The Hidden Cost of Being “Too Busy” to Manage Your Finances

We all say it.

We all feel it.

And most people genuinely believe it:

“I’m too busy to manage finances right now.”…..or something similar!

Between work, family life, commitments, and general day-to-day chaos, it’s easy to let financial tasks slip further and further down the list.

But here’s the uncomfortable truth:

Being “too busy” is one of the most expensive habits you can have.

You don’t see the cost immediately.

There’s no alarm bell, no red warning light, no missed payment notification.

But the impact is very real — and it compounds quietly over time.

The Busyness Trap

“Busy” has become a socially acceptable way of avoiding the parts of our financial life that feel heavy or overwhelming.

Often, “I’m too busy” really means:

-

I don’t know where to start.

-

It feels overwhelming.

-

I’m afraid of making a mistake.

-

I’m worried about what I’ll discover.

-

I’ll get to it eventually…

The problem?

Eventually rarely comes.

And while you feel you’re too busy to manage your finances, your financial future keeps moving without you.

The Real Cost of Delay

Delaying financial decisions doesn’t feel like a loss — and that’s what makes it so dangerous.

But make no mistake, the costs are there:

You might be missing out on:

-

Pension contributions and tax relief

-

Years of compounding on investments

-

A better allocation or lower-cost structure

-

Reducing unnecessary fees

-

Planning for major life expenses

-

Fixing outdated protection or insurance

-

Consolidating old pensions into something more efficient

And you may be silently losing money to:

-

Inflation eroding idle cash

-

Fees you haven’t reviewed in years

-

Poor investment decisions made out of haste

-

Missed tax opportunities

-

Overpaying for debt or credit

None of these losses are dramatic on their own — but they compound.

Just like investing, procrastination compounds too…but in the wrong direction.

The Myth of the “Better Time”

We all have our go-to lines:

-

“I’ll sort it after summer.”

-

“After the tax deadline.”

-

“After the kids’ activities calm down.”

-

“After Christmas.”

-

“After work gets quieter.”

Here’s the truth: Life never slows down.

If you feel your too busy to manage your finances or are waiting for the perfect moment to get your finances in order, you’ll be waiting forever.

The right time to start is never later — it’s now.

The 20-Minute Rule

The biggest misconception about finances is that everything takes hours.

But most important actions take no more than 20–30 minutes, such as:

-

Reviewing a pension statement

-

Cancelling an unused subscription

-

Setting up an automatic transfer to savings

-

Reviewing insurance cover

-

Uploading documents to start a financial review

-

Booking a call with a planner

It’s not the task that’s overwhelming — it’s the idea of the task.

When you actually start, the heaviness lifts quickly.

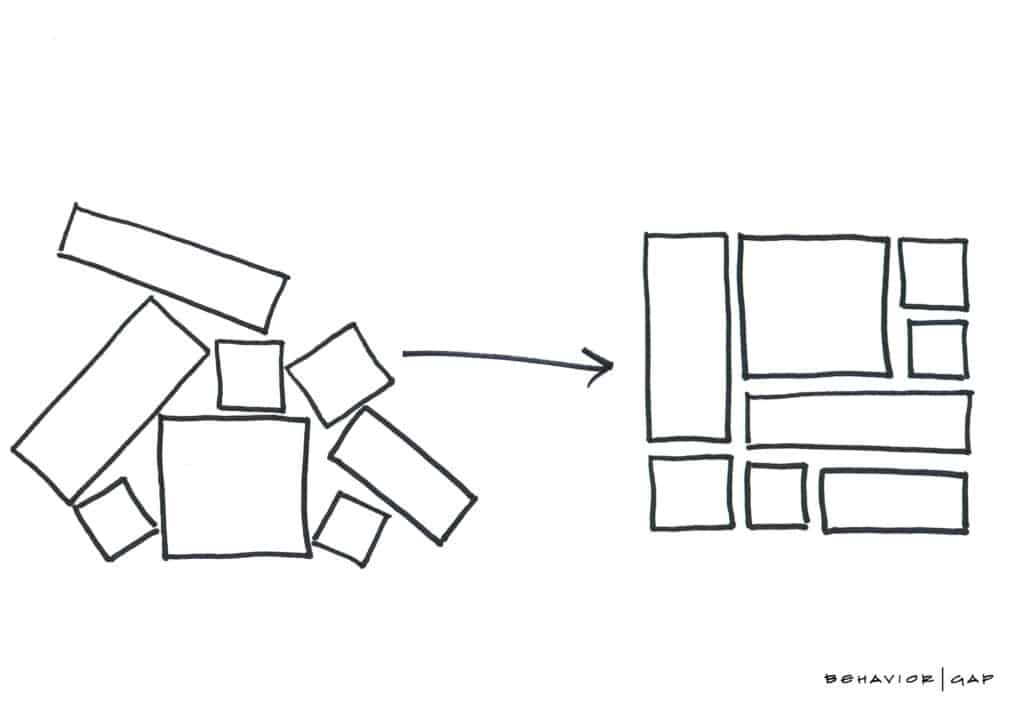

Why Good Planning Saves You Time — Not Takes It

Financial planning isn’t paperwork.

Financial planning is clarity.

A solid plan:

-

Reduces future admin

-

Cuts through noise

-

Helps you avoid rushed decisions

-

Makes financial choices simpler

-

Reduces stress and uncertainty

-

Gives you a roadmap so you always know the next step

When your finances are organised and joined up, life gets lighter.

Your time expands.

Your mental load shrinks.

A good plan doesn’t consume your time — it gives it back to you.

Takeaway: Stop Postponing Your Future

Being “too busy” isn’t a time problem.

It’s a clarity problem.

But here’s the mindset shift:

💡 Small pockets of time invested today create years of financial confidence tomorrow.

You don’t need hours.

You just need to start.

Your financial future doesn’t demand perfection — it simply needs you to stop postponing it.

How We Help

At Fortitude Financial Planning, we help busy people gain clarity, confidence, and structure around their finances — without overwhelm.

Here’s how we support you:

-

We simplify everything.

No jargon, no noise — just clear, actionable guidance. -

We prioritise what matters most.

So you don’t waste time on things that don’t move the needle. -

We save you hours of admin.

You get clarity — we handle the heavy lifting. -

We keep you accountable.

Life gets busy. We ensure your financial priorities don’t slip. -

We give you a long-term roadmap.

One that grows with you, adapts with you, and supports the life you want.

You don’t need more time — you need a clear plan and the right support.

Book a no-obligation consultation today and let’s keep your financial plan working as hard as you do.

📅 Click here to book your call now.

Visit our Insights – A hub of information covering saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production