Client Case Study: Mr and Mrs Early Retirement

In the past, we wrote articles based on case studies of real clients and without a doubt, we got great traction with these.

I imagine this was because people could resonate with the situations and there is no better way to outline the benefits of our advice than real life examples.

In this article, we are going to demonstrate a couple who worked to not only retire early but enjoy retirement with a purpose.

We’ll outline from when they first contacted us to where they are today.

Let us call them Mr and Mrs Early Retirement!

Note some details have been changed for privacy purposes.

The Situation

Mr and Mrs Early Retirement initially contacted us with a clear objective in mind.

Both were employees in separate industries and they clearly wanted to retire early.

However, importantly, they had clear plans about how they wanted to spend their retirement, clear goals and objectives.

They did not want to stop working just for the sake of it.

What was stopping them was they were not at all sure if they could financially afford to retire at their target age.

As well as that, due to a bad experience a parent had with investments, they were completely unsure of investing!

Their Journey

Discussion

We had our initial meeting with Mr and Mrs Early Retirement.

Very little talk of financials, this was to thrash out what their clear goals, objectives and perosnal values were.

We clarified what their retirement lifestyle looked like and the objective of purchasing a holiday home and all that entails.

Gathering the information

Now that we knew what their target retirement age and retirement looked like, we went on to gather their information.

Our clients completed their financial planning questionnaire and provided details of their existing financial arrangements in place.

Arrangements like pensions, savings, investments, life insurance etc.

Preparing the Analysis

When we had all of their information we went to work and analysed everything they had.

It was clear they came to us with the usual financial bag of spanners.

A few different pensions, savings in multiple accounts along with an investment account they didn’t know much about.

Initially, the key issues we identified were:

- There was a surplus income disappearing due to everyday life

- Unfortunately, they were not paying much into their pensions and losing out on growth and tax relief

- They had significant sums sitting on deposit earning next to no return

Following our initial projections, it was clear we were going to have to put their assets to better use and they were going to have to change their mindset to achieve their early retirement objective.

Financial Planning Meeting

We sat down and reviewed the findings.

We mapped out their financial life without advice and then discussed our recommendations which initially were (in no particular order):

- Maintain a rainy day emergency fund in a low risk easily accessible structure

- Use surplus income that’s disappearing to maximise their pensions – this gives the benefit of 40% tax relief (i.e. a 66% investment gain)

- Create a simplified investment account to help them generate growth on money they were holding on deposit earning no return and inflation was just eating away at (creating a real negative return)

Super important, due to the historical bad experience with investments, we spent time with our clients and take the time to outline investing, framing what real risk is and why one needs to invest.

At this point, we also compare the financial future with our recommendations with their financial future without advice.

Implementing the strategies

Unquestionably, the key point is the client understanding the process.

Mr and Mrs Early Retirement fully understood they were seeking advice for a reason, that they could not do it themselves and needed expert guidance.

Following on from our meetings and guidance, the client then implemented the following:

- Firstly, they got onto their payroll, maximised their pension AVC’s – a quick win

- Secondly, ringfenced a specific amount as their rainy day fund

- Finally, engaged us to open an investment account in line with our investment philosophy and advise accordingly

Simply put, this means the clients assets are now all working towards their main goals of retiring at a specific age and being in a position to purchase and travel to a holiday home on a regular basis.

Importantly, projections show they have the means to do it.

Fast Forward

Once implemented, it’s then about checking in to see if the clients are still on track.

We regularly reviewed and made any amendments as required.

Yes, there was some hand-holding to be done particularly when investment markets were temporarily declining.

However, as a result of them embracing the financial planning process and implementing the recommendations, they arrived at their target retirement age and financially could pull the trigger.

Present Day 2024

The process is not complete – we still regularly review.

It’s important to us, and to them, we ensure they are still on track.

I’m pleased to be able to say we recently had our up to date review, they have been enjoying their holiday home for two years now and are in fine fettle.

Grandchildren have now appeared on the scene and we are planning some financials around them.

Kudos to Mr and Mrs Early Retirement that when investment markets temporarily declined significantly in 2020 due to Covid-19 and 2022, they didn’t panic.

They didn’t panic because they had a plan, a roadmap, and an investment philosophy to fall back on and they trusted the process.

Both the financial planning and investment process.

Their investments are sitting with a lovely 24% total return, currently annualising at 6% return.

In short, simply, if they never embraced the financial planning or investment process, their assets wouldn’t have been correctly allocated, their money wouldn’t have been working and they wouldn’t have been able to retire early.

Summary

Mr and Mrs Early Retirement approached us with a clear vision.

A vision of not only when they wanted to retire but how retirement looked.

They understood they could only do so much themselves and needed professional assistance.

Despite an aversion to investments, they took the time to understand investments, why investing is crucial and the process.

Collaboratively, we then allocated their resources accordingly.

Leading to them hitting their lifestyle goals.

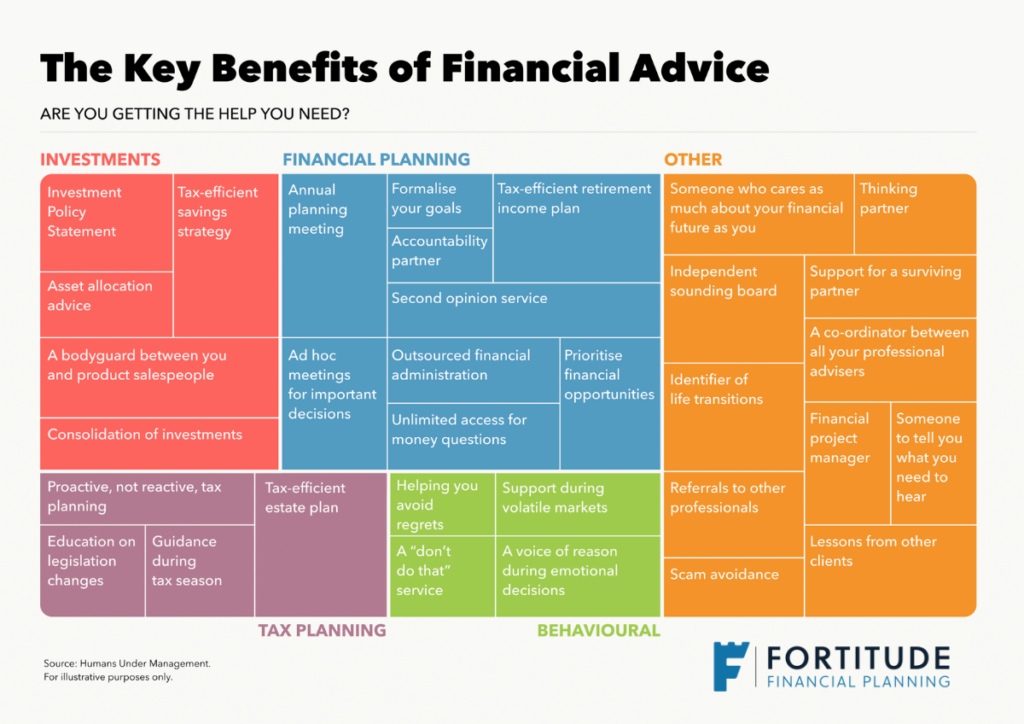

How we help

Whether you are clear or unclear about your financial and life goals, everyone can get value from financial planning.

Financial planning is not just for the older or wealthier client.

Indeed, the earlier you get started with financial planning, the chances of long term success increase.

We have service levels to suit everyone, for those who are just starting out or those looking for a more detailed plan.

Working with us, you are safe in the knowledge you are getting advice from a company Certified Financial Planner™ certified.

Get in touch

Contact us and take the first steps to getting your finances in order.

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production