How to Save Money and Build Wealth: 5 Essential Strategies for Financial Success

Saving money is the foundation of financial security.

Whether you’re building an emergency fund, putting aside a deposit for a home, or preparing for retirement, the core principles remain the same.

These five strategies on how to save money and build wealth that work for any age or income level and can help you build long-term financial stability.

1. Pay Yourself First

Before you pay any bills or spend a cent, set aside a portion of your income for savings and investing.

Treat savings as a non-negotiable expense — just like rent or utilities.

How to start:

-

Decide on an amount or percentage (even €100 a week can make a difference).

-

Automate transfers to a separate savings or investment account right after payday.

-

Increase your contributions when your income rises or debts are cleared.

Over time, aim for at least 20% of your income. If your goal is aggressive saving—such as catching up on retirement—push for 30% or more.

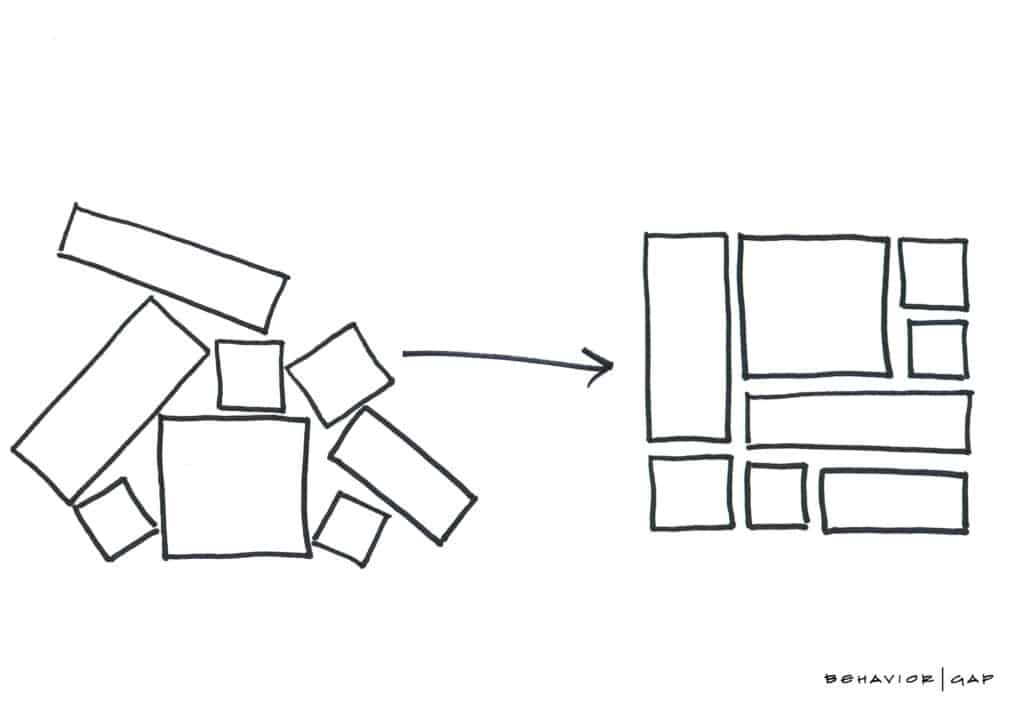

2. Use Separate Accounts

Keeping your money in clearly defined accounts makes it easier to stay organised and resist temptation.

Example account setup:

-

Emergency fund

-

Fixed expenses (rent, utilities, groceries)

-

Lifestyle spending (dining out, entertainment)

-

Savings or investment accounts for specific goals (e.g. holidays, a new car)

Many banks now let you create multiple “buckets” or nickname accounts—perfect for tracking exactly what’s allocated to each goal.

3. Stick to Your Budget

A budget only works if you follow it.

If you set €100 for entertainment, that’s your limit—no top-ups, no “just this once.”

Tips to stay on track:

-

Avoid impulse buys with a 24-hour cooling-off rule for non-essentials.

-

If you overspend, review the cause and adjust next month’s plan.

-

Leave some “fun money” to avoid feeling restricted.

Remember: a budget should feel like a tool, not a punishment.

4. Track Every Euro

You might think you know where your money goes—until you write it down.

Tracking every expense (yes, even that €3 coffee) can reveal hidden leaks in your budget.

Ways to track:

-

Use a finance app for real-time tracking.

-

Keep a simple spreadsheet.

-

Go old-school with pen and paper.

At the end of each week or month, review your spending patterns and look for areas to cut back. Over time, you’ll naturally become more mindful with your money.

5. Invest to Grow Your Wealth

Saving is essential, but investing is what grows wealth over the long term.

A savings account will keep your money safe, but inflation can erode its value. Investing helps your money outpace inflation through compounding returns.

Beginner tips:

-

Learn your risk tolerance, goals, and time horizon.

-

Start small

-

If available, make the most of retirement accounts like a PRSA or employer pension, especially if your employer matches contributions.

-

Focus on “time in the market” rather than trying to time the market.

When in doubt, seek professional advice to create an investment strategy that suits your situation.

Final Thoughts

You don’t need a high salary or a finance degree to take control of your money.

Start with these five steps:

-

Pay yourself first.

-

Separate your accounts.

-

Stick to your budget.

-

Track your expenses.

-

Invest for the long term.

Small, consistent actions—over time—create lasting wealth.

How We Help

At Fortitude Financial Planning, we help you move from good intentions to real results.

Our role is to make saving, budgeting, and investing feel less like a chore and more like a clear, achievable plan.

Here’s how we work with you:

-

Personalised Savings Strategy – We tailor a plan that fits your income, goals, and lifestyle, so saving becomes effortless and sustainable.

-

Clear Budgeting Framework – We help you create a budget that works in real life—flexible enough to enjoy today, but disciplined enough to secure tomorrow.

-

Investment Guidance – We explain your investment options in plain English, so you can make confident decisions about growing your wealth.

-

Ongoing Support & Accountability – We check in regularly to keep you on track, adapt your plan as life changes, and ensure you’re always moving towards your goals.

No jargon. No guesswork. Just a clear path to building the financial future you want.

Ready to take control of your finances and learn how to save money and build wealth?

Whether you’re starting from scratch or refining your existing plan, we can help you turn financial goals into achievable steps.

Book a no-obligation chat with us today and see how Fortitude Financial Planning can help you save smarter, invest wisely, and build lasting wealth.

📅 Click here to book your call now.

Visit our Insights – A hub of information covering saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production