When Is It Time to Work With a Financial Planner?

Let’s be honest—asking for help with your finances can feel a bit awkward.

For many people, it almost feels like admitting failure.

Shouldn’t you be able to figure this out yourself?

Well, maybe. But just like you’d hire a builder to renovate your home or a mechanic to service your car, there comes a point when bringing in a professional isn’t just smart—it’s necessary.

Here are some common signs that it might be the right time to bring a financial planner into your corner.

1. Your Financial Life Is Becoming More Complex

You might be approaching retirement, changing jobs, buying a home, or welcoming a child.

Life changes bring financial complexity—and with it, decisions that are often hard to get right alone.

A financial planner can help you stay organised and ensure your finances are aligned with your life plans.

2. You’re Wondering, “Am I on Track?”

This is one of the most common questions we hear—and a very valid one.

In fact, often, clients come to us with some other question but underneath it, this is the real question they’re asking.

But there’s no one-size-fits-all answer.

A good planner will assess your full financial picture—income, spending, pensions, investments, tax position—and help you determine if you’re on course to achieve what matters most to you.

3. You’ve Received a Lump Sum—And You’re Not Sure What to Do With It

Whether through inheritance, a redundancy package, or the sale of a property, receiving a large lump sum can be both an opportunity and a responsibility.

The temptation might be to park it in a bank or invest it quickly.

But what you do with that money can affect your financial future, your tax liabilities, and even your legacy.

A planner can help you pause, reflect, and act with purpose.

4. You Have Multiple Pensions or Assets Scattered Around

Old pensions, company shares, savings accounts, rental properties—if your finances feel fragmented, you’re not alone.

A financial planner can help you consolidate, coordinate, and make sense of it all, ensuring your assets work together toward your financial goals.

5. You’re Not Sure How to Invest (or If You Should Change Strategy)

Whether you’re looking to start investing, you’re a DIY investor or someone who’s always been hands-off, your investment approach should reflect your goals, your timeline, and your ability to take on risk.

A planner can help you build or refine a strategy that’s designed not just to grow your wealth—but to protect and use it wisely.

6. You’re Thinking About Tax, Healthcare, or Legacy Planning

Managing your finances isn’t just about today—it’s also about what happens next.

A financial planner can help you make tax-smart decisions, prepare for potential healthcare needs, and plan for how you’d like to pass wealth on to loved ones.

7. You Want Clarity and Confidence

Perhaps most importantly, if you’re losing sleep, second-guessing decisions, or just unsure where to start, that’s a clear sign it’s time to get support.

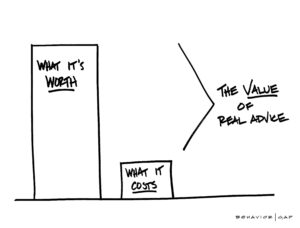

Working with a financial planner isn’t just about spreadsheets and projections—it’s about having someone in your corner who brings clarity, structure, and peace of mind.

Final Thought

You don’t have to go it alone. In fact, the best time to work with a financial planner is before things start to feel overwhelming.

It’s about being proactive—not reactive.

Whether you’re navigating a life change, planning for retirement, or simply want to take control of your finances, a trusted adviser can help you make smarter, more confident decisions—now and for the future.

Ready to get started or just want to explore if financial planning is right for you? We’re here to help you build a plan that fits your life, your goals, and your future.

Get in Touch

Whether you’ve just received a lump sum, are approaching a major life change, or simply want more clarity about your financial future—now’s a good time to start the conversation.

📞 Book a no-obligation chat

📧 Email us directly – info@fortitudefp.ie

📅 Click here to book your call now.

Visit our Insights – A hub of information covering saving, investing, financial planning, protection, and pension advice.

Taking the first step doesn’t mean committing to anything—it just means exploring your options with someone who’s in your corner.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production