What’s the money for?

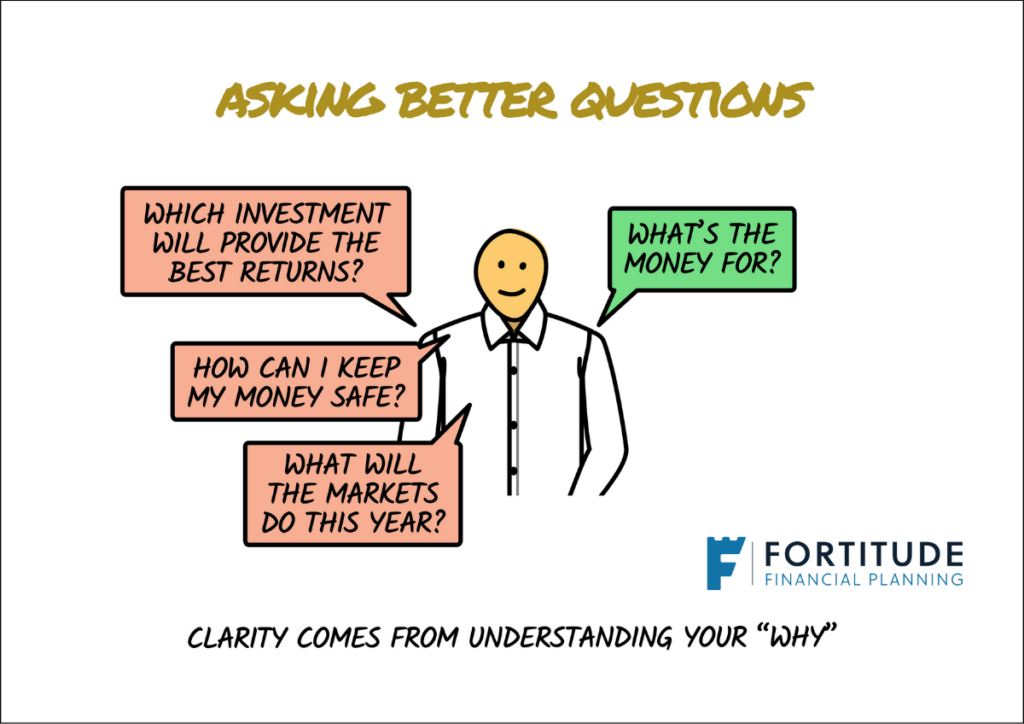

As financial planners, one of the biggest mistakes we see investors making is asking the wrong questions.

While the reason for asking them is understandable, too often, an investor’s first question is, “Which investment will provide the best returns?” or “How can I keep my money safe?”

These questions make the investment journey unnecessarily complex and emotionally taxing.

Asking better questions is the first step to simplifying the investment decision.

In our experience, the question that provides the most clarity is: “What’s the money for?”

A simple question, yes, but this question defines the purpose of your money and lays the foundation for smart financial planning.

The Pitfalls of Aimless Investing

Investing without a clear goal is like embarking on a road trip without a destination in mind.

You might encounter some interesting sights along the way, but you’ll likely waste time, money, and energy making haphazard turns.

When you don’t know the purpose of your money, your investment approach can quickly devolve into a jumble of impulsive decisions, trend-chasing, and knee-jerk reactions to market noise.

If you’re saving for retirement decades down the line, should you really be concerned about daily market fluctuations?

Your long-term horizon allows plenty of time for growth.

On the flip side, if you’re investing money you need for a known expense next year, a portfolio designed for long-term investors could derail your plans.

Skipping the crucial step of defining your money’s purpose often leads to emotional decision-making.

The consequences? Missed opportunities, undue stress, and a lack of confidence in your financial future.

Aligning Investments With Your “Why”

The solution to this predicament is as profound as it is simple: always begin by identifying your goals.

When you ask yourself, “What’s the money for?” you create a framework for making informed, purposeful decisions.

You are forced to grapple with the “why” behind your investments, which helps you understand your investment time frames.

Clarifying your goals upfront establishes a clear direction for your investment strategy.

This goal-oriented approach does more than just guide your investment selection.

It also bolsters your resilience in the face of market uncertainty. When you know your investments align with your objectives, staying the course during temporary downturns is easier.

You have the confidence to rely on a clear plan.

Your Trusted Guide on the Journey

Successful investing doesn’t have to be complicated.

It begins with asking the right questions. So, whenever you evaluate an investment, we encourage you to ask yourself, “What’s the money for?”

We understand that translating goals into an investment strategy can seem daunting, especially with the complexities of today’s financial markets and the media.

That’s where a competent and caring financial planner comes in.

By acting as your trusted guide, we can help you refine your goals and craft a tailored investment plan to achieve them.

We aim to bring clarity and expertise to the process so you can focus on what matters most.

Investing is not about chasing the latest trends or finding some elusive “perfect” strategy.

It’s about leveraging your money as a tool to build the future you desire.

And it all starts with one powerful question: “What’s the money for?” Your future self will thank you.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production