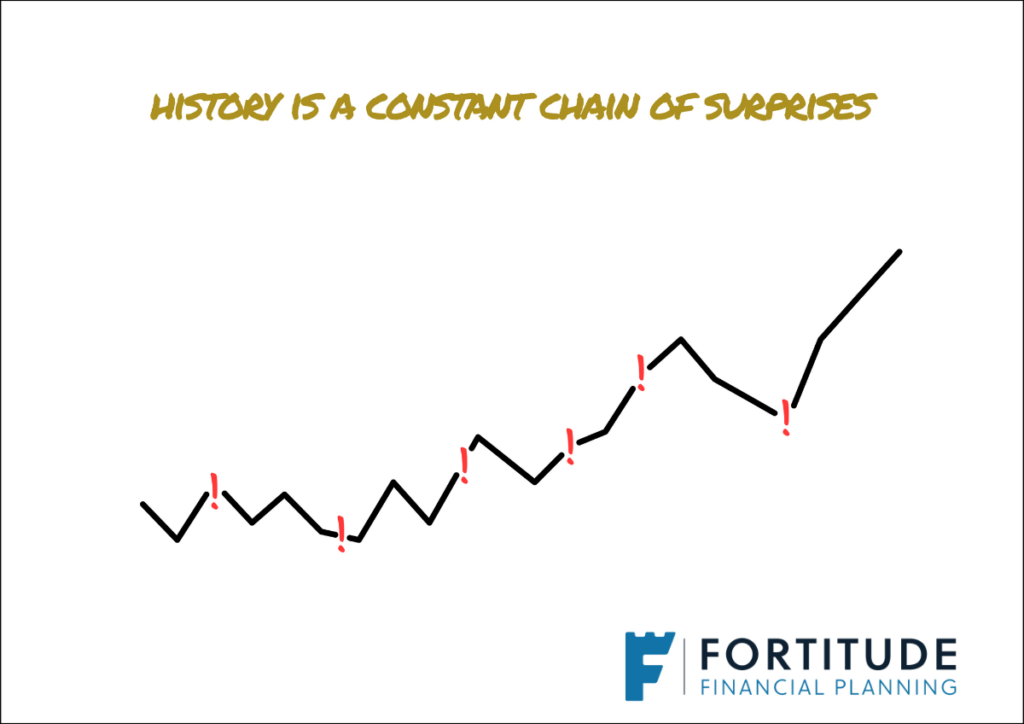

A Constant Chain of Surprises

Experienced investors know that uncertainty is a constant companion. While the human mind craves certainty, there is, unfortunately, none to be found in investment markets.

Yes, history being our guide, we believe that the stock market (companies and businesses we use daily) will reward patient investors who remain disciplined. Still, there are no guarantees (or facts) about the future.

Uncertainty, however, comes in different flavours.

As a former US Secretary of Defense once said, there are known unknowns (the things we know we do not know) and unknown unknowns (the things we don’t know we don’t know).

It’s the former category, the known unknowns, that investors tend to concern themselves with.

In June 2024, concerns about inflation are starting to ease, the various election uncertainties will soon pass, and the ongoing wars are slowly moving off the front pages as readers become sanitised to the ongoing tolls.

How each of these topics will end is unknown, but the element of surprise has undoubtedly passed.

They are known unknowns.

With many previous surprises wearing old, believing that certainty is around the corner is tempting. However, as financial author Morgan Housel states, “History is a constant chain of surprises.”

Unknown Unknowns

While known unknowns get all the attention, it’s the unknown unknown that causes investors the most trouble.

“Surprise is the mother of all panic”, said Nick Murray, and panic is an emotion that leads to poor financial decisions.

History is full of these surprises….

Latin American countries, having borrowed eagerly throughout the 1970s, faced the music in the 1980s. When Mexico defaulted in 1982, it echoed like a gunshot.

As domino after domino fell, the world noted a sobering truth: debt-fueled growth carried a heavy price.

The market opened abruptly on October 19, 1987. Without warning, the Dow Jones plunged by 22%. Traders were blindsided, staring at screens flashing red (doom).

The culprit? Program trading—machines executing trades at lightning speed, transforming a ripple of panic into a tidal wave.

In the 1990s, the internet ignited a frenzy. Stocks soared, fueled by dreams of online gold. By March 2000, reality hit hard. The crash was a harsh reminder: innovation couldn’t replace sound financial fundamentals.

The NASDAQ index plummeted nearly 80% over two years. Startups vanished, and investors faced massive losses.

In the early 2000s, banks handed out mortgages like candy, assuming housing prices would eternally rise. By 2007, cracks appeared.

In September 2008, the collapse of Lehman Brothers sent shockwaves across the globe. Financial markets seized up, and economies plummeted.

Finally, an invisible enemy brought the world to its knees. In 2020, the COVID-19 pandemic shut down economies overnight.

Markets plunged, unemployment soared, and global supply chains fractured.

Prepare, Don’t Predict

By definition, we cannot predict the next global or financial surprise. Based on the track record of serial forecasters, it’s not worth searching for the answers in the media, either.

As investors, it’s prudent to assume that we will frequently be surprised by the course of events. How can we prepare for something that we cannot predict?

While we do not know what will bring the next round of panic, we can reliably predict some of the consequences.

As with previous surprises, market volatility, sharp interest rate increases/decreases, and inflation could all rear their heads.

However, like the ship crew that practices lifeboat drills while docked in harbour, we, too, can assess our preparedness before the storm arrives.

Stress-testing our financial plans for their ability to provide long-term returns but also survive frequent temporary declines, having a cash buffer for emergencies, and investing enough so that even future personal surprises won’t jeopardise our independence are all sensible ways to plan.

The importance of a margin of safety in our financial plans cannot be stressed enough.

Lastly, while the next surprise may shift your focus to short-term survival when it arrives, we encourage you to build your plan around the likely long-term trajectory of financial markets. When it comes, the next storm will pass like the others before it.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production