility is the frequency and size of price movements. The bigger and more frequent, the more volatile the market is said to be.

What affects it?

Market volatility is affected by a broad range of factors that can be economic (relating to inflation figures, employment statistics, GDP growth rates), geopolitical (elections, international conflict etc) psychological (investor sentiment) and structural (trading rules, regulation etc).

Market volatility never looks as bad when viewed from a distance

Volatility has started to creep up again in 2024, but it’s always worth taking a step back and look at the bigger picture.

To do this, let’s look at what’s sometimes referred to as ‘the fear index’, the CBOE Volatility Index, or VIX. Based on future options of the S&P 500, the VIX tries to gauge when investors are nervous about future volatility.

Over the last few years, there have indeed been occasions when it has shot up – notably during the pandemic. But these spikes are only for short periods; volatility isn’t a permanent state.

Furthermore, when you zoom out and look at the longer-term trend, market volatility, which feels sharp at the time, isn’t that bad.

Now let’s take a look at seven ways to manage volatility.

7 Steps To Managing Market Volatility

#1 Diversification

We always advocate not putting all your eggs in one basket.

Diversification is your only free lunch when it comes to investing.

It is about spreading your investments across different asset classes (stocks, bonds, etc.).

We can then diversify further across sectors and geographical regions within these asset classes.

That way you can reduce the impact of a downturn in any single area on your overall portfolio. Diversification doesn’t guarantee profits or protect against loss, but it can stabilise your returns.

#2 Rebalance often

Rebalancing is the process of realigning the weightings of a portfolio of assets by periodically buying or selling assets to maintain an original or desired level of asset allocation or risk.

For example, a portfolio of 60% equities and 40% bonds may drift to 62% stocks and 38% bonds and is rebalanced back to 60/40.

This can be particularly important in volatile markets where asset values can fluctuate widely, causing some investments to weigh too heavily or too lightly in your portfolio.

We rebalance your portfolios for you to help maintain your risk tolerance and investment strategy alignment.

#3 Avoid checking your investments

Online logins, the work of the devil! Constant monitoring of your investment portfolio can lead to impulsive decisions and unnecessary stress, especially during periods of high market volatility.

Frequent checks often heighten emotional responses to short-term market dips and peaks, which can derail your long-term investment strategy.

It’s important to remember that markets naturally fluctuate, and daily movements are generally less relevant to long-term investment goals.

#4 Stay invested to capture key market days

Attempting to ‘time’ the stock market — identifying the exact moments to buy low and sell high — is an exceptionally challenging task, even for seasoned investors.

Recent periods of sharp market fluctuations have only amplified this difficulty.

Notably, the most significant gains in the stock market tend to occur on just a few critical days. Missing these key opportunities can have long-lasting repercussions on your investment returns.

In fact, evidence shows that by missing the 10 best days in the market, an investors portfolio could shed 50% of it’s gains.

#5 Have a long-term view

Short-term market fluctuations can be alarming, but having a long-term investment strategy can keep you grounded.

Focus on your long-term investment objectives and avoid making impulsive decisions based on short-term market movements.

Long-term investing has proven to be a more successful approach because it allows you to ride out the volatility and benefit from the growth of the markets over time.

#6 Remember: investing beats cash

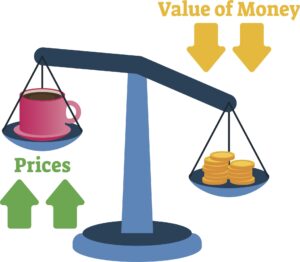

Keeping large sums of money in cash or traditional savings accounts leads to a decrease in purchasing power.

This is because the interest rates on these accounts fail to keep up with the rate of inflation, effectively diminishing the value of your money over time, i.e. providing you with a guaranteed negative return.

Conversely, investing in the financial markets provides a significant advantage.

Although investing carries its own risks, historically, it offers returns that exceed inflation, preserving — and increases — your wealth’s real value.

The financial plans we create ensure you retain enough cash, not too much or too little, as liquidity is important in the short term.

#7 Stay calm and patient

Finally, one of the most important steps in managing market volatility is maintaining your composure.

Emotional investing leads to poor decision making. When the market is turbulent, remind yourself of your investment strategy and long-term goals.

Patience is essential; overreacting to short-term market movements often results in missed opportunities when the market rebounds.

Summary

While market volatility can be stressful, taking proactive steps to manage your investments can mitigate risks and enhance potential returns.

By diversifying your portfolio, sticking to a long-term investment plan, and maintaining a calm approach, you can navigate through turbulent times more effectively.

Remember, volatility isn’t a permanent state – and it can be an opportunity for those who are prepared.

Get in touch

Worried about market volatility or your pensions or investments?

Contact us and take the first steps to getting your finances in order.

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production