As business owners there can be a number of reasons why we opted to set up our businesses.

It could be a work/life balance.

The freedom to be our own boss.

I would suggest financial freedom is pretty high up on the list.

What happens after financial freedom is that we have to plan how to exit the business – tax efficiently.

We don’t want to walk away from our businesses empty-handed but we have to plan our exit strategy correctly.

As a business owner, a pension must form part of your overall retirement planning and exit strategy.

An Executive Pension allows you to turn company profits into personal wealth.

It facilitates the transfer of cash from the company to you personally – tax efficiently.

It’s one of the most tax-efficient ways of getting money from your company into your own name.

An additional benefit is that it ensures when the time comes to retire, you are not depending on the sale of your business to facilitate a comfortable retirement.

What your business should do for you

If you run a business, you have a huge opportunity that must be utilised.

For many business owners, it is your most valuable asset – on paper at least.

It should:

- Grow your wealth – it should increase in value over time and you should be using tax breaks as it grows

- Cover your cost of living – it should be able to provide you and your family with a comfortable lifestyle

- Provide a comfortable retirement – your retirement costs should be factored into the cost of running your business

- Give you plenty of time off – No one wants to be chained to the business. It should be able to give you plenty of time off to spend with your family and run independently of you

My business is my pension – I’ll just sell it

This is a common theory but similar to people who want to rely on selling a property to fund their retirement, it’s significantly flawed.

It’s reliant on two things, the selling market at the time and finding a buyer.

Another spanner in the works could be if the business is completely reliant on you.

A business reliant on one person isn’t really a sellable asset.

Companies that are viewed as a good acquisition have to be able to function independently of the owner.

Relying on selling your business as your long term retirement plan brings too many variables into play.

It’s a future event you can’t control.

Good financial planning is about giving yourself options and retaining control of your options.

Why rely on something you ultimately can’t control?

Executive Pension

When we talk pensions, people have a tendency to fog over, clam up.

Pensions are not everybody’s thing.

A high % of the population just think pensions are boring and of no use.

This is likely because they either don’t know or don’t understand the workings of a pension or have no interest in learning.

I like them because I understand them, know and appreciate their benefits.

An Executive Pension (sometimes commonly known as a Director’s Pension) allows you to grow your wealth for your retirement – tax efficiently.

It allows you to transfer your companies profits onto your own personal balance sheet – tax efficiently.

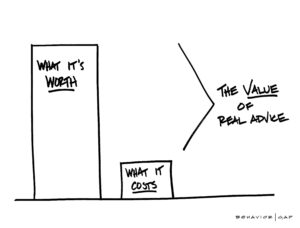

The initial tax breaks on contributions to the pension are:

- There is no Benefit-In-Kind (BIK) liability on your companies contributions to your pension

- Your pension fund grows completely tax-free

The alternative tax treatment to contributing to the pension looks something like this:

- Draw as salary – (PAYE, USC, PRSI) – approximately 52%

- Dividends – 40%

- Sell Shares (Capital Gains) – 33%

- BIK – 30%

- Leave in the Company – Corporation Tax – 12.5%

Balance a 0% tax rate versus the above.

There is no contest.

What is the maximum pension pot I can have?

Under Revenue guidelines, the Standard Fund Threshold (SFT) is €2,000,000.

There is a quirk in the rules that allow you to fund up to €2,150,000.

However it is important to have numbers run specific to yourself as depending on a number of variables, your own personal limit may be less than the €2,000,000 SFT.

Review Your Current Executive Pension

What are the maximum amounts the company can pay

I always recommend you get numbers specific to yourself calculated and we can arrange that for you.

As a guideline however below are some estimates as to how much your company can pay to your pension:

- Male, age 46, married – 100% of your salary

- Female, age 50, married – 115% of your salary

- Male, age 55, single – 136% of your salary

- Female, age 60, single – 317% of your salary

There are a number of factors here and it’s important to get calculations specific to yourself.

Yes – I want my numbers calculated

The structure of an Executive Pension

An Executive Pension is set up under trust and the director is the beneficiary.

This means it is legally separate from the business.

Independent Trustees are appointed.

Once the pension is set up, regular contributions are made and once-off end of year contributions are facilitated.

At Retirement

From age 60 onwards, from your executive pension, you can take a tax-free lump sum.

We calculate the tax-free lump sum in one of two ways:

- Your salary and service with your company* or

- 25% of the fund value.

Quick note, a cap of €200,000 applies on the tax-free lump sum.

If you have a pension fund of €800,000 you would receive the maximum €200,000 tax-free (€800,000 x 25%).

*There is the potential for you to draw 1.5 times your salary tax-free subject to certain variables. Note this is till capped at €200,000.

You can read more about the options available from age 60 onwards here.

Are there any other business exit strategies I should know of?

Absolutely. Retirement Relief and Entrepreneur Relief.

Two tax breaks that are available and combined with your pension, you should look to avail of one of them should you sell your business.

Without going into specifics (they could be a whole blog on their own) I’ll touch on them.

Retirement Relief – potential exemption from Capital Gains Tax (CGT) on qualifying business assets.

Entrepreneur Relief – reduced CGT rate of 10% on chargeable business assets.

Important to note, to qualify for either of the above, there are specific limits and qualifying conditions you have to meet.

I work alongside my client’s tax advisors in these instances.

Ideally, an exit strategy should knit together one of these reliefs along with your executive pension.

Recent Case

A client with a directors pension in place already.

Approaching the end of his company accounting year there is a €50,000 surplus in the company.

He can:

- Draw as a bonus, 52% tax in total (income, USC, PRSI) – net cash in hand €24,000

- Leave in company – Corporation Tax bill of €6,250.

Instead, he topped up his pension with €50,000 and paid zero tax.

Assuming 4% growth over the next 18 years that €50,000 will grow tax-free to over €100,000.

We help our clients set up their executive pensions and equally as important ensure they’re correctly structured.

We have also reviewed existing pensions for clients who have come to us with them already in place.

If you would like to review or discuss your existing arrangements or set up a new arrangement, request a callback or drop me a mail, francis@fortitudefp.ie.

Alternatively you can reach me directly on 086 0080 756.

Francis McTaggart CFP® SIA RPA QFA

Disclaimer: All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production