Financial Clarity – Take the First Step

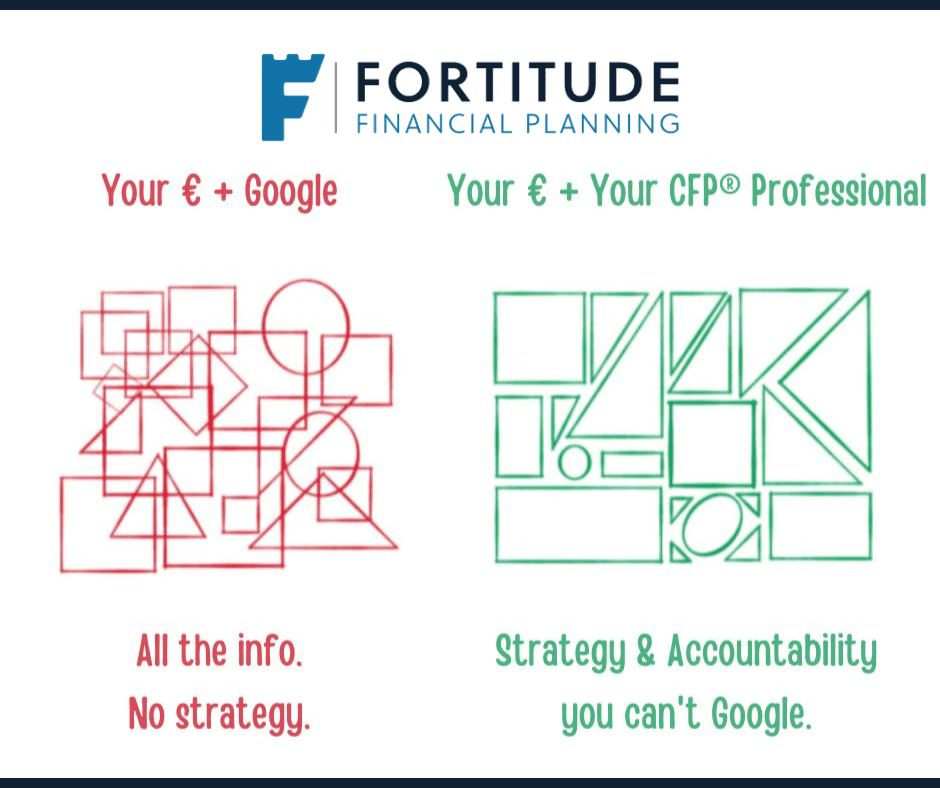

The first step in the financial planning process is gathering all the information needed to make financial decisions.

Because this can take valuable time, people are often tempted to jump straight to the decision.

This usually leads to suboptimal financial choices, some of which may be irreversible.

From our work with clients, we’ve learnt that making smart financial decisions is only possible when all the relevant information is available.

For this reason, our relationship with new clients always starts with getting financially organised.

Doing this well lays the groundwork for the clarity and confidence that always follows excellent financial planning.

Moving from Chaos to Order

Many individuals & families struggle with disorganisation.

The overwhelming nature of scattered documents, unclear cash flow, and a lack of clarity about one’s financial situation can take a significant mental and emotional toll.

It’s easy to feel trapped in a cycle of financial uncertainty.

Furthermore, unsure how to break free and take control of your money.

However, hidden beneath the surface of this chaos lies the transformative power of financial organisation.

Getting organised initially seems daunting, but every journey begins with a single step.

We suggest that you start small and celebrate your progress along the way. Financial organisation is a skill that can be learned and improved over time.

One of the first steps in getting organised is to create a centralised hub for your financial information.

This can be a physical binder, a digital folder, or a combination of both.

Now the second step,

Collect documents, statements, and information that make up your financial life and save them in your centralised hub.

By having all your important documents in one easily accessible place, you can quickly and easily reference the information you need to make informed decisions about your money.

The Power of Financial Clarity

At the heart of organisation lies the power of clarity.

When you take the time to gather and review your important financial documents and information, you create a clear picture of your current financial situation.

This clarity is like a map, helping you navigate the complex landscape of your financial life with confidence and purpose.

With your financial information organised, you can gain a deeper understanding of your financial life.

This means closely examining your income, expenses, savings, and investments and identifying patterns and trends that may impact your financial health.

Are there areas where improvement can be made? Are there opportunities to redirect your resources towards your goals?

Financial clarity also enables you to set meaningful, achievable goals for your future.

When you clearly understand your starting point, you can create a roadmap to guide you towards your desired destination.

Whether you’re saving for a new home, planning for retirement, or working to pay off debt, having a clear action plan can help you stay motivated, focused, and on track.

Taking the First Steps towards organisation and Financial Clarity

Financial organisation is like a beacon of light guiding you through the fog of financial confusion and illuminating the path to a brighter, more secure future.

The process and effort of getting financially organised may seem daunting at first, but the rewards are well worth the effort.

When you commit to decluttering your finances, you’re not just tidying up paperwork—you’re laying the foundation for a more empowered, intentional relationship with your money.

We have successfully assisted countless families in this process, and we are more than capable of guiding you through the first step towards achieving the peace of mind from excellent financial planning.

Get in touch

Contact us and take the first steps to financial clarity.

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production