Your Estate Planning Dilemma

Most people’s primary motivation for financial planning is to ensure they don’t outlive their money.

Disciplined investors, most of whom are supported by a competent and caring financial planner, can, however, reach a position where it becomes clear that they will never spend all their money in their lifetime.

While this position is a luxury, it is well deserved.

It can also be traced back to their decisions over multiple decades.

Some investors can be convinced to increase their spending on activities and causes that bring them meaning.

However, many will still die with a sizeable net worth.

They are driven by a desire to leave a legacy to those they love, and their wealth becomes a river that will flow to the next generation.

Studies suggest that we will witness one of the most significant wealth transfers in history over the coming decades.

This presents opportunities and challenges for families and raises important questions about how and when to pass on assets.

The Traditional Approach

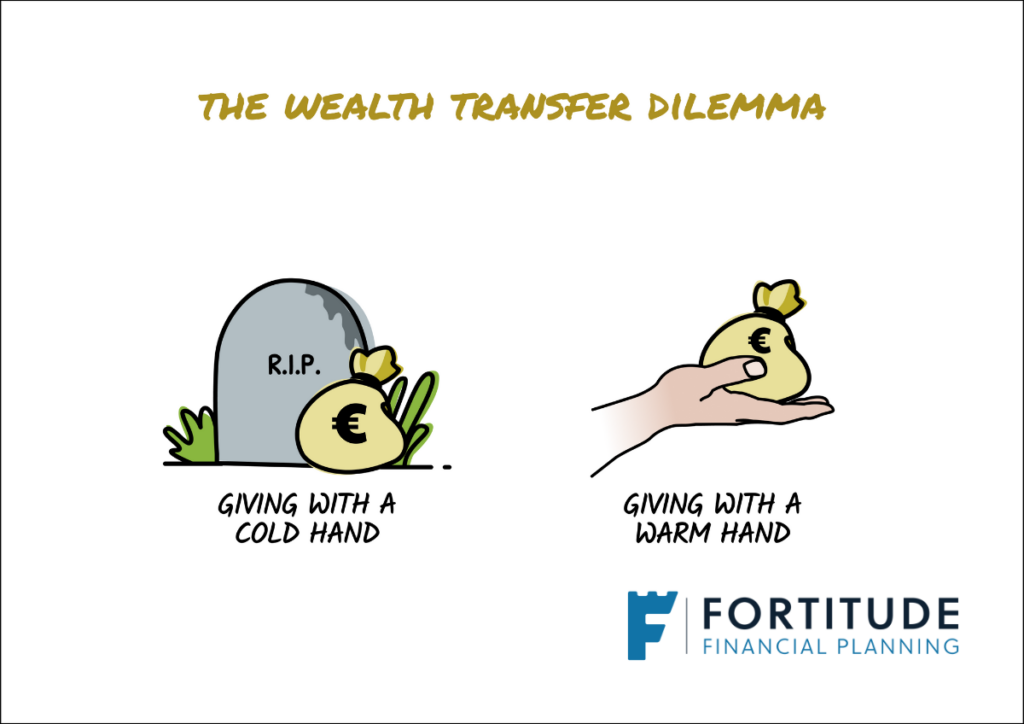

For a long time, most families have defaulted to the conventional method of wealth transfer, leaving an inheritance after death.

This approach offers several advantages.

It allows investors to maintain control of their assets throughout their lifetime, insuring against unforeseen setbacks or expenses.

The extent and cost of future medical care are difficult to predict, and more wealth only means more freedom and opportunities.

However, this traditional model also comes with potential drawbacks.

One significant concern is timing – your heirs may not need the money when they finally receive it, possibly being close to retirement themselves.

By waiting until after your passing to transfer wealth, you miss the opportunity to witness and guide the impact of your generosity.

There’s something uniquely rewarding about seeing your hard-earned wealth make a difference in your loved ones’ lives while you’re still here.

Additionally, depending on your jurisdiction, there may be higher estate taxes compared to lifetime giving strategies, potentially reducing the amount your beneficiaries ultimately receive.

The traditional inheritance model offers security and control, but it’s important to weigh these benefits against the potential missed opportunities for impact and guidance.

The Warm Hand Approach

An alternative to the traditional inheritance model is the “warm hand” approach – giving while you’re still alive.

This strategy has gained popularity in recent years.

More people now recognise the potential benefits of transferring wealth during their lifetime.

One of the most significant advantages is the ability to witness the impact of your generosity firsthand.

There’s a unique joy in seeing how your financial support can change lives, whether helping a grandchild through college or giving your children a head start with weddings, house purchases or business projects.

The warm hand approach also allows you to provide guidance alongside your gifts.

You can share your financial wisdom, helping recipients learn to manage and appreciate the wealth they’re receiving.

However, this approach has its challenges.

Giving away assets during your lifetime gives you less control over your wealth.

You also risk jeopardising your financial security if you give away too much too soon.

Ensuring you retain enough assets to support yourself through retirement and potential healthcare needs is crucial.

Many people start by utilising annual gift allowances, which can provide tax benefits while gradually transferring wealth.

Contributing to education costs is another popular option, whether paying school fees or funding a college savings plan.

Some choose to help with major life expenses, such as providing a down payment for a child’s first home.

Crafting Your Strategy

Navigating the wealth transfer dilemma often involves not choosing one approach over the other.

Rather it’s about finding the right balance between lifetime giving and traditional inheritance.

This balance will be unique to each individual and family based on various factors.

As your financial planner, we’re here to help you understand your options.

We’ll help you consider the implications, and create a personalised plan that aligns with your goals and values.

By taking a thoughtful, balanced approach to wealth transfer, you can create a legacy that provides financial support to your loved ones and imparts your values and wisdom to future generations.

It’s a powerful way to ensure that your life’s work continues to have a positive impact long into the future.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production