Transitioning from Saving to Spending

It’s a common belief that our job as financial planners is to help clients spend less so their money lasts longer.

While that’s true in some cases, we often find ourselves doing the opposite: encouraging clients to spend more.

After decades of saving, many retirees have accumulated substantial wealth and developed solid financial plans.

Yet when it comes time to use that money, they freeze. We regularly meet with clients who could easily afford their dream trip, a home renovation, or to financially help their children.

But they’re paralysed by decades of “save more, spend less” conditioning.

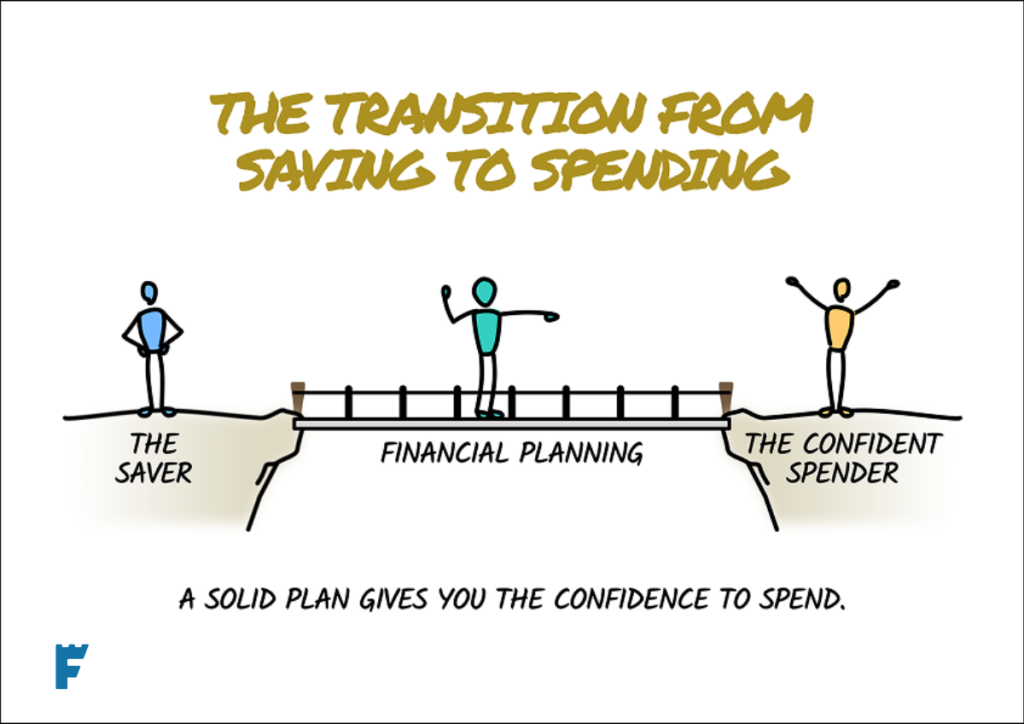

This raises the question: How do you shift from a lifetime of accumulation to confident spending?

A Psychological Challenge

After 30 or 40 years of “spend less, save more,” the habit gets deeply ingrained. It’s not just about numbers. It’s about identity.

You’ve been a saver, a planner, someone who sacrifices today for tomorrow.

The fear makes sense. It’s both logical and emotional.

Logically, you know there’s uncertainty ahead. Markets will at some point decline. Healthcare costs are likely to rise.

You might live longer than expected. Emotionally, spending feels like losing that financial security blanket you’ve worked so hard to create.

You’ve trained for this moment your entire working life, but now you hesitate to run the race.

We see clients with rock-solid financial plans still living like they’re financially stressed, rationing themselves unnecessarily.

In our view, the greater risk is missing the early, healthiest years of retirement due to unnecessary financial anxiety.

The Healthy Years

Your 60s and 70s are usually your healthiest years in retirement. Unfortunately, while you can defer spending, you can’t bank physical capability for later use.

That adventure travel you’re postponing will only get more difficult every passing year.

Under-spending isn’t just about missing experiences. It means missing opportunities to help your children with major purchases, support causes you care about while you can see the impact, or enjoy the comfort that would improve your daily life.

Money isn’t just for basics and emergencies.

It’s for creating the life and legacy you want.

The happiest retirees understand that meaningful spending has multiple parts: personal fulfilment, family impact, charitable giving, and daily comfort.

You put in effort to build this wealth so you can actively use it, not merely hold onto it.

Sadly, many retirees end up with far more money than they ever needed. What more could that money have done for them and their loved ones?

How to Move Forward Without Fear

The solution to the rational fear of overspending is a comprehensive financial plan that takes into account your basic lifestyle costs, as well as the “nice-to-haves.”

When these costs are aligned with a diversified long-term portfolio, a good financial adviser will be able to provide the comfort you need to spend what is sustainable.

By planning regular reviews, you build in checkpoints that will allow you to recalibrate if necessary.

Good financial planning provides a solid foundation for confident spending.

It helps you avoid forgoing a fulfilling life in the first decade of retirement, based not on evidence but on fear. Yes, we don’t know what the future holds, but if unexpected expenses arise or markets perform poorly, you can adjust your course.

This isn’t permanent.

The key is not letting fear of unknown future events rob you of meaningful present opportunities.

We can help you find that sweet spot between sensible caution and confident living. The goal isn’t reckless spending.

It’s the purposeful use of the wealth you’ve created. You’ve earned the right to use your money for meaning, impact, and joy.

If you’re holding back on spending that would bring meaning to your life or the lives of others, let’s review your plan together. We can help you find the confidence to make the most of the wealth you’ve worked so hard to create.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production