Pension versus Property!

Right, the gloves are off!

A pension versus a property, what’s best?

Is one of them the better option?

In Ireland and indeed Scotland, there is an attachment to property.

This is a psychological issue as we can see it, go and knock on the door.

It’s a tangible asset.

‘You can’t beat bricks and mortar!!’ some say.

There is also an adverse view on pensions, particularly as an alternative.

Without a doubt, I come across this regularly.

Too regularly for my liking.

There can be a view that a property is the be all and end all.

The same people tend to have a negative view of pensions.

They know someone or other who ‘lost their pension!’.

Newsflash, no one loses a pension.

Yes, clearly, they may have invested incorrectly and as a result, suffered a decline at the wrong time.

However, unquestionably this is more about bad choice and advice than the pension itself.

I like property.

It can play an important role to play in a client’s portfolio.

It provides a stream of passive income.

In addition, I also like pensions.

They’re so tax-efficient and provide significant opportunities for us.

All I ask is people weigh up the facts and take a balanced view.

Let’s look at some of the myths surrounding the debate, ‘pension versus property’.

And does one really hold water over the other?

Challenges

Firstly, we will look at some of the challenges I’ve come across.

Some are below, but not limited to:

- “I don’t need a pension – I have my property”

- “My property is my pension”

- “People lose pensions, I can’t lose my property”

Tax Efficiency

None of us enjoys paying taxes.

Fact.

In Ireland, we have one of the lowest thresholds for entering the higher tax bracket.

Clearly, we then pay too much tax.

Contributions to a pension qualify for tax relief at the rate of income tax you pay.

So if you are a higher rate tax payer, you get 40% relief.

That’s 40% of your pension contribution that Revenue will cover the cost of.

If you contribute €1,000, it only costs you €600.

So, for every €1,000 invested in a pension the net cost to the investor is €600. For every €10,000 invested in a pension, the net cost to the investor is €6,000.

Yes, Revenue pay you to invest in a pension!

If you own a company, you have even greater flexibility.

Let’s assume you are an owner of a company drawing a Schedule E income.

Your company can contribute to a pension on your behalf.

This reduces your corporation tax bill – the pension contributions are tax-deductible.

Compare to buying a property.

When buying a property, you are buying out of after-tax income.

We will assume a rounded 50% tax rate.

For a €1,200 per month mortgage payment, we have to earn €2,400.

If we want to buy a property at €200,000, the actual cost to us is €400,000.

Secondly, your rental income is heavily taxed.

Like salary, assessable for income tax, USC, PRSI. Generally speaking 50%/52% tax all in.

Thirdly, Capital Gains Tax (CGT) on the sale of the property.

You will pay 33% CGT on the gain you make on the property.

Your pension has tax relief and tax-free growth versus income tax, USC and PRSI on rental income and CGT on the sale.

On tax efficiency, there is only one winner.

Growth

Pension funds are exposed to markets.

There will be some exposure to global equities – in line with the investors risk profile and capacity for risk.

Equities, over time, consistently outperform every other asset class.

If a pension investor is 40, they have a significant amount of time ahead of them to be invested.

A good 30 plus year investment term (beyond retirement).

I’m not going to get into detailed growth stats here.

As per www.tradingeconomics.com, Irish Residential Property Prices have not yet reached the highs of late 2007.

On the other hand, the MSCI World Equity Index (Gross TR), since 31/12/2007 has returned approximately 260%.

Now we’ll throw in a Balanced multi-asset fund available in Ireland.

Over the same period that has returned approximately 162%.

The pro-property individual won’t acknowledge one thing.

There is a flaw in expecting that the property around the corner from them will outperform the growth of the world’s largest companies!

When considering property returns it’s not a case of cost less income.

One has to consider taxes and additional costs.

When it comes to long term growth potential, again, only one winner.

Liquidity

There is no liquidity in property.

One can’t take a brick out of the building to pay for the shopping!

Ok, pre-retirement this is a dead heat as there is no liquidity in a pension fund before accessing the benefit however there is also no liquidity in a property.

However, pre-retirement there is no liquidity in the pension either.

That pension has to remain there until you crystallise the benefit and retire it.

Nevertheless, in retirement, it changes. invests in an Approved Retirement Fund (ARF) the ARF holder has access to withdrawals and drawing an income.

Thinking pre-retirement, this one is a draw.

Inconvenience

When it comes to owning and renting a property, very few give consideration to the ongoing maintenance etc.

Stuff that can cause headaches and inconvenience.

Repair and maintenance (practicalities), repair and maintenance (costs), sourcing tenants, legal fees, management fees, tax returns etc.

No such inconvenience with a pension.

Yes, market volatility may cause some discomfort but this is only a temporary devaluation of the fund before it moves upwards again.

And once you are investing for a long period of time, short term volatility is not an issue.

Diversification

Diversification of one’s overall portfolio is essential.

Importantly, no one should have all of their eggs in one basket.

A well made out pension portfolio is diversified across thousands of different equities.

Then diversified over multiple different industries and geographical regions.

The bricks and mortar of a property is 100% reliant on the Irish property market, no diversification.

Can we combine both a pension and property?

Yes. we can.

It is possible to use a pension fund to purchase a property subject to certain Revenue rules.

This then enjoys the following tax efficiency:

- Tax relief on our pension contributions

- No income tax, USC or PRSI on rental income

- No Capital Gains Tax (CGT) on the sale of the property

The recent IORPS II ruling has made this a bit trickier.

However, not impossible and can still be done both pre and post retirement.

Summary

Whether you’re pro-property, pro pension, anti pension, whatever, I hope this has given you food for through.

If you are pro-property and anti pension, it’s likely because you’ve been ill-informed in the past as to exactly how pensions work.

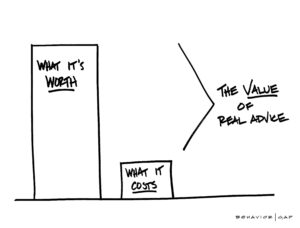

From what I say above, a pension is clearly the winner in my opinion.

It’s more tax-efficient and provides the opportunity for better growth.

You can also increase your diversification more effectively.

That said, holding a property is another diversifier, and provides some passive income (albeit subject to tax).

However, importantly, you can be over exposed and reliant on property if that’s all you are interested in.

How We Can Help You

Any questions on the above?

Would using your pension or ARF to buy a property interest you?

Even if you just want to run through a generic financial planning or advice query, give us a shout.

Get in touch

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our insights.

We now have over 60 articles on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production