The simple (yet extreme) advantages of Pensions

Planning for your future is one of the most important financial decisions you can make, and pensions play a crucial role in ensuring long-term financial security.

However, in Ireland, they can often come with a bad rep.

They are not just a way to save for retirement—they come with a variety of benefits that make them an essential component of any financial plan.

Whether you’re self-employed, an employee, or a business owner, understanding the advantages of pensions can help you make informed decisions about your future.

Let’s dig a bit into the simple advantages pensions bring you.

Why you need a pension?

Firstly, why do you need a pension?

The state pension in Ireland is only approximately €15,000 per annum.

Assuming you retire on a salary of €40,000 in todays money, that’s a decrease in retirement income of over 60%.

Simply put, you need a private pension to provide you with additional income in retirement.

The State pension is not enough.

1) Pensions provide Generous Tax Relief

Tax free contributions!

One of the most attractive aspects of pensions in Ireland is the tax efficiency they offer.

Contributions to a pension plan are eligible for tax relief at your marginal rate of income tax, up to certain limits.

This means that for higher-rate taxpayers, every €100 you contribute to your pension could cost you only €60 after tax relief.

Additionally, the growth of your pension fund is exempt from capital gains tax and income tax while it remains invested, allowing your savings to grow more efficiently over time.

Tax free – yay! Who doesn’t like reducing their tax bill?!

2) Investment Growth Potential

Tax free growth!

When you contribute to a pension, your money is invested in a variety of asset classes, such as equities, bonds, or property, depending on your chosen fund (hopefully, mainly if not solely equities).

Over the long term, these investments have the potential to grow significantly, especially when combined with the power of compound interest.

Unlike traditional savings accounts, as mentioned previously, pensions allow your contributions to grow in a tax-efficient manner (tax free!), maximising returns over time.

3) Tax-Free Lump Sum at Retirement

Tax free (again!!) lump sum!

When you reach retirement age, you’re entitled to withdraw a portion of your pension savings as a tax-free lump sum.

You can take up to 25% of your pension fund as a lump sum, subject to limits (€200,000 tax-free, with a further €300,000 taxed at a reduced rate of 20%).

This provides flexibility to pay off debts, invest in other areas, or enjoy a significant financial cushion as you transition into retirement.

4) Employer Contributions to Pensions

If you’re employed and part of a company pension scheme, your employer may contribute to your pension as well.

This is essentially “free money” that boosts your retirement savings.

Employer contributions are also tax-efficient for the employer, making it an appealing benefit for companies to offer.

For employees, this additional funding significantly increases the value of your pension pot without requiring extra personal contributions.

5) State Pension Supplement

The State Pension, while a helpful foundation, is unlikely to provide enough income to maintain your standard of living in retirement.

A private or occupational pension acts as a supplement to the State Pension, ensuring you have sufficient income to cover your needs and enjoy your later years without financial strain.

With increasing life expectancy, relying solely on the State Pension can leave retirees vulnerable to inflation and unexpected expenses.

A private pension fills this gap effectively.

6) Flexibility in Contributions

Pensions offer flexibility in how much and how often you contribute.

Depending on your circumstances, you can adjust your contributions to fit your budget or take advantage of available tax relief opportunities.

Self-employed individuals, in particular, can benefit from this flexibility, as they can contribute higher amounts relative to their income and reduce their annual tax liability.

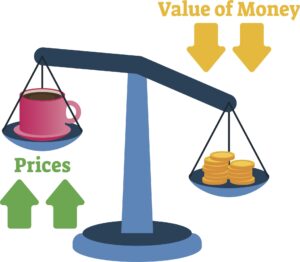

7) Protection Against Inflation

Inflation erodes the value of money over time, which will severely impact savings held in low-interest accounts, providing a negative real return.

Pensions, however, are typically invested in assets like equities that have the potential to outpace inflation, ensuring that your purchasing power in retirement is preserved.

Come back to tax free growth, all your growth is yours, tax free!

8) Early Retirement Options

Depending on your pension plan, you may have the option to access your pension funds before the standard retirement age.

For example, certain occupational pensions allow access from age 50, offering flexibility for those who wish to retire early or transition to part-time work.

9) Estate Planning Benefits

Pensions are not just about retirement—they also offer benefits for your family.

In the event of your death, your pension funds can often be passed on to your dependents or beneficiaries, making pensions a useful estate planning tool.

10) Security and Regulation

The pension system in Ireland is heavily regulated to ensure transparency and protect savers.

Occupational pension schemes and personal retirement savings accounts (PRSAs) are governed by strict rules under the Pensions Authority, providing reassurance that your funds are managed securely.

Summary

In summary, a pension plays an integral role in your financial plan.

Note only is it an efficient way to reduce your tax bill, it helps you

The advantages of pensions are both simple and extremely effective, they extend far beyond basic retirement savings.

From significant tax relief and employer contributions to tax free investment growth and financial security, pensions are a powerful tool to ensure you can enjoy a comfortable and independent retirement.

Starting a pension as early as possible can make a dramatic difference to the size of your retirement fund, but it’s never too late to begin.

How We Help

Do you fit any of the following criteria:

- Are you looking to start a pension?

- Do you have an existing pension you wish to review?

- Have you left your employer and wish to discuss your options with your ex employers pension?

- Do you wish to plan for a comfortable retirement?

- Are you approaching retirement and wish to review and discuss your retirement options?

As part of our financial planning service, we can help with all of the above.

Get in touch

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

If you’re unsure where to start, consulting a financial advisor can help you choose the right pension plan for your needs and goals.

Your future self will thank you for the decisions you make today. Secure your financial future by taking full advantage of the pension system in Ireland.

Production

Production