The Year Ahead

As we begin a new year, we have an excellent opportunity to reset and reflect before life gets busy again.

As this relates to your financial planning, it’s the perfect time to remind ourselves of a few core beliefs underpinning how we approach the world of planning and investments.

These are the beliefs that inform how we engage with you and the recommendations we make.

We hope this reminder provides the foundation for a successful 2025.

A Reminder of What We Believe

-

Any investment portfolio decisions must be made based on a personal financial plan, and any financial plan must be based on your unique circumstances and life goals.

-

If there’s been no change to your circumstances and goals, your plan should not change. If there’s been no change to your plan, your portfolio should not change.

-

Purchasing power is the only sane definition of money, and the biggest threat to purchasing power is inflation.

-

Historically, global equities (ownership of the great companies of the world) have been the asset class providing the best long-term returns and protection from inflation.

-

When we invest in global equities, we do so as long-term owners of businesses, not as short-term stock market speculators.

-

Equity markets undergo frequent, temporary declines that cannot be predicted or timed. The only way to earn the market’s full return has been to remain invested at all times.

-

Lifetime investment success comes from acting continuously on your plan. Likewise, substandard returns and even lifetime investment failure come from reacting to current events.

How We See The World in 2025

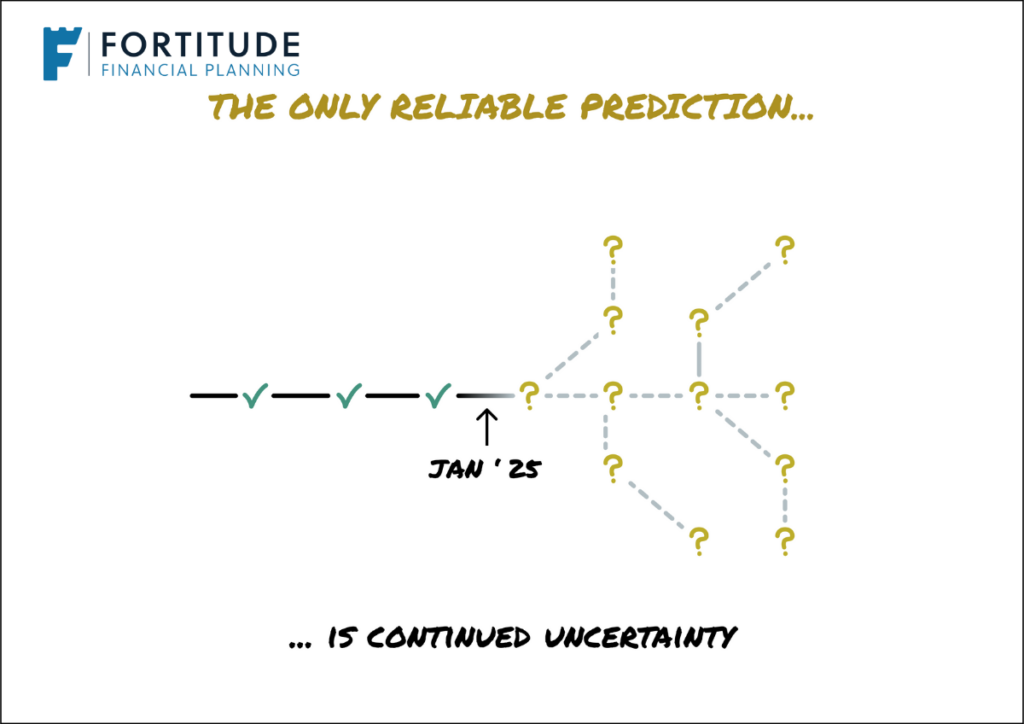

You will find no shortage of forecasts and predictions in other publications.

Based on the accuracy of past forecasts, we do not believe these hold any value for long-term investors. Therefore, we will not attempt the impossible.

However, we think it’s valuable to “zoom out” to understand the current state of investment markets and the world.

At the surface, there appears to be significantly less uncertainty in the world than a year ago. After a slew of important elections in 2024, global governments are primarily settled.

However, as is often the case, the next risk is likely one we are unaware of. We, therefore, expect uncertainty to continue around a range of geopolitical factors that will be impossible to predict.

On an economic front, global companies continued their trend of increasing profits and raising dividends.

These metrics are ultimately the driver of future stock market returns, and we are confident that they will continue to do so no matter what challenges await us.

After a year of negative returns in 2022, global markets provided disciplined investors with exceptional returns in 2023 and 2024.

These returns also came, unusually, with very low volatility. It would be reasonable to expect this trend to reverse at some point, and we would caution against expecting the same smooth ride we experienced over the last two years.

Stand Firm

History, as we know, is a chain of constant surprises. We await to see what surprises await us in 2025.

We therefore urge you to remain optimistic about the long term but open to the possibility of anything happening over the next 12 months. Your financial plans should reflect this.

No matter what is in store for this year, we encourage you to remember the core beliefs we’ve shared above. For the long-term investor, the short-term future is mainly irrelevant. What does matter is how we respond to short-term surprises.

If you continue to act on your long-term plans rather than reacting to short-term events, we are confident that your family’s financial success will be secure.

We encourage you to focus your energy and attention on the things you can control and hope that you will continue to achieve your family’s cherished goals this year.

We are always here to assist you with any financial decisions, and we look forward to continuing to work with you.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production