To save or invest?

Every week (day even) I have conversations around saving and investing.

The key question being “Should I save or invest?”

According to a recent report in the Irish Time, Irish households now have a record high of €126m on deposit.

Couple this with the low or no returns offered by banks and Credit Unions its only natural the question ‘Do I save or start investing?’ arises.

Saving and investing can mean the same thing in one context whilst at the same time mean something completely different.

For the purpose of this blog and to keep it simple, lets think of saving as money going into the bank and investing going into an investment fund that targets growth.

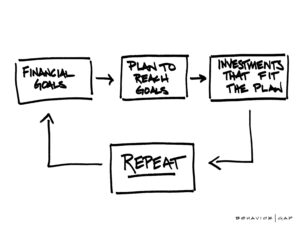

Before deciding, one should first of all think about they are trying to achieve with their money.

Is the money for short term financial goals or medium-long term financial goals,.

Whilst everyone’s financial goals are different, there is generally a consistency amongst clients with some of the more common goals.

Listed below are some of the more common financial goals and objectives I see that will provide you with a good starting point to get you thinking:

Short Term Goals – typically within the next 5 years (the 5 year rule!)

- Emergency fund (for all that stuff life throws at us like home and car maintenance, kids activities, pandemic income interruption!)

- Next years family holiday (Please!!)

- New home deposit

- Home improvements or upgrades

- Assuming the kids are currently in college, the next couple of years fees

Medium Term Goals – typically within the next 5-10 years

- Additional rainy day fund

- Assuming the kids are younger, their future anticipated college fees

- Regular family holidays

- Upgrading the car

- Holiday home purchase

Longer Term Goals – typically 10 years plus

- Retirement planning

- General long term growth of assets

What’s important to note is that the various goals mentioned above can switch between short-medium-long term dependent on your own evolving circumstances.

Before Investing

Before you consider investing it is vital that you have an emergency fund built up.

We recommend a minimum of three months after tax household income so if your take home income is €3,000 per month – this should be €9,000.

A maximum and a target to actually aim towards is 6 months after tax household income.

This should be held in a short term no risk vehicle like the bank or Credit Union where it is readily accessible.

Short Term Goals – Save

For your short term goals and objectives (under 5 years) you should save this money.

When I say save I mean retain this in a short term no risk vehicle, as outlined above the bank or the Credit Union.

Although the returns are not attractive a 5 year investment term is too short to wash out any potential short term market volatility that could come with investing.

Medium Term Goals – Invest

Over 5 years is where it gets interesting as we can’t leave the money in the bank due to next to no returns on offer so we have to generate growth.

Additionally, as we are looking at a longer than 5 year term we now have increased capacity for risk to wash out any potential short term market volatility.

We then align your savings with your objectives and your capacity and tolerance for investment risk and get your money working for you towards your individual goals.

Long Term Goals – Invest

Very similar to the medium term goals process, there is no point in leaving money in the bank to simply erode in value due to inflation.

We are now at a much longer investment term with increased capacity for risk and therefore able to target greater growth via investing.

Your long term objectives are aligned with your capacity and tolerance for risk and your money can work even harder for you to meet your long term goals.

Inflation

The reason you have to look away from the bank, Credit Union (the old favourite!) or the Post Office (another favourite!) for the medium and longer term goals is inflation.

Inflation is the general increase in prices which results in the fall in the purchasing value of our money.

Put simply, if you have €30,000 in the bank today, in 5 years time that €30,000 will still be €30,000 but in numerical format only.

That €30,000 won’t buy you in 5 years what it would today – because of inflation, the increase in prices.

Inflation results in a constant decrease in value of money you hold in the bank, credit union or post office due to zero/low returns within these structures.

Therefore, you have to generate growth over the medium to longer term to a) keep pace with inflation and b) retain your money’s purchasing power.

Logically, there is no reason to retain money in the bank or Credit Union or Post Office that is not earmarked for short term goals.

So, should you save or invest?

Before thinking about saving or investing, think to yourself, what is it that I/we want to do, provide and achieve?

This then works back into whether you should save or invest with your resources.

How we help

We understand that thinking about your financial goals and objectives can be difficult – for some it can be like a rabbit in the headlights question as we generally move through life and don’t give much thought to it.

Therefore as part of our advice process we will help you articulate your short, medium and long term goals.

We don’t work like the banks or a traditional financial adviser where if you have €100,000 on deposit they try and get you to invest the full amount for their benefit – irrespective of what is going on elsewhere in your life.

We will work with you, we’ll start with you and your family and work back. Calculate what you need to keep in the short term vehicles and then what is left over to invest and grow.

This can either be in a lump sum investment format or a regular monthly investment contribution.

We will then create a saving and investment strategy in line with your objectives, your tolerance & capacity for risk to help you meet your various objectives – all whilst your safe in the knowledge you have ready access to funds at short term if required.

You can find out more about our advice process and how we work here.

Our investment recommendations are underpinned by a set of principles and guidelines and you can find out more here.

What next?

We would love to work with you and help you with your saving and investing plans so book an initial call with us here.

Francis McTaggart CFP® SIA RPA QFA

Disclaimer: All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice. You should always engage the services of a fully qualified financial planner before entering any financial contract. Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts

Production

Production