The Power of Zooming Out

The single most important skill in long-term wealth building isn’t predicting what happens next.

It’s the ability to maintain a proper perspective on what has already happened.

Yet even the most rational investors struggle with this. Recent experiences feel more real and urgent than abstract historical data because our brains evolved to prioritise immediate, vivid information over distant statistics.

This isn’t a lack of intelligence. It’s human nature. Behavioural economists call this recency bias, and it affects everyone from Nobel Prize winners to seasoned investment managers.

The challenge becomes acute during extended periods of either strong performance or significant declines. After a few years of solid returns, it’s easy to assume this will continue. After a sharp correction, it feels like the world will never be the same again.

Smart investors recognise this psychological trap and consciously fight against it.

Without this awareness, investors make costly permanent changes based on temporary conditions.

The Power of Extended Time Frames

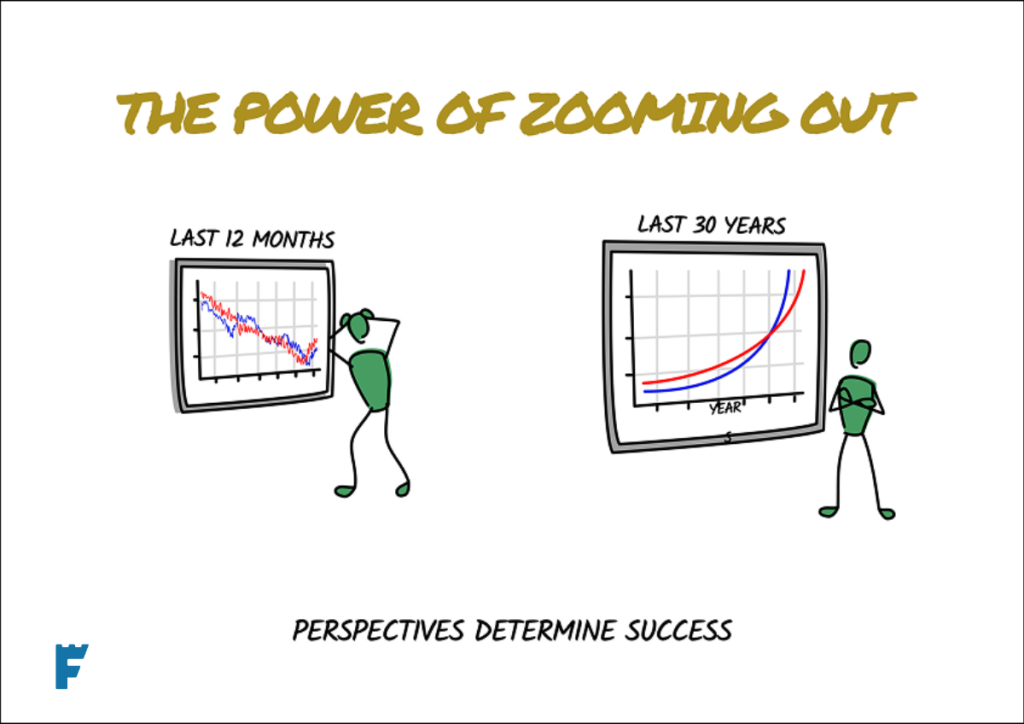

The simplest habit of fighting this human urge is to force yourself to extend the time frames you are looking at. By zooming out, you are consciously extending your analytical timeframe beyond recent events.

Instead of focusing on this month’s returns or this year’s market movements, you examine patterns over multiple years or decades.

This shift reveals something crucial: most of what feels significant in the moment becomes statistical noise over longer periods. The market correction that dominated headlines for weeks becomes barely visible on a ten-year chart.

The three-year run of strong returns, which feels so reassuring, represents just a small sample in market history.

Extended timeframes also reveal the true nature of investment returns. They don’t arrive in neat packages. Years of strong performance cluster together, followed by periods of disappointing results.

Volatility isn’t a bug in the system; it’s an inherent feature that creates the opportunity for long-term wealth building.

This broader perspective works both ways. It prevents the panic that leads to selling at market lows, but also prevents the overconfidence that leads to poor decisions during good times. When you understand that current conditions are temporary, you’re less likely to make permanent changes based on temporary circumstances.

Today’s Context and Historical Perspective

We’re approaching the end of what could be the third consecutive year of solid global equity returns. This creates a unique psychological challenge.

Investment returns that should feel exceptional start to feel normal. Investors begin building mental models around recent success, unconsciously extrapolating current conditions into the future.

Historical analysis tells a different story. Consecutive years of above-average returns are relatively rare and never last. Market cycles are characterised by periods of strong performance followed by periods of below-average returns or outright declines.

This isn’t pessimism, it’s pattern recognition. Mean reversion is one of the most reliable principles in financial markets. We can’t predict the catalyst or timing, but we can prepare for this reality.

The investors who navigate cycles successfully aren’t the ones who avoid volatility; they’re the ones who expect it. When you zoom out and view current market strength within the context of normal cyclical behaviour, you’re more likely to stay disciplined when conditions change.

Developing This Discipline

Building the “zoom out” habit requires conscious effort, especially when recent results support your natural biases. The goal is to maintain analytical objectivity regardless of current conditions.

Before making significant portfolio changes, ask whether you’re responding to temporary noise or permanent shifts in fundamentals. Most market events that feel momentous prove temporary when viewed through a longer lens.

The investors who consistently zoom out compound wealth over decades rather than chasing short-term results. We’re here to help you maintain this perspective, especially when it feels most difficult.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production