Difficult Conversations: The Heart of Financial Guidance

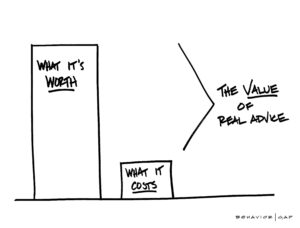

For many years, the role of a financial adviser/planner was limited to providing access to financial products.

Often, just acting more as an order-taker than an advice-giver.

However, in an era where financial information is at our fingertips and financial products are readily available, our role has had to evolve significantly.

Today, the best advisers act as thinking partners and professional advisers to help families achieve their most cherished financial and life goals.

We are committed to this new way of being and see ourselves as partners in your financial journey, dedicated to guiding you towards a secure future.

However, like any meaningful relationship, this partnership thrives on mutual respect, trust, and honesty.

Short-Term Discomfort, Long-Term Gain

While it’s easy to maintain this honesty when you’re on track with their financial goals, true partnership shines brightest during challenging times.

When it becomes apparent that you may be veering off course from their financial objectives, our commitment to honesty compels us to have difficult yet crucial conversations.

We regularly encounter situations that require a difficult conversation that requires empathy.

Some days, we encounter a pre-retiree who believes that investing regularly is unnecessary because retirement is decades away.

On other days, we encounter retirees withdrawing unsustainably from their investments, jeopardising their long-term independence.

While uncomfortable to discuss, these scenarios require crucial conversations that can alter financial trajectories.

As financial discussions can be emotionally charged, we aim to guide clients through these conversations with sensitivity and care.

If we ever need to have these conversations with you, we’re here to support you as we work together towards your financial goals.

Embracing Honesty for a Secure Tomorrow

While avoiding these topics might feel easier in the moment, if not addressed, the problem will only grow, potentially causing irreparable damage.

By addressing issues early, you can make smaller, more manageable adjustments rather than drastic overhauls later.

Think of your financial journey as a flight.

As your advisers, we are the co-pilots, regularly checking the instruments and suggesting course corrections.

Even a slight deviation can lead you far off course over time without these adjustments.

Our duty is to ensure you reach the intended destination, and course corrections are inevitable.

How We Help

As we navigate your financial journey together, remember that our commitment to honesty stems from a genuine desire to see you succeed.

We’re not just looking at the you of today but advocating for your future self – the person who will benefit from the decisions and adjustments made now.

We are committed to being a supportive partner who cares enough to tell you what you need to hear, not just what you want to hear.

If there’s anything we need to hear that will strengthen our relationship and the value you get from it, we encourage you to bring it up.

We encourage open dialogue with our clients.

Ask us questions, share your concerns, and be receptive to feedback.

This collaborative approach, built on mutual trust and respect, is the cornerstone of our mutual long-term success.

Get in touch

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production