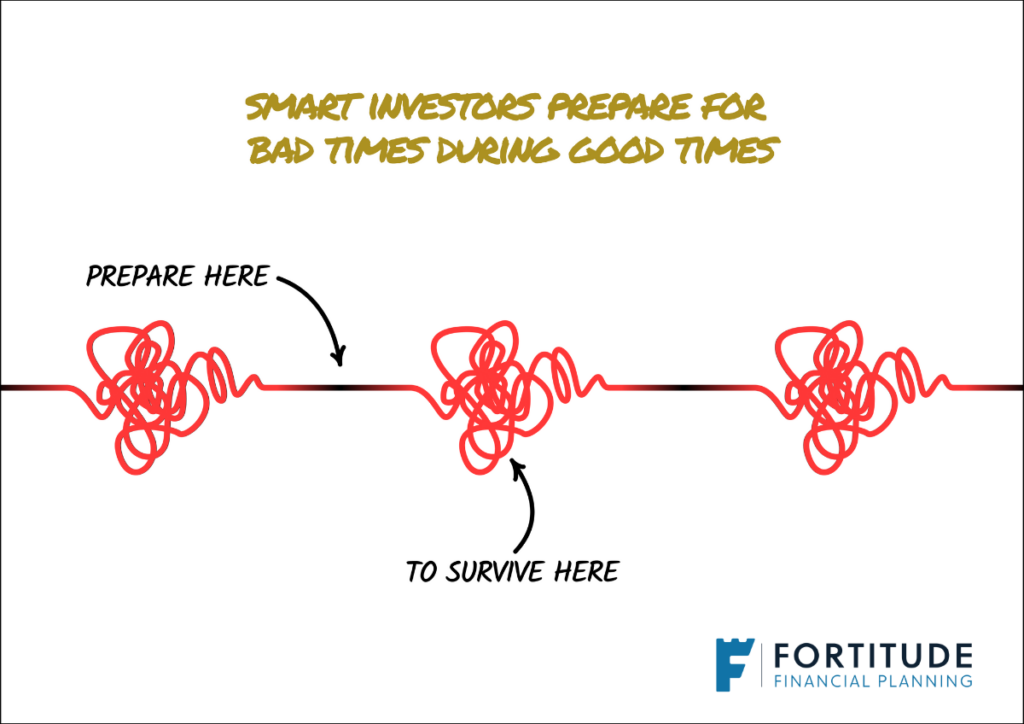

Smart Investors Prepare for Bad Times During the Good Times

As we approach the end of 2024, it’s hard not to feel optimistic. The runaway inflation we experienced over the last few years has subsided, interest rates have started to decline, and the uncertainty about the many government elections held in 2024 is almost over.

As a bonus, the market has delivered impressive returns over the past two years, rewarding patient investors who endured significant market declines in 2020 and 2022.

Just like a ship’s crew that prepares for trouble at sea by doing “lifeboat drills” while safely docked in the harbour, we believe this moment of relative prosperity is the time to have a crucial conversation about market dynamics and investor preparedness.

The calm of an upward-trending market is the perfect time for investors to prepare for future market “storms.” Doing so before the volatility we will inevitably have to endure will help reinforce long-term investment strategies and increase the likelihood of good investor behaviour when it matters.

The Rythm of Markets

History offers valuable insights into equity market behaviour. On average, markets tend to rise three out of every four calendar years. This statistic is reassuring, yet it also implies that declines are a regular part of the investment journey. While impossible to time accurately, these downturns are as natural to markets as waves are to the ocean.

It’s crucial to understand that after periods of significant outperformance, as we’ve experienced recently, markets often undergo a process called ‘mean reversion’. This doesn’t necessarily predict an imminent decline but reminds us to temper our expectations about future returns.

Not only have the last two years provided above-average returns, but we have also experienced below-average volatility. This has the danger of creating unrealistic expectations of what investors can expect. It is prudent to expect long-term trends to continue, and it would not be strange for the next year or two to include a market decline. After all, forewarned is forearmed.

Building Your Investor Lifeboat

How do mature investors prepare for potential market turbulence?

First and foremost, they ensure that any short-term cash flow needs are adequately provided for in safe, stable investments. These investments do not offer long-term security but short-term peace of mind. This financial “lifeboat” allows you to weather market storms without being forced to sell assets at inopportune times.

Second, spend a moment to remind yourself what your long-term investments represent. Rather than being a bet on a group of stocks, they represent ownership of real companies that sell real things to real people. A temporary period of negative market sentiment does not reduce the long-term value that patient investors will receive.

Third, consider that the market comprises millions of investors, not all playing the same game. The traders and speculators who have legitimate fears during volatile markets are playing a different game to you. Remember what game you are playing!

Perhaps most importantly, maintain a long-term perspective. Remember, investing for financial independence is a multi-decade journey. Short-term market volatility, while emotionally challenging, is often inconsequential to your long-term financial success.

Be wary of financial media sensationalism. Their primary goal is to attract attention, which can lead to exaggerated portrayals of market events. Guard your mind against overly negative reactions, and don’t hesitate to contact us to discuss any concerns.

Navigating Your Financial Future With Confidence

As we conclude, let’s revisit our ship analogy. The crew who practised their drills in calm waters isn’t pessimistic about their journey; they’re realistically optimistic. They know that preparing for all possibilities makes them more likely to reach their destination safely.

Similarly, by acknowledging the possibility of market declines and preparing ourselves emotionally and financially, we’re not predicting doom. Instead, we’re equipping ourselves with the tools and mindset needed to navigate whatever market conditions we may encounter.

Market history is filled with periods of decline followed by recovery and growth. By staying disciplined, patient, and focused on your long-term goals, you can benefit from the enduring power of markets.

As always, we’re here to guide you through calm and choppy waters. Feel free to reach out if you have any questions or concerns about your financial journey.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production