The Cost of Leaving Your Old Employers Pensions Behind

Most people change jobs several times during their career — but their old employers pensions often don’t move with them.

Across Ireland, millions sit in old workplace schemes earning little attention, no guidance, and in many cases… quietly working against the person who owns them.

If you’ve left a workplace pension behind, here are the costs you may not even realise you’re paying.

1. You’re Getting Nothing for the Fees You Pay

When you have an old employers pension you’re part of a workplace scheme, you pay ongoing charges, but once you leave the employer:

-

You no longer receive advice

-

Nobody is managing or reviewing your investment strategy

-

You’re not being guided on drawdown planning, tax relief, or retirement timing

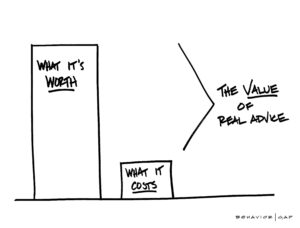

In other words: you’re still paying, but getting nothing for it.

2. Your Investments May No Longer Suit You

When you were an employee, the scheme investment options may have been fine.

Years later, they might be completely wrong for:

-

Your current risk tolerance

-

Your retirement timeline

-

Your financial goals

-

Your overall portfolio (you may be unknowingly doubling up on certain risks)

A “set and forget” employers pension is rarely aligned with the life you’re living now.

3. You Lose Control

Old employers pensions are often:

-

Harder to access

-

Limited in investment choice

-

Slow to update

-

Less flexible at retirement

Transferring to a Personal Retirement Bond (PRB) or PRSA, where appropriate, gives you flexibility, visibility and proper advice — all in one place.

4. You Risk Fragmenting Your Retirement Planning

Multiple scattered pensions make it harder to:

-

Plan income in retirement

-

Understand your actual fund value

-

Manage risk

-

Build a tax-efficient drawdown strategy

Consolidation (when suitable) creates clarity and control.

How We Help

At Fortitude Financial Planning, we:

-

Analyse your old schemes

-

Review investment suitability

-

Compare your options (stay vs transfer)

-

Explain the tax implications clearly

-

Consolidate where appropriate

-

Build one clear retirement strategy going forward

Ready to take control of your old workplace pensions?

Book a no-obligation call and we’ll help you understand your options.

📅 Click here to book your call now.

Visit our Insights – A hub of information covering saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production