The Importance of Asset Allocation (or misallocation!!)

There are lessons that can be learned from military history and applied in other fields.

Take, for example, the unexpected fall of Singapore in World War II. Known as the Gibraltar of the East, Singapore’s defence seemed unbeatable, with massive guns pointing to the sea, waiting on a naval attack.

However, the actual assault came through the Malayan jungle, where the guns couldn’t even aim.

Without a doubt, this strategic blunder resulted from putting resources in the wrong place and had severe consequences.

Singapore fell due to a mistaken assumption about the threat’s direction.

Now, many modern-day investors are being misled about the ultimate threat to their financial security.

Guns Facing The Wrong Direction

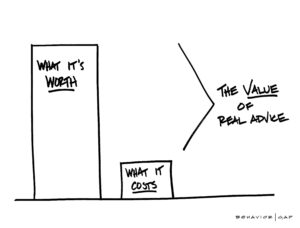

Investors are bombarded by internet gurus telling them about the danger of high fees, with the adviser’s cost coming under the spotlight.

Indeed, this has led to many investors believing that a DIY approach is the optimal strategy.

While we acknowledge that some investors have the ability and discipline to follow a DIY approach, unfortunately, we see too many examples of investors working in isolation, leading to suboptimal results.

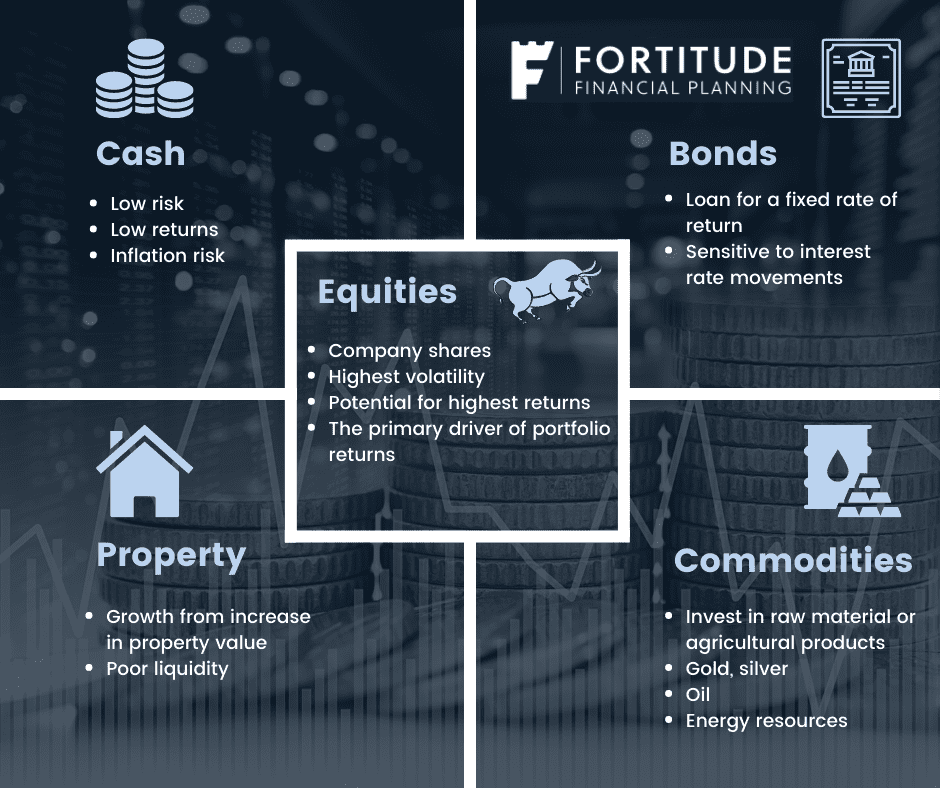

We frequently see clients making poor asset allocation decisions: how much to allocate to equities, bonds, and cash.

Mostly, with a heavy leaning towards cash.

This complex decision must weigh the investor’s time frame, goals, attitude to investing risks, and emotional makeup.

Research shows that over 90% of a portfolio’s return can be attributed to this single decision.

We encounter too many investors who misunderstand the path to success. When we have helped clients correct their approach, the value has far exceeded our advice fees.

While it’s true that high fees can eat into returns over time, fixating on them can distract from more crucial aspects that significantly impact investment success.

It’s time we face the guns in the correct direction.

The Critical Link Between Asset Allocation and Behaviour

A successful investment strategy starts with knowing how to allocate assets correctly.

Our best ally in this war is a good understanding of market history.

While equities (the ownership of the great companies of the world) has been the primary driver of global markets, too many investors have shied (and still shy) away from this asset class for fear of the frequent but temporary declines they experience.

Many long-term investors who can withstand short-term losses have given up real wealth to avoid the emotional stress of unpredictable markets.

Some investors willingly accept this trade-off, understanding what it means.

But too many investors don’t realise what they’re giving up or what other options they have.

This is the great tragedy of asset misallocation.

There are countless examples of clients who have prospered thanks to a simple change in mindset aided by a caring adviser.

As I write this, I am thinking of one in particular this week who we had our forward planning review.

They come to us cash heavy, wary of investing as there was a historical issue there.

However, their investment is showing a 24.3% total return net of fees.

Importantly, this has been achieved despite significant market sell offs in 2020 (COVID-19) and 2022.

This is the real value of advice and one we’re excited about showing to more clients.

The Courage To Be Disciplined

We live in a time where lifespans are becoming longer and longer.

Even so, too many investors are at risk of investing without intention.

Nevertheless, no single portfolio is perfect for every single client.

However, all investors unquestionably could benefit from stress testing their portfolio simply by asking:

“Am I short-changing my future self?”.

Our role as your lifetime financial partner is to reflect your decisions back to you, helping you make the correct trade-offs for your unique circumstances.

Where appropriate, we will push back and encourage you to follow the path of discipline that your future self will thank you for.

Look at the client I referred to previously.

If they weren’t courageous, made the initial step, and stood their ground during sell-offs, they would be 24% worse off than they are today.

Let’s face the guns in the right direction!

How We Help

Do you have a pension or investment?

How much do you know about your asset allocation?

Importantly, where are you invested?

Lets talk.

Get in touch

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production