Financial Planning – what is it and how do we actually do it?

You will hear us and other advisors talking about financial planning.

Without a doubt, it is very important.

According to the American Psychological Association money is the top cause of stress in the United States.

A country with a population of 329 million people.

For this reason, it’s important to control your finances and not let them control you.

You do this with the help of a CERTIFIED FINANCIAL PLANNER™, like ourselves.

But what exactly is financial planning and how do we do it?

What is financial planning?

Firstly, what is financial planning?

In its simplest form, it’s a comprehensive look at your current situation, where you are, where you’re going, your goals and any strategies you have in place.

It’s an ongoing process that will reduce your stress or concerns about money and give you confidence in the present and into the future.

Financial planning also helps you make the most of your assets whilst mitigating financial risks to you and your family.

How we create your financial plan

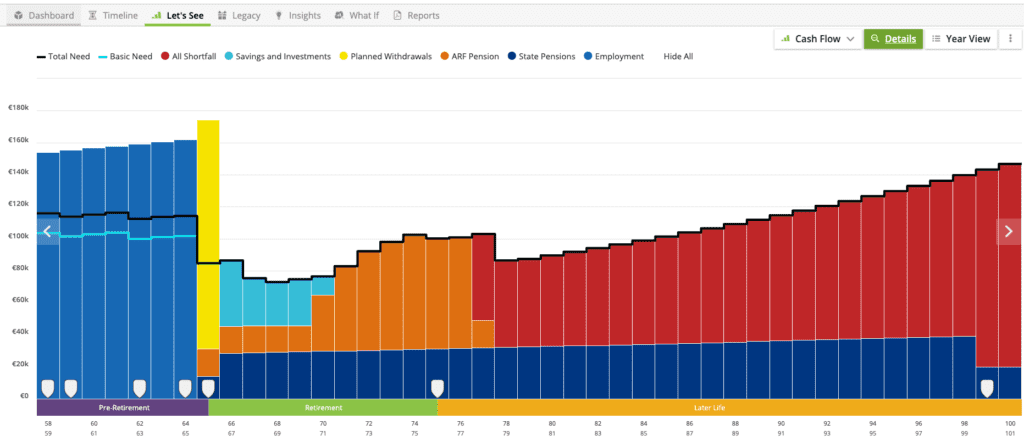

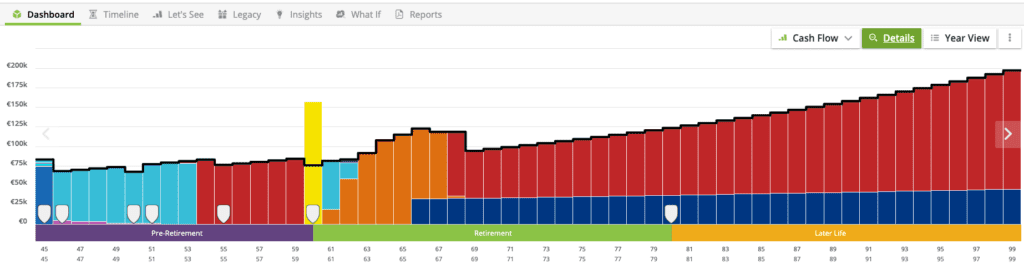

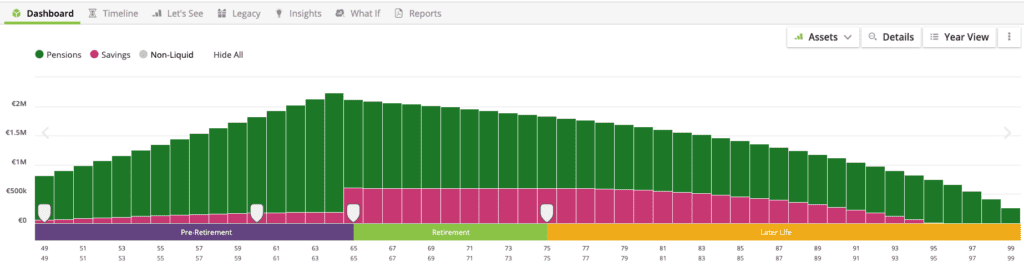

At the heart of your financial plan done properly is your personal financial forecast.

For this, we use sophisticated software, the global and industry leader, Voyant.

The software is incredibly powerful.

Firstly, we map out your current situation, factoring in things like long-term inflation.

Secondly, we can create various scenarios based on your own financial and lifestyle goals.

Furthermore, we can illustrate what strategies you have at the moment that are working, what’s inefficient, what benefits that changes you can make would give you and highlight risks to you.

Consequently, this feeds into our recommendations.

As a result, our financial planning clients only get recommendations specific to their own circumstances.

The software is the cornerstone of our financial planning service.

Watch this short video to learn more.

How does the financial forecasting software work?

Firstly, we enter your main financial data.

Things like:

- Salaries

- Rental income

- Investment income

- Pension income

Secondly, we then look at your current and future expenditure.

This is provided to us and is mainly broken down into the following categories:

- Household expenses

- Debt repayments

- Motoring

- Family

- Personal

- Holidays

- Leisure

- Luxury

At this point, our clients provide estimated future life events expenditure, for example, kids’ college fees, special occasion family holiday, retirement cruise etc.

Thirdly, we add your assets, things like:

- Property (family home and investment)

- Investments

- Cash savings

- Pensions

Finally, liabilities, things like crappy debt (high interest loans) and good debt (mortgage) are added.

Understandably, the world changes consistently so we have to make certain assumptions and the three main assumptions are as follows:

- Long term inflation

- Cash saving returns

- Investment returns

Once complete, we run the forecast and the different scenarios.

We show you how good, bad, and indifferent your current situation is in line with what you want to do.

We will highlight the inefficiencies you currently have and the risks you carry.

Then, we can show you the impact our knowledge and recommendations or even a slight change in your behaviour will have.

So, what questions can financial planning answer?

Generally, when clients come to us, initially they have one of two questions:

- Are we doing ok? and/or

- What should we be doing differently?

However, in addition to these, some other questions can trigger a call to us or are uncovered in our meeting process.

These include but are not limited to:

- Are we putting our savings to the best use?

- We have we grow our savings as the bank are giving us nothing

- Do we need to save more?

- Inflation is high, how is this affecting us?

- Can I retire now or early?

- When can I retire?

- I’m setting up an Approved Retirement Fund (ARF), what level of income can I draw from it?

- My pension options are an annuity or an ARF, what’s best?

- Can we give our children a deposit for a house or will I need this money later?

- We’re thinking about a career break, how will it affect our finances?

- What would happen if our income stopped for whatever reason?

- If we died tomorrow, what inheritance tax would our estate have to pay?

- Do we have enough life insurance?

- I’m thinking of working part-time, how would that affect us financially?

Ultimately, this could go on however I hope you have a flavour of some of the questions financial planning can assist with.

Can’t I just do all that by myself?

Not really, one may think they can but they really can’t.

Yes, some have knowledge of how to manage money but a CFP® brings in knowledge of the domain.

Do you have time to educate yourself about your finances and how stuff works?

How about keeping up to date with constant changes in the markets and the economy?

Or ongoing legislation changes and product changes?

As I said, some may think they can but they can’t, no one has the time.

Additionally, we all get emotional when it comes to dealing with our own money, fact.

Leading to decisions that are not the best.

Therefore, it’s important to have an objective view.

Summary

That’s how we do our clients’ financial plans.

So who can benefit from planning their finances proactively?

Everyone, simply.

Having a proper financial plan will give you the confidence you are doing the correct things, are on the correct road and are in a position to absorb any unexpected financial shock.

This will give you peace of mind, now and most definitely into the future.

How we help

Maybe you’re asking yourself those questions:

- How are we doing, are we doing ok? and/or

- What should we be doing differently?

Or, maybe you’re thinking, ‘I’m sick of it, I want to retire but I don’t know if I can afford to?’.

Maybe you have received your pension retirement options and are weighing up an Annuity versus an Approved Retirement Fund (ARF) and are unsure what’s best for you, not what’s best for the pension administrator.

Alternatively, you may be asking yourself one of the questions we listed above or a completely different question!

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production