How much should I save in an emergency fund?

Why does every Irish household need an emergency fund!

Because life is unpredictable.

One day everything is going smoothly, and the next you’re facing a medical emergency, redundancy, or an unexpected home repair.

That’s why having an emergency fund is so important. But how much should I save in an emergency fund in Ireland?

The answer depends on your financial situation, lifestyle, and how much risk you’re comfortable with.

Let’s explore.

The General Rule: 3 to 6 Months of Expenses

Most financial experts recommend having three to six months’ worth of essential living expenses or net after tax income set aside.

This gives you a safety net for unexpected events like illness, job loss, or major household issues.

To work out your emergency fund target:

-

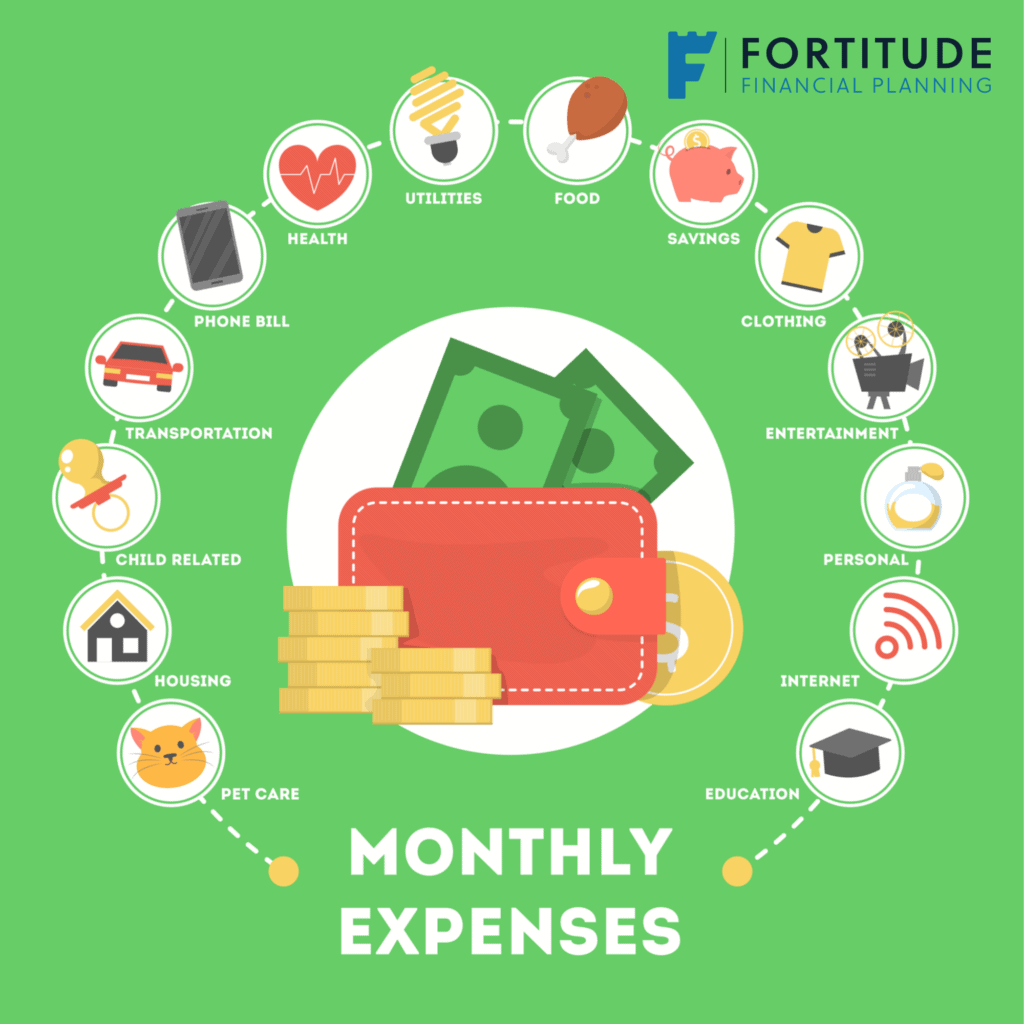

Add up your essential monthly expenses – Think mortgage or rent, utilities, groceries, insurance premiums, transport, and minimum loan repayments.

-

Multiply by 3 to 6 – Depending on your level of job security and personal comfort, aim for between three and six months of those core expenses.

For example, if your essential monthly outgoings total €2,500, a healthy emergency fund would fall between €7,500 and €15,000.

Or simply take your net monthly take home pay and multiply by 3 to 6 months.

When You Might Need to Save More

While the 3–6 month rule is a solid benchmark, some people may need to build a bigger cushion. Here are a few scenarios where that makes sense:

-

Job Stability

If you’re in a sector with higher redundancy rates or fixed-term contracts, it’s wise to aim higher. In Ireland, the average duration of unemployment can vary widely depending on the industry and location, so a 6+ month buffer can provide peace of mind. -

Variable Income

Freelancers, sole traders, and those with irregular income (such as seasonal workers or commission-based earners) may want to target 9–12 months of expenses. -

Dependents and Financial Commitments

If you have children, elderly parents, or other dependents relying on you financially, a larger safety net is sensible. -

Health Considerations

Ongoing medical needs—whether for yourself or a loved one—can justify building a more substantial reserve.

The Reality in Ireland

While saving for emergencies is important, the reality is that many Irish households are underprepared. According to the Central Bank of Ireland:

-

Around 35% of Irish households would struggle to cover an unexpected expense of €1,000.

-

A significant number of people don’t have enough savings to cover three months of expenses.

-

Rising living costs have made saving harder, but also more essential.

If you’ve been asking yourself “how much should I save in an emergency fund in Ireland?”, you’re not alone. Many people are unsure where to start—especially when budgets are already tight.

How to Build Your Emergency Fund

If you’re starting from scratch, don’t be discouraged. Building your fund is a journey—and small, consistent steps make all the difference.

-

Start Small, Stay Consistent

Even €25 or €50 a week adds up over time. -

Automate Your Savings

Set up a direct debit to transfer money into a separate savings account the day after payday. -

Cut Unnecessary Spending

Identify areas where you can cut back and redirect that money to savings. -

Make the Most of Windfalls

Use tax refunds, bonuses, or gifts to top up your emergency fund. -

Choose the Right Account

Keep your emergency fund in a high-interest deposit account or credit union account that offers easy access without penalties.

Final Thoughts

The right emergency fund size depends on your personal circumstances.

Whether you’re a full-time employee, a business owner, or a freelancer, having a financial cushion gives you breathing room when life throws a curveball.

Wondering how much you should save in an emergency fund in Ireland? Start where you can and build gradually—your future self will thank you.

Ready to build your emergency fund with confidence?

Knowing how much to save is one thing—creating a realistic, achievable plan is another.

Book a quick chat today and let’s figure out the right target and strategy for your situation.

Visit our Insights – A hub of information covering saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production