Behavioural Biases & Your Finances

When it comes to managing personal finances, logical thinking isn’t always at the forefront of our personal decisions.

Where your own money is concerned, your financial behavior is influenced by psychological behavioural biases.

These are subtle but powerful mental shortcuts and emotional triggers that lead you away from rational decisions.

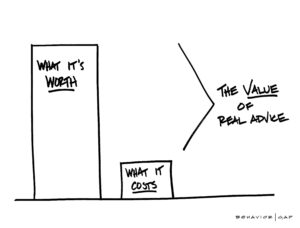

This is why a financials planner role is sometimes more akin to a psychologist than a financial planner – we’re objective when it comes to your finances.

Understanding these biases is essential for making better financial choices and building long-term wealth.

In this article, we’ll explore some of the most common behavioural biases that affect financial decisions and how to overcome them.

Loss Aversion

What it is: Loss aversion is the tendency to prefer avoiding losses over acquiring gains. In other words, the pain of losing money is often more intense than the pleasure of earning the same amount. For example, someone might be more upset about losing €100 than they would be happy about gaining €100.

Impact on finances: This bias can lead to overly conservative investment strategies. Many people keep their money in low-interest savings accounts or avoid investing altogether because they fear losing money, even when a well-diversified portfolio will provide higher returns.

This then results in inflation outpacing their own money, providing a negative return on their money.

How to overcome it: Acknowledge that volatility is a part of investing and that short-term temporary declines are a natural part of long-term financial growth.

Educating yourself about risk management strategies, like diversification, can help you manage risk without avoiding opportunities for financial growth.

Herd Mentality

What it is: Herd mentality occurs when individuals follow the actions of a larger group, often because “everyone else is doing it.”

This bias can be seen in financial markets when investors buy or sell assets because others are doing the same, without considering whether it aligns with their financial goals.

Impact on finances: Following the crowd can lead to poor investment decisions, such as buying into a market bubble or selling in a panic during a downturn. This “herd behavior” often results in buying high and selling low—exactly the opposite of sound investment strategy.

How to overcome it: Before making financial decisions, take the time to research whether the choice aligns with your goals and risk tolerance.

Building a disciplined investment strategy based on your financial plan can help you avoid making impulsive decisions driven by others.

Overconfidence

What it is: Overconfidence bias is the tendency to overestimate your financial knowledge or abilities. This often leads people to believe they can predict the stock market, choose winning investments, time the market perfectly or believe they are more qualified than a certified financial planner.

Impact on finances: Overconfidence can lead to excessive decisions, underestimating risks, and ignoring professional advice. It can also result in failing to diversify investments, assuming that you can pick the “winners” every time.

How to overcome it: Recognise that the market is unpredictable and that even experienced investors cannot time it consistently. A balanced, diversified approach with regular contributions to your investments, like euro-cost averaging, can reduce the impact of market fluctuations.

Furthermore, understand that personal finance isn’t your forte, it’s ours.

Anchoring

What it is: Anchoring bias occurs when people rely too heavily on the first piece of information they receive (the “anchor”) when making decisions.

Impact on finances: Anchoring can lead to overvaluing or undervaluing investments. You may hold onto a stock just because you think it should return to its previous high, or you may refuse to sell an investment at a loss, waiting for it to “recover,” even when it might be time to cut your losses.

How to overcome it: Be mindful of the anchors influencing your financial decisions. Base your investment choices on current market data and your financial goals, not on past prices or emotional attachment to an investment.

Confirmation

What it is: Confirmation bias is the tendency to seek out information that supports your pre-existing beliefs and ignore information that contradicts them. This often leads to one-sided research and reinforcing poor financial habits or decisions.

Impact on finances: Confirmation bias can lead to poor decision-making, as you may overlook warning signs or ignore critical data that could affect your investments. It can also create a false sense of security about risky financial decisions.

How to overcome it: Actively seek out opposing viewpoints and be open to changing your perspective when presented with new information. Regularly review your financial strategy with an objective eye or consult a financial advisor for an unbiased assessment.

Present

What it is: Present bias refers to the tendency to prioritise immediate gratification over long-term benefits.

In simple terms, it manifests as spending money now rather than saving or investing for the future. For example, people may choose to buy a luxury item today rather than contribute to their retirement savings.

Impact on finances: This bias can lead to inadequate savings, overspending, and under-investing, resulting in future financial insecurity. The effects of present bias compound over time, particularly when it comes to saving for retirement or large future expenses.

How to overcome it: Develop a habit of paying yourself first by automating your savings and investments. Setting up automatic transfers to your savings or retirement accounts can help you avoid the temptation of spending everything in the present.

Recency

What it is: Recency bias is the tendency to focus on recent events while ignoring the bigger picture. For example, after a stock market crash, people may assume that future market conditions will remain poor, even if historical data shows that markets recover over time.

Impact on finances: Recency bias can cause people to overreact to short-term market fluctuations, leading to panic selling or avoiding investments altogether during downturns. It can also cause individuals to chase after hot investment trends based on recent success, potentially buying into a market bubble.

How to overcome it: Maintain a long-term perspective when making financial decisions. Review historical market performance and remind yourself that markets move in cycles. Sticking to your investment plan and resisting the urge to act on short-term market events is key to long-term success.

Summary

Fact. Behavioural biases are part of human nature.

However, being aware of behavioural biases can help you make more rational and informed financial decisions. By identifying the biases that influence your thinking and taking steps to counteract them, you can develop a more disciplined approach to managing your finances.

Whether you’re a seasoned investor or just starting your financial journey, a thoughtful strategy that prioritises long-term goals over emotional responses is the key to building lasting wealth.

Get in touch

Contact us and let’s look at your investments together and see how they fit with your plans.

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production