Cardio for your finances

Your heart is the most important muscle in your body.

As a regular gym goer, one thing never ceases to amaze me:

The number of people who exercise every other muscle in their body but do zero cardio to exercise the most important muscle.

You know the type.

Built like a brick sh*thouse yet you will never ever see them on a treadmill, a stairmaster or a cross trainer.

I often think to myself ‘why?!’

Your finances

So what’s the link between your finances and your heart?

Ok, so your finances aren’t the most important thing in life (ultimately, health is, see point above about cardio! Get to the gym!).

As a financial planner, I always encourage clients and friends to look at life as a basket of experiences.

As humans, we remember experiences.

I clearly remember my firstborn’s first Christmas, our first family holiday as a family of four.

39 years later I still recall my first Celtic match, the birth of both my daughters etc etc.

What I struggle to remember is what iPhone I had ten years ago.

While I remember the car I had 10 years ago I can’t recall anything special about it.

We are less inclined to remember material things, but then again that could be dependent on the type of person you are.

If you are a material person maybe material things are more important.

If that’s the case I suggest you recalibrate your life.

So whilst experiences are more important than your finances, ultimately how healthy and planned your finances are will dictate the experiences you can achieve.

For example, are your kids in their teens?

Wouldn’t it be great to plan for one last big memorable family before they start heading off to Kavos and Santa Ponsa with their mates?

It would, but it costs money.

Cardio for your finances

Think of the financial planning process, at the outset and ongoing, as cardio for your finances.

Similarly, as cardio for your heart keeps your heart healthy, financial planning gets and keeps your finances healthy.

Undoubtedly, it keeps you on track to experience what you want to experience.

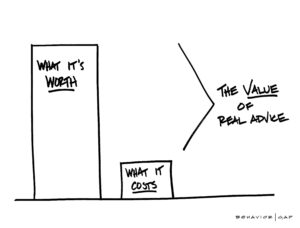

In particular, a lot of the heavy lifting in getting your financial plan is done at the outset.

Even over the first year!

Firstly, the start of the process is about helping you tease out your goals, aspirations, and values.

Don’t worry, people can change over time so these can change, more on that later.

Secondly, we then move on to getting your plan created.

Thirdly, it is then about getting the various parts of your financial plan in place and aligned with your goals and aspirations.

Initially, think of this phase as similar to the first part of commencing your heart cardio.

You’re out of shape, it takes time to build up your fitness, and the first sessions are the most difficult.

Similarly, if your finances are not in great shape or are muddled, getting the plan created and implemented is the most difficult.

However, as a result of kicking off your heart cardio, you’ve made the most important step, to get started.

Similarly, getting your financial plan up and running, that’s the most important step, getting over that initial barrier.

Ongoing

With your heart cardio, the more you do, the easier it becomes.

Therefore, you have a healthier heart.

With your financial plan, once it’s up and running, it’s about regular check-ins to continuously improve the health of your finances.

Check-ins to see what’s changed at your side, what’s changed at our side, changes in the economy, legislation, and so on.

Importantly, this is where we capture changes in your goals, objectives, and aspirations.

You may wish to drop a previous goal you had or add something new to aim for.

Importantly, it’s a fluid and ongoing process.

The same as heart cardio, the more often you do it, the easier it becomes.

More importantly, how healthier your finances become.

The effect of compounding, little actions on an ongoing basis equals BIG longer term results.

Heart cardio sessions you do weekly.

Financial planning, once the initial heavy lifting is done to get everything in place, really only has to be revisited once or twice a year.

Summary

In summary, finances are not the be all and end all.

However, they are pretty darn important as healthy finances result in you being able to comfortably experience in life more of what you want to experience.

You can live the life you want to live.

The alternative to having a proper financial plan in place is just winging it.

The old “ah sure it’ll be grand” narrative.

Taking the correct steps now (larger steps, then smaller ongoing ones) can ensure your finances are directly aligned with what you want to experience in life, your goals, your aspirations, and your values.

The Result

As a result, you will be in a position where you have control over your day to day and month to month finances.

You will be in a position where you can absorb a financial shock that may come your way.

And financial shocks do crop up, life happens.

Unquestionably, you will be on track to meet your financial and life goals and have the financial freedom to make choices that allow you to enjoy life.

Proof

Some recent proof of this.

A client we have worked with for a number of years now was recently made redundant.

Two young kids.

However, the strategies we implemented a few years ago enabled her to take time out from going back into the workforce.

Time out to enjoy spending time with her kids and peace of mind financially she could do so.

She and her family were in a position to absorb that financial shock and focus on what was important.

How We Help

We can help you with your cardio for your finances.

Firstly, our process will map out where you are.

We’ll then look at where you want to go and what you want to do.

Finally, we’ll get everything aligned with your goals and personal values to support your plan.

Peace of mind and security for you.

Get in touch

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production