In recent years, investors have had little respite from unsettling headlines.

From the Covid pandemic to inflationary shocks, geopolitical tensions, and sharp market swings, it can feel as though we’re moving from one global crisis to the next with barely a moment to breathe.

For those newly retired or on the cusp of a major life transition, this constant stream of bad news can be particularly unnerving. You might find yourself wondering:

“Is it still safe to withdraw from my pension?”

“Should I be spending this money?”

“Is now the right time to make big financial decisions?”

These are natural questions, but they’re best answered with perspective.

The wall of worry

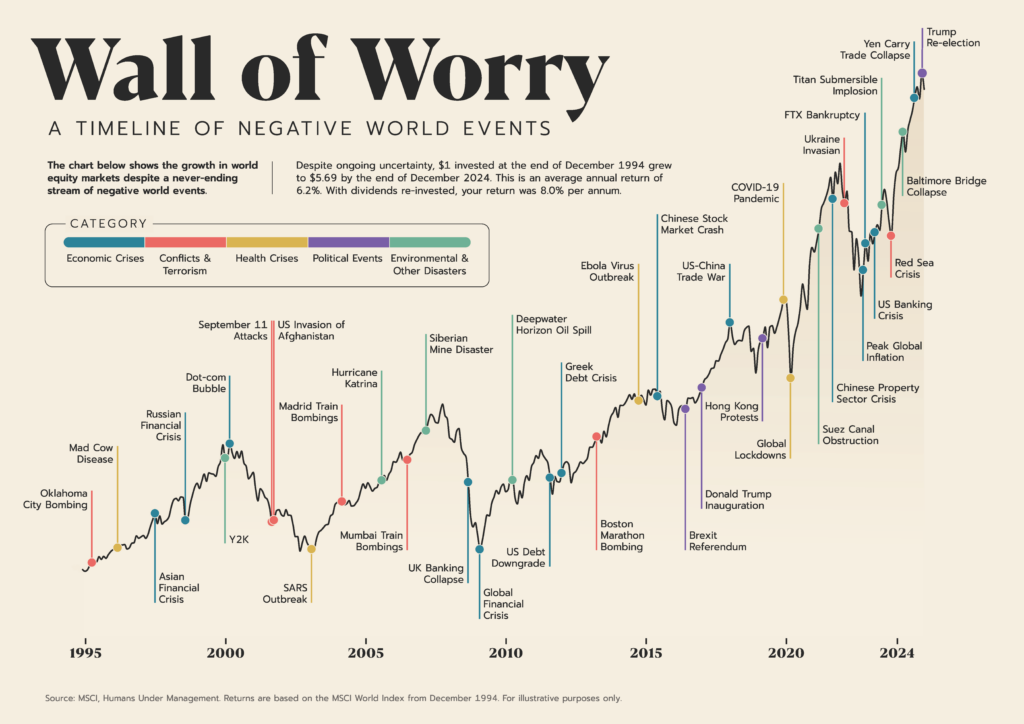

The chart below tells a powerful story. It tracks global stock markets over the last five decades, with key world events marked along the way – everything from oil crises and wars to tech bubbles, financial meltdowns and pandemics.

Every moment on this chart felt significant at the time and had the accompanying market volatility to match.

Many of these events made headlines around the world and spooked investors into selling or pausing plans.

And yet, despite all of it, markets have continued to rise over the long term.

This isn’t about blind optimism. It’s about recognising that markets have always recovered.

That the path of progress has always involved bumps – sometimes steep ones – along the way. And that reacting emotionally to short-term noise can often cause more harm than good.

Your strategy was built for this

For our clients, when we created your strategy, it wasn’t based on an assumption that everything would go smoothly.

It was built with market volatility ups and downs in mind. Diversified portfolios, time horizons, and careful modelling are there precisely for times like these.

If you’re nearing or already in retirement, your strategy should include more defensive investments like government bonds, which tend to hold value (or even rise) when equity markets fall. That’s not a coincidence – it’s deliberate.

What matters most is whether your strategy still supports the life you want to live. In most cases, the answer will be yes – and if that changes, we’ll adjust. That’s what planning is for.

Give yourself permission

In uncertain times, it’s easy to put everything on hold – the trip you were planning, the home upgrade, the long-dreamt-of treat.

Spending money can feel inappropriate when the world feels fragile. But planning isn’t just about protecting your money. It’s also about giving you the confidence to enjoy it.

If your plan shows you can afford to spend – whether that’s a new adventure or simply more freedom day-to-day – then holding back isn’t prudence, it’s hesitation.

Plans can flex. If your needs change, if life throws something unexpected your way, we’ll revisit and adapt. But freezing out of fear isn’t a strategy – it’s a reaction.

Don’t go it alone

When headlines scream, it’s human to want to do something – to change course, to act. But often, the best course of action is the hardest: to do nothing.

That’s where advice comes in. One of the most important parts of my role is to help our clients tune out the noise and stay focused on the bigger picture.

To help them make decisions based on their goals, not anxiety.

If recent events have left you feeling uneasy or unsure, you’re not alone. And you don’t need to work through that uncertainty alone either.

If you’re an existing client of ours – let’s talk.

If you’re not an existing client of ours – let’s also talk.

Maybe you just need that reassuring second opinion.

Get in Touch

Drop us an email at info@fortitudefp.ie or click here to schedule an initial call with us.

Visit our Insights – A hub of information covering saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production