Inflation and Your Personal Finances

Inflation is the buzzword of the last few years.

It is a term that often pops up in news headlines, economic reports, and conversations about the state of the economy.

But what exactly is it, and why does it matter so much?

In simple terms, inflation is the general increase in the price of goods and services over time.

Whilst a small, steady level of inflation is normal in a growing economy, a high or unpredictable level can have serious consequences.

This article will explore the dangers of inflation and how it affects your personal finances.

Erosion of Purchasing Power

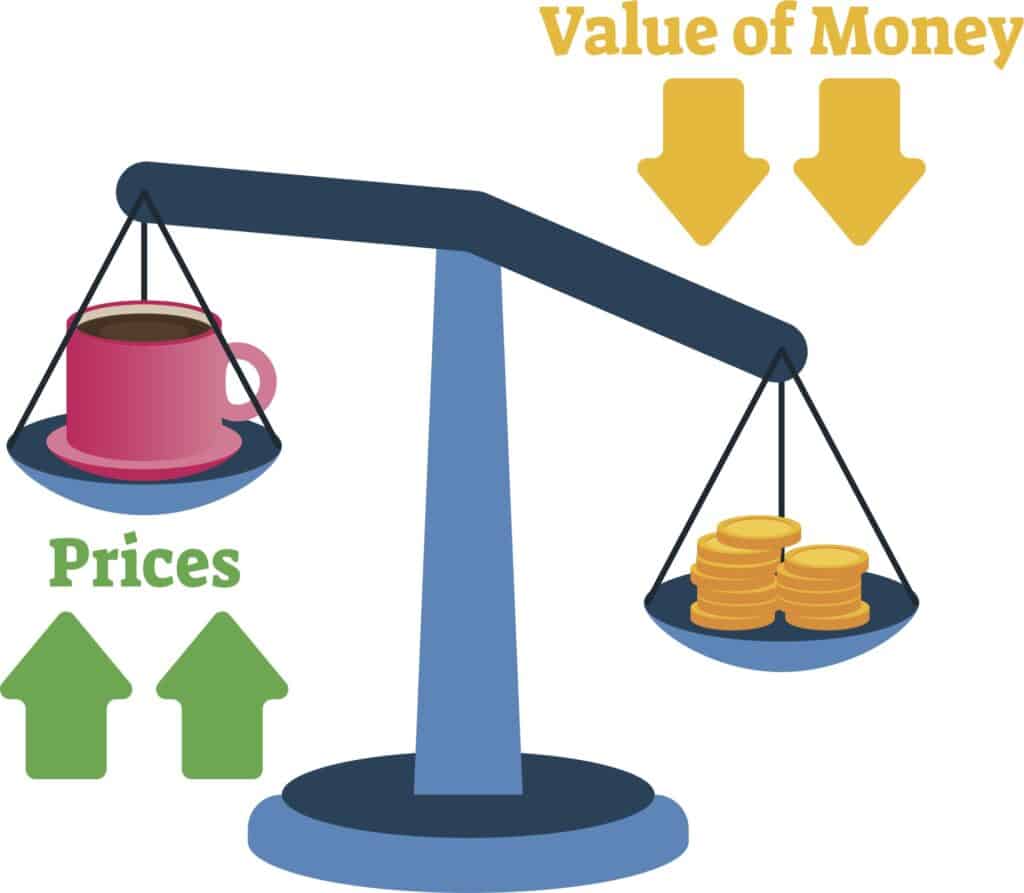

The most immediate and obvious impact of inflation is the erosion of your purchasing power.

As prices rise, the value of your money decreases, meaning that the same amount of money buys fewer goods and services than it did before.

For example, if inflation is running at 5%, a product that costs €100 today will cost €105 next year.

This devaluation affects everyone but hits low-income households the hardest since a larger portion of their income is spent on essentials like food, housing, and transportation.

Impact on Savings

Inflation doesn’t just affect what you can buy today—it also eats away at the value of savings.

If inflation outpaces the interest earned on savings accounts or fixed-income investments, the real value of your money decreases.

Holding money in the bank is like an investment with a guaranteed negative return.

This makes it harder for people to save for major life expenses like education, buying a home, or retirement.

Higher Interest Rates

To control inflation, central banks like the Federal Reserve or European Central Bank often raise interest rates.

However, this then makes borrowing more expensive.

Higher interest rates can affect your ability to borrow, leading to higher costs for new loans, mortgages, and credit cards.

If you have variable-rate debt, your payments might increase.

This in turn puts more pressure on your budget.

Housing Costs

As we touched on earlier, inflation causes the cost of goods and services to increases.

Specifically on housing, the bare essentials, this can be rent, mortgage, groceries and utilities like energy.

Costs specific to running your household go up, again pressuring your budget.

Impact on Retirement

As inflation erodes purchasing power of your money, this relates to your income in retirement.

If you’re retired and in receipt of an annuity income that is not indexed linked, the value of your income is reducing each year.

You may be invested in an Approved Retirement Fund (ARF) giving you the opportunity to expose your pension to assets that combat the erosion of your purchasing power.

However, If your retirement savings don’t grow faster than inflation, you might find it harder to maintain your desired lifestyle in retirement.

Planning for an inflation-adjusted withdrawal strategy is super important.

How to Manage Inflation

It is not an unstoppable force.

Whilst we can’t influence it (we leave that up to the Central Banks!) we do have tools at our disposal to assist us in our personal battle with this increase in everything around us.

For individuals, protecting against inflation involves making smart financial choices.

This could include investing in assets that typically outpace inflation, such as equities.

In fact, holding equities long term is proven to be a reliable hedge versus inflation.

Furthermore, it’s important to limit low interest savings (cash in the bank!).

Holding more cash in the bank than what is required is a sure fire way to gradually destroy your wealth as inflation will outpace your return, giving you a negative return.

Reducing debt, especially variable-rate debt, can also help mitigate the effects of rising interest rates.

Summary

Inflation is a double-edged sword. While moderate inflation is a sign of a healthy, growing economy, it also leads to a reduction in your purchasing power.

High or uncontrolled inflation can lead to economic instability and greater inequality.

When it comes to your personal finances it’s a silent tax.

A tax on your hard earned money you don’t see, a silent wealth killer.

Understanding the risks of inflation and how it affects both the broader economy and your personal finances is key to making informed decisions in an ever-changing economic landscape.

Managing inflation effectively is not only the responsibility of central banks and governments but there is also a responsibility on you and you can take steps to combat inflation.

It’s important to regularly reassess your financial goals and strategies to ensure they align with an inflationary environment.

Get in touch

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production