Financial Goals: Short, medium, and long term

A key element of financial planning is investing (sensibly).

Why?

By investing, you grow your assets and your wealth.

This allows us to work towards achieving our financial goals.

We can’t hold too much cash as inflation erodes its real value.

A key question we’re regularly asked is “Should I save or invest?”

However, to answer this, it’s important to identify your short, medium, and long term financial goals.

By doing this, one understands what they are trying to achieve with their money.

If the money is for short-term goals, save in the bank, credit union, or post office.

Medium or long-term (5 years plus) goals, invest.

So how does one identify their financial goals?

Whilst everyone’s financial goals are different, there is generally consistency amongst clients with some of the core financial goals.

Here are some of the more common financial goals and objectives I see.

This should provide you with a good starting point to get you thinking.

Quick note, depending on your age or your children’s age, some of them can fit into either of the below brackets.

Short Term Financial Goals – typically within the next 5 years

- Emergency fund (for all stuff like home and car maintenance, kids’ activities, income interruption)

- Next couple of years family holidays

- New home deposit

- Planned home improvements

- Assuming the kids are currently in college, the next couple of years’ fees

Medium Term Financial Goals – The next 5-10 years

- Assuming the kids are younger, their future anticipated school or college fees

- Regular family holidays

- Regular changes of the family car

- Holiday home purchase

Longer Term Financial Goals – 10 years plus

- Assuming the kids are really young their future college fees

- Retirement planning

- Potential long term care requirements

- General long-term real growth of assets

Summary

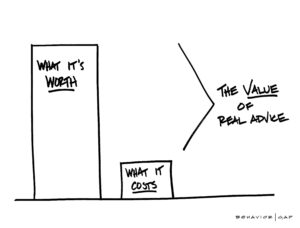

To summarise, we should all be investing.

Why? Numerous reasons, two of which are to grow our wealth and nullify inflation.

However, prior to investing, you must first consider your financial goals.

Getting asked what your financial goals are can be a rabbit in the headlights moment.

It can be one of those questions where you think ‘eh, urgh, I haven’t really considered them’.

This is because we mostly just float through life, maybe putting a bit of money away here and there and trying to deal with stuff as it arises.

How we help you

Hopefully, the above has given you a couple of things.

- A jolt to consider your financial goals

- A starting point to what they may include

As said, everyone’s individual goals are different however the above are core financial goals many of us have.

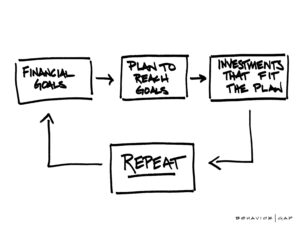

Part of our financial planning process is helping you articulate your goals and objectives.

Then, when we have ascertained them, we can then move onto advising on saving and investing.

Giving our clients one cohesive plan built around what they want to achieve.

Get in touch

To discuss further email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production