The Real Risk Is Not What You Think: Why Investment ‘Risk’ Is Really Just Volatility

When people talk about investing, the word “risk” comes up a lot.

“This is a risky fund.”

“You need to manage your risk.”

“Are you comfortable taking risk?”

But what does risk actually mean?

Most people instantly associate it with losing money—and that’s completely understandable (but wrong).

In reality, when investing, the real story is a little different.

In fact, what most people call “risk” is actually something else: volatility.

Volatility vs. Risk: What’s the Difference?

Let’s break it down:

-

Volatility refers to how much the value of an investment goes up and down over time. It’s a natural part and a feature of markets. A volatile investment might swing by 10% in a week. A more stable one might barely move.

-

Risk, in the real sense, is about permanent loss. It’s not just watching your investment fluctuate—it’s losing money in a way that can’t be recovered, like panic-selling at the bottom or investing everything into a speculative asset that fails.

The problem? Investors often treat volatility as if it’s risk. And that can lead to poor decisions.

Volatility Feels Like Risk — But It’s Not

Imagine this: you invest in a globally diversified equity portfolio.

Over the next few years, it jumps up and down with the markets—sometimes dramatically. That’s volatility.

It can be uncomfortable, but if you stay the course, long-term growth is still very likely.

Now imagine a different scenario:

You sell everything at the bottom of a market dip because the headlines spooked you.

You lock in the losses and miss the rebound. That’s the real risk—and it’s usually driven by emotion, not the investment itself.

Ironically, it’s often the fear of volatility that pushes people into risky decisions.

Why Words Matter

When we hear the word “risk,” our brains interpret it as “danger.” And that can trigger reactions like:

-

Avoiding equities completely

-

Selling during market downturns

-

Holding too much in cash out of fear

If we used the word volatility instead, we’d be having a different conversation—one grounded in fact, not fear.

Because volatility is expected. It’s natural and a feature of markets.

It’s the price you pay for long-term returns.

What Real Risk Looks Like

Here are a few examples of actual financial risks:

-

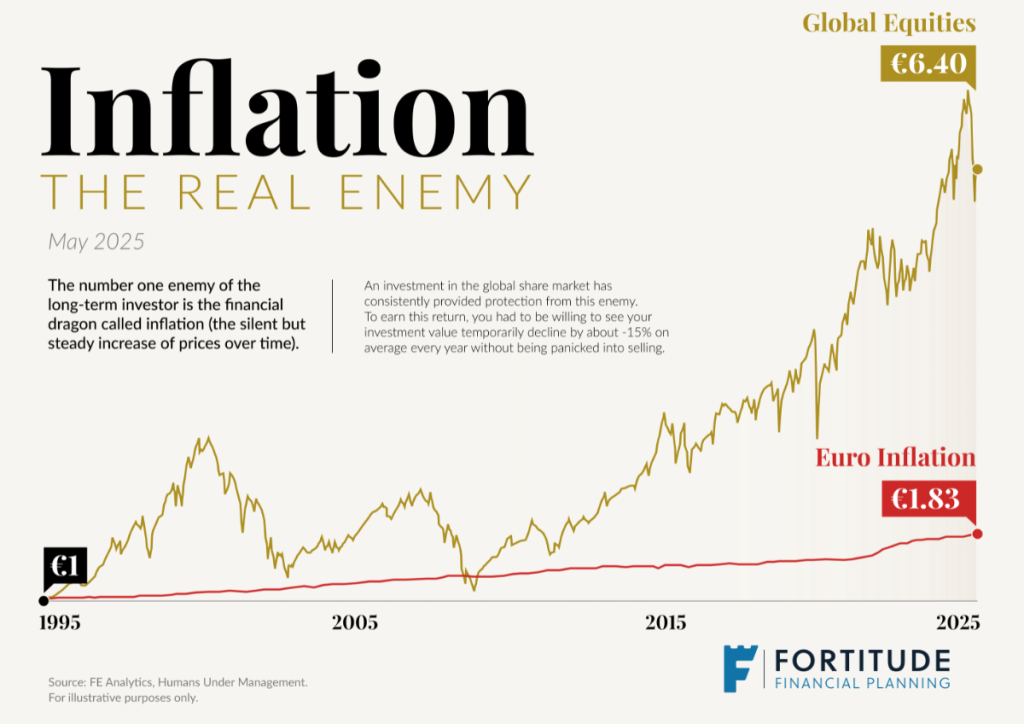

Losing purchasing power to inflation

-

Not saving enough for retirement

-

Taking on excessive debt

-

Being underinsured

-

Reacting emotionally to market noise

-

Not having a long-term financial plan

These are the kinds of risks that can truly undermine your finances and in turn your future—not the temporary market dips that headlines love to dramatise.

What This Means for You

Understanding the difference between volatility and risk is crucial if you want to build long-term financial security.

Final Thought

Volatility is uncomfortable, but it’s not dangerous if you have a plan and stick with it. Real risk comes from not having a plan—or abandoning it at the wrong time.

Next time you hear someone talk about “investment risk,” ask yourself: Do they really mean risk—or do they just simply mean volatility?

How We Help

At Fortitude Financial Planning, we guide clients through the noise and emotions that often come with investing. Our role is not just to build portfolios—but to help you understand what real risk looks like and how to manage it effectively.

Here’s how we support you:

-

Clarifying your goals and timeframes, so your investments are aligned with what truly matters

-

Helping you stay invested through volatility, avoiding costly emotional decisions

-

Designing diversified portfolios that match your risk tolerance and capacity for loss

-

Protecting your wealth from real risks—like inflation, poor planning, or panic selling

-

Providing calm, expert guidance when headlines and markets get turbulent

We help you stay focused on the big picture, so short-term volatility doesn’t derail your long-term progress.

If you’d like help navigating market uncertainty and building a plan grounded in what really matters, we’re here to help.

📅 Click here to book your call now.

Visit our Insights – A hub of information covering saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production