What is an Approved Retirement Fund (ARF)?

You reach retirement and you have a pension fund.

And you have choices to make with your fund.

Tax-efficient retirement lump sum (an element of which will be tax-free).

An annuity (a fixed income payable for life).

Or, invest in an Approved Retirement Fund (ARF).

These also apply if you want to draw your pension before your retirement age.

When these terms are thrown around it can cause confusion.

We previously wrote an article on these options which can be read here.

At Fortitude Financial Planning, one of our reasons for being is to simplify this stuff for clients.

Cut through the jargon and provide simple, easy to understand advice.

We’re going to focus on an ARF here.

What is it and how does it work?

This is not a comparison of an ARF versus an Annuity, you can read that here.

If you have an ARF or are faced with your pension options, you’ll find this relevant.

The history of the Approved Retirement Fund

The ARF was originally introduced in 1999.

When originally introduced, they were only available to personal pension holders and certain directors of companies that operated defined contribution (DC) occupational pension schemes.

The Finance Act 2011 permitted the availability of an ARF to members of a DC occupational scheme.

Consequently, this was a significant change in the availability of an ARF.

Additionally, a further change to legislation in 2016, opened up the ARF option to Defined Benefit scheme members.

This is on the basis they first transfer their benefit out of the DB scheme.

What is an ARF?

Simply put, an ARF is a post-retirement investment vehicle.

It allows you, when you take your lump sum, to continue to invest the balance of your pension fund in retirement.

The ARF is an alternative to purchasing an annuity with your pension fund.

It is tax-efficient in the manner that there is no tax on the growth of your ARF.

An ARF provides you with flexibility and control of how you draw your pension income.

It also affords you the opportunity to pass on your ARF to your estate, subject to relevant taxes.

Review Your Retirement Options

How does an ARF work?

Your pension fund remains invested.

It has exposure to investment markets giving you the opportunity to preserve your fund in retirement.

Your investment portfolio within your ARF is in line with your own individual retirement objectives.

You draw an income from your ARF to supplement your lifestyle in retirement.

What income can you take from your Approved Retirement Fund?

You have control over what income you withdraw from your ARF.

Consequently, this can provide you with an opportunity to control your tax liability in retirement.

ARF income is assessable for income tax, USC and PRSI.

However, there is a minimum income requirement you must draw from your ARF.

From the calendar year you turn age 61, you must withdraw a minimum 4% of your ARF value as an income.

Before age 61, there is no minimum income drawdown requirement.

This 4% increases to 5% from age 71.

Additionally, if you are aged 60 or over and hold ARF assets over €2m, your income liability is 6%.

How frequently can the income be distributed?

Generally speaking, the income is paid annually.

However, the income can also be paid monthly, quarterly or half-yearly.

Additionally, there is a common misconception your ARF income has to be a % of the value.

This is incorrect.

An ARF can also pay a fixed income.

Presently, certain providers can accommodate a fixed monthly income amount from an ARF if this is more suited to your lifestyle.

Is an ARF taxable?

The growth on an ARF is tax-free.

No exit tax, no capital gains tax.

However, income withdrawn, or encashments from your ARF is assessable for income tax, USC and PRSI.

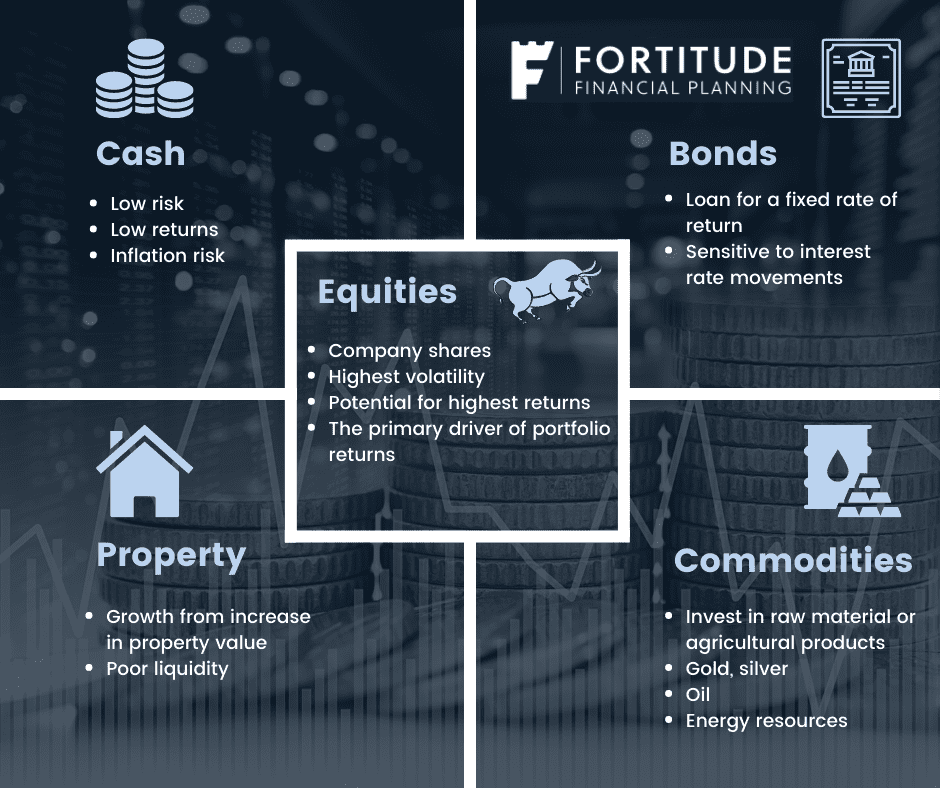

Is an ARF invested?

Yes, an Approved Retirement Fund invests in the markets to some degree.

However, your ARF investment strategy should be specific to your circumstances.

It should factor in:

- The clients’ tolerance for investment risk

- Their capacity for investment risk

- Their own individual investment objectives

- Finally, their income requirements

An ARF investment portfolio shouldn’t be an off the shelf solution for a client.

Because each client is different, no two ARF investors should have the same portfolio.

So, an ARF is not risk free, it carries investment risk.

However, investment risk that can be controlled by your asset allocation.

Bomb Out Risk

Bomb out risk is where the ARF holder outlives the ARF.

Large income drawdowns and encashments, coupled with poor investment returns can result in this.

Is bomb out risk realistic?

With careful planning, not likely in my opinion but it is a possibility so has to be acknowledged.

Income Drawdown Strategy

To avoid or reduce bomb out risk an ARF holder needs to consider their income draw down strategy.

If someone retires at age 60, this ARF is a potential 30 year investment.

30 years it likely has to provide income for.

Consequently, this is where engaging with a financial planner as opposed to a pension salesperson or company significantly benefits an ARF holder.

A financial planner will build a client a proper plan for their ARF around their individual circumstances and income requirements.

This then feeds into the recommended investment strategy.

What about an Approved Minimum Retirement Fund (AMRF)?

Previously, there was a requirement to access an ARF.

An individual had to meet one of two conditions:

- Invest €63,500 in an Approved Minimum Retirement Fund (AMRF) or

- Have guaranteed income for life of €12,700 per annum

However, this requirement was removed in the 2021 Finance Bill and an AMRF is no longer available or required.

Treatment of an ARF on death

On death, subject to the relevant tax treatment, an ARF allows you to leave a legacy.

The value of your ARF will pass into your estate.

For married couples, the surviving spouse or civil partner can receive the ARF tax-free into an ARF in their own name.

Tax Treatment on Death:

| ARF Inherited by | Income Tax due | Capital Acquisitions Tax (CAT) due |

| The surviving spouse or civil partner |

None where transferred to an ARF of the surviving spouse or civil partner

|

No |

| Child under 21 | No | Yes, taxable inheritance subject to thresholds |

| Child over 21 | Yes. Subject to 30% income tax | No. Exempt |

| Other (incl. to spouse / civil partner directly) | Yes. Treated as income of deceased in the year of death. By default, the QFM deducts higher rate income tax at source under PAYE. | Yes. Taxable inheritance. |

Advantages of an ARF

- The capital is preserved subject to investment risk

- Flexibility and control over how the income is drawn (subject to minimum requirements)

- The fund invested grows tax-free (no tax on the investment growth)

- Multiple investment options

- An ARF can always be used to purchase an annuity at a later date

- The balance of the ARF passes to the estate of the holder on death

Disadvantages of an ARF

- Investment risk – the underlying investment is subject to investment risk and will fluctuate

- Fluctuating income if withdrawn as a % of the fund value

- Bomb-out risk – if a holder lives long and exercises large drawdowns coupled with poor returns

Is there a requirement for ongoing advice?

Practically, simply put, yes.

When an ARF is set up, that’s not the end of the road.

Like any other investment, it requires ongoing management, review and monitoring.

As an example, the asset allocation at outset may not be suitable for you in 6, 12, 24 months time.

Your objectives and circumstances change, thus affecting your asset allocation requirements.

The asset allocation could ‘drift’ due to one asset outperforming the other and it needs to rebalance.

Your income drawdown. Are you drawing enough? Too much?

How does your income affect your necessary investment strategy?

Without ongoing advice, none of the above will be catered for.

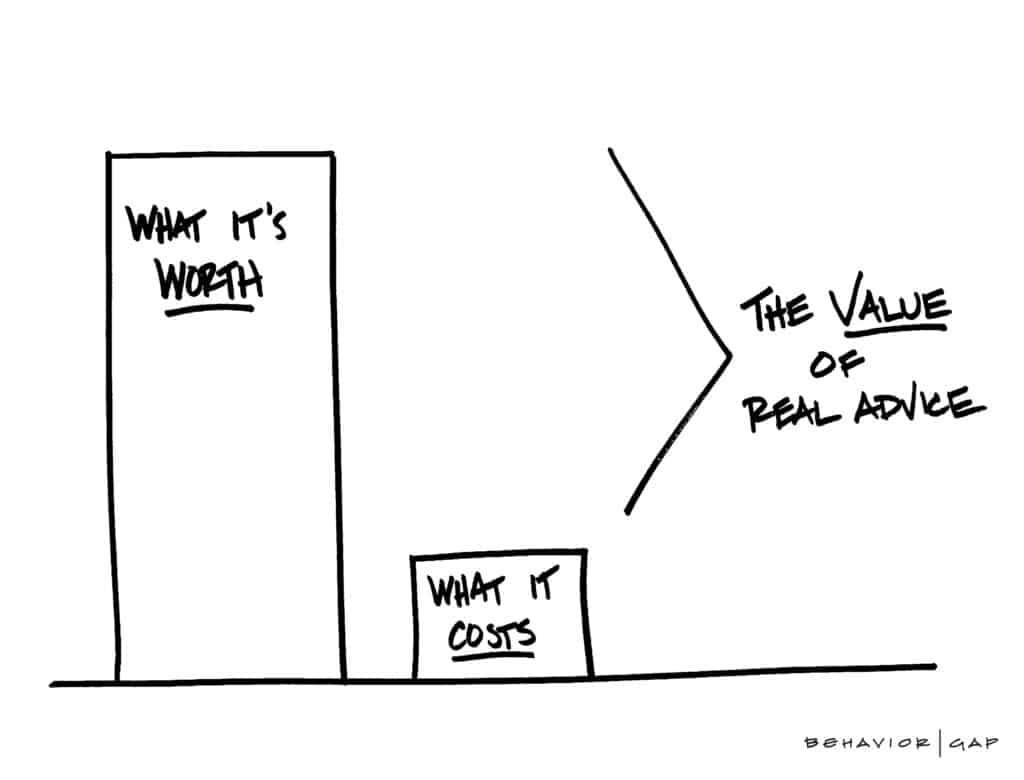

Good, proper, ongoing advice will also help you avoid one of the main pitfalls of DIY investing, ‘the big mistake‘.

The big mistake is where you buy high or sell low.

Investing your own money is an emotive act and it can push you towards irrational decisions.

For example, when the market drops, the worst thing you can do is cash out, but your emotions will push you to do that.

Not necessarily every time but it will at some point.

Our emotions cloud our judgement when it comes to our own money.

Working with an advisor helps you avoid these costly mistakes.

A book I highly recommend on this subject is ‘The Behavior Gap’ by Carl Richards.

You can purchase it by clicking here. No referral fees! It’s just really good.

Vanguard is one of the world’s largest investment managers.

They conducted a study (you can read it here) that quantified the value of an investor working with an advisor to an estimated 3% in net investment returns.

Summary

In summary, there is a lot going on when it comes to an Approved Retirement Fund.

It’s not necessarily as straightforward a product as you may think.

However, with the proper, jargon-free advice it can be.

Evidently, there are advantages and disadvantages.

Consequently, an ARF will suit some and not others.

The most important thing is an individual takes the proper advice, both on an existing ARF and on their retirement options if they have reached retirement or are looking to access their pension early.

Review Your Early Retirement Options

How We Help

At Fortitude Financial Planning, we look after many Approved Retirement Funds.

Importantly, we factor in our clients’ circumstances to our recommendations.

Their individual circumstances, tolerance for investment risk, capacity for investment risk, their objectives and their income requirements.

Subsequently, this ensures there is logic, reasoning and math behind our ARF recommendations.

This is the opposite of an off the shelf recommendation, typically produced by a pension salesperson, company or bank.

Are you planning on drawing your pension in the next 5 years?

Have you received your pension retirement options?

Or are you looking to access your pension before Normal Retirement Age (NRA)?

If so then you need to become used to the ARF term, what it is, how it works and your income options.

Get in touch

Take the first steps to working through your retirement options or learning what they will be and request a callback.

You can also drop me an email, francis@fortitudefp.ie give me a call, 086 0080 756 or access our diary here and book a call at your convenience.

We are happy to have a no obligation chat with you initially, this allows us to assess if we can help and bring value to you.

We have over 40 articles in our content library on various subjects and you can access them here and learn more about our experience and expertise.

A wealth of free information covering all aspects of saving, investing, financial planning, protection and pension advice.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production