The 20 Most Common Investment Mistakes

Investing is a key component of financial planning.

Whether investing via your pension or separately, it’s a necessity to grow your overall wealth.

It’s also a key strategy to protect the real value of your money from inflation.

Even so, emotions cloud our judgment when it comes to our own money.

As a result, this can, very often, lead to investment mistakes.

Below is a powerful graphic outlining the 20 most common investing mistakes that are made and I’ve also summarised a few of them.

Huge credit goes to Visual Capitalist for creating the extremely powerful graphic and you can read the original article by clicking here.

#1 Expecting too much

Some investors are unreasonable when it comes to their return.

If for example they are invested in a 60/40 portfolio and don’t get the full return of the equity market, they’re disappointed.

An alternative version is they want the get rich quick return, no one wants to get rich slowly.

It’s important to be reasonable about your expected portfolio returns from the outset.

#4 Focusing on the short term

Some investors focus too much on the short term. This can actually border obsession with some investors.

No one invests for 6/12/18 months. Investing is a long term strategy, years, decades, a lifetime.

Focusing on the short term, typically a period of underperformance, whether it at the outset of an investment or a small window during an investment, can lead investors to make emotional decisions like pushing the eject button.

Investment markets between January 2022 and now is a great example, a period of underperformance but such a short window in ones lifetime.

#10 Misunderstanding Risk

This is a good one. We are raised in the belief that investments moving up and down is risky. THIS IS NOT RISK!

The real risk to you, me, everyone, is inflation. The silent tax that erodes the real value of our capital.

So the ‘cautious’ investor, because no one has taken the time to explain investing properly, takes too little risk.

Resulting in low returns which in turn causes disappointment and more importantly, inflation outpacing the investment.

It’s important to not take too much risk but equally as important to not take too little risk, get the balance.

#12 Reacting to the media

Bad news sells, unfortunately. Please, tune out the noise. It’s for your own good.

The media lead us to believe doomsday is upon us and this time is different when markets are volatile.

It’s never really different, it’s only a different event.

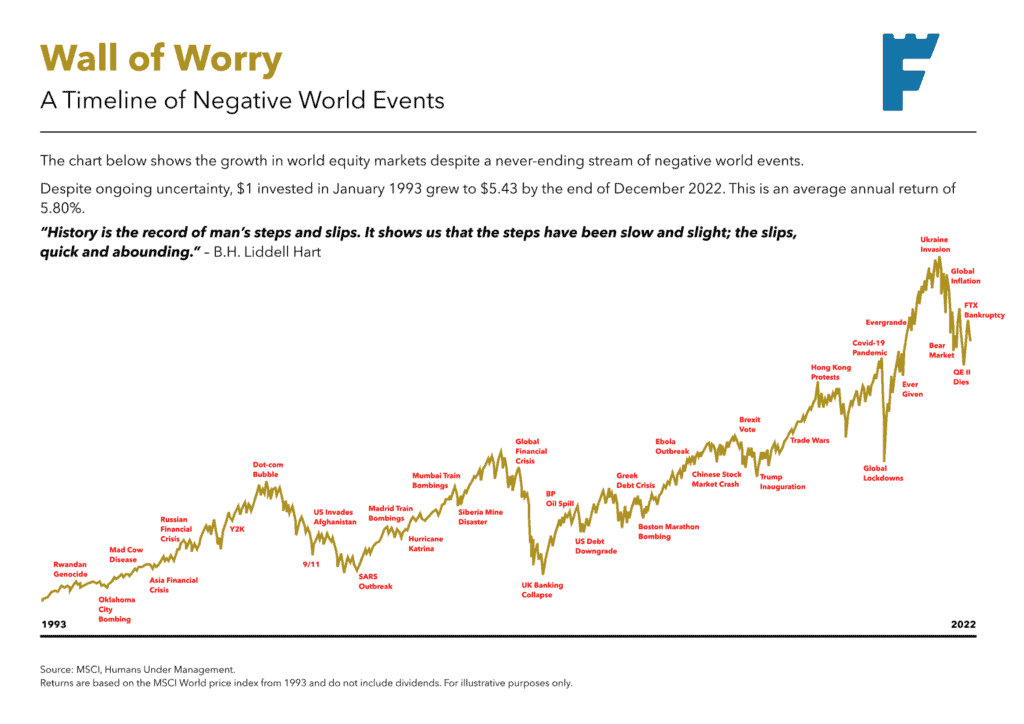

Refer to our ‘Wall of Worry’ chart for proof why it’s never different.

#14 Trying to Time the Market

It’s about time in the market, not timing the market.

To time the market you need to make two calls, when to get in and when to get out (or vice versa).

A bell doesn’t ring at the top or bottom.

The best time to invest? When you have the money.

There is hard evidence available to show the effect of missing the best days in the market.

Put your money in, leave it and let it work. Don’t worry about where the markets are when you are getting in.

#16 Working with the wrong advisor

It’s super important to work with the correct advisor.

Ensure they have an investment philosophy and a robust advice process.

Ask them questions on it, after all you are potentially entrusting them with your life savings.

#17 Investing with Emotions

As I said previously, we are emotionally attached to our own money.

This significantly increases the potential for decisions to be made via emotions and not objectively.

For example ‘markets are rocky, I can’t cope, I’m going to cash’.

Fast forward 12 months, markets have performed, as has inflation and you’re still sitting in cash which hasn’t.

An emotional decision is a potential destruct button on an investment.

#20 Control What You Can

Most importantly, your behaviour.

Asset allocation and specifically the allocation to equities is what primarily drives your return.

Investor behaviour and letting emotions rule is what can actually destroy your return.

Investing is simple, but not easy a famous man once said.

Summary

To summarise, investing, and investing sensibly is a key strategy to growing your overall wealth.

However, it is a journey littered with potential pitfalls that can seriously impact your overall return.

Have you ever asked yourself ‘Should I switch to cash?’ or ‘Should I move more into cash?’

Maybe ‘I’ll wait until things settle down before I invest’.

Hopefully the above has given you some insight into some of them and maybe you even resonate with them.

How We Help

If you have any questions about investing, an existing investment, or how to get started, we’d love to hear from you.

Just click the button below and schedule a call at your convenience.

Get in touch

Alternatively, Email us at info@fortitudefp.ie or request a callback.

Or give me a call on 041 213 0307.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production