The Role of Your Investment Contributions

Many investors spend a great deal of time choosing the ‘perfect’ investment portfolio on their journey to building wealth.

Creating the correct investment portfolio does have a massive impact on our expected future investment returns, it’s a critical element of our financial success.

However, while investment returns can be the difference between a good and a great retirement, they are ultimately out of our control.

The best we can do is to position our portfolios for the return we need, but the rest is up to the financial markets.

However, another element contributes to your financial success and is arguably far more important.

Control What You Can

Your financial success is based on the investment market returns we receive and on the money you contribute to your investment portfolios.

In contrast to your investment returns, your investment contributions are entirely under your control.

The more you contribute to our portfolios, the greater the potential for future compounding growth.

An inconvenient truth for some, this means that your future financial success is largely down to us.

Any additional money contributed to your portfolios are a sacrifice of current consumption and an investment in your future shelf.

A reduction in instant gratification whilst pioritising delayed gratification.

The discipline to continue prioritising your futures over your present needs is often the difference between surviving rather than thriving in retirement.

As you journey toward financial independence, it is crucial to recognise that your future security doesn’t solely depend on the market returns you expect but also on your contributions.

The Harsh Reality

One common misconception is that investment returns will quickly outpace your personal contributions.

However, a simple calculation shows that assuming regular contributions and reasonable return assumptions, market returns can take up to 20 years to surpass the amount we’ve contributed.

While returns can contribute significantly to your wealth, your disciplined, regular contributions to your investment portfolios will do the heavy lifting, especially in the early years.

Two Examples

We’ve observed distinct outcomes among our clients based on their approach to contributions.

Some clients have consistently prioritised their investment contributions, even during challenging economic times.

For them, pausing contributions was a last resort, and they instead found ways to adjust other aspects of their lifestyle.

They cut their cloth.

Conversely, other clients paused their contributions at the first sign of financial difficulty, planning to resume them once conditions improved.

This period often lasts longer than anticipated, leading to significantly different outcomes than their diligent peers.

Summary

It’s easy to be lured by predictions of quick riches.

However, understanding the slow and steady nature of investment growth helps us to remain committed to consistent contributions, minimising the risks of falling behind.

We encourage you to consider how you perceive your investment contributions.

Treat them as your most important monthly expense—an investment in your future self.

Prioritise them over other discretionary expenses if necessary. By reframing your mindset, you’ll acknowledge the control you have over your financial success.

On the other side of this discipline lies compounding growth that will reward the disciplined investor many times over once it reaches a tipping point. This will result in true financial freedom for you and your loved ones.

How We Help

Are you unsure if what you’re contributing is enough?

Wondering what your future projections look like?

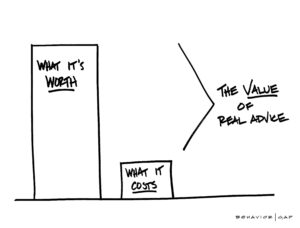

For clarity and certainty on your financial future, avail of our financial planning service.

It puts you in a position where you know which financial levers to pull.

Get in touch

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production