Your Investment Journey Doesn’t End When You Retire

You’ve finally done it. After decades of saving and investing, you’ve reached retirement. There’s enormous relief and excitement about what awaits in the next chapter of life.

But then a new worry creeps in. For the first time ever, you’re living off your investments instead of adding to them each and every month.

For many investors, their first instinct is to “play it safe” with their hard-earned investments.

This thinking may have made sense for previous generations.

Most investors retired, bought an annuity (turned their pension pot into an income for life), and lived off the guaranteed payments. For many, the investing was done, the end of the road.

But times have really changed. Today’s retirees (couples) face retirement periods of 20 to 30+ years, not the shorter timelines of the past.

At the same time, investment markets have become more sophisticated, while lower interest rates have made guaranteed products less appealing.

What was once a safe approach is now a risk to your financial future. Our challenge to all investors, especially retirees, is to recognise that their investment timeline is much longer than they think.

The Reality Check: You’re Investing for Decades, Not Years

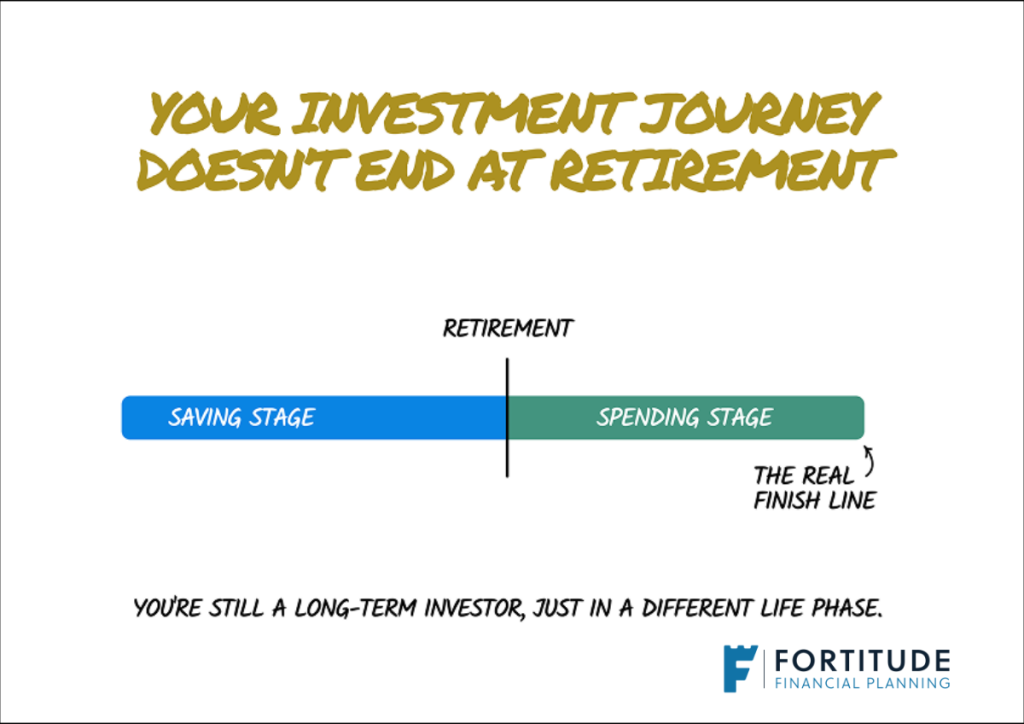

It’s easy for retirement to feel like the finish line. You’ve moved from the savings stage to the spending stage.

Finally, no more worrying about the stock markets and investment returns.

However, that’s no longer the reality. Today’s 65-year-old couple has a one-in-three chance that at least one partner will live to age 95. Seen through this lens, it’s clear that your spending stage could be as long as your savings stage.

The conventional strategy of gradually shifting to low-return, low-volatility portfolios in the years leading up to retirement is no longer sensible given this reality.

Rather than being at the investment finishing line, you are merely at the intermission.

Your planning, mindset, and investment strategy need to reflect this. Your assets will ideally need to provide a rising income for up to three decades to keep pace with inflation.

This might feel overwhelming. But it’s actually good news.

You’re not a retiree managing a shrinking pot of money. You’re still a long-term investor, just in a different life phase.

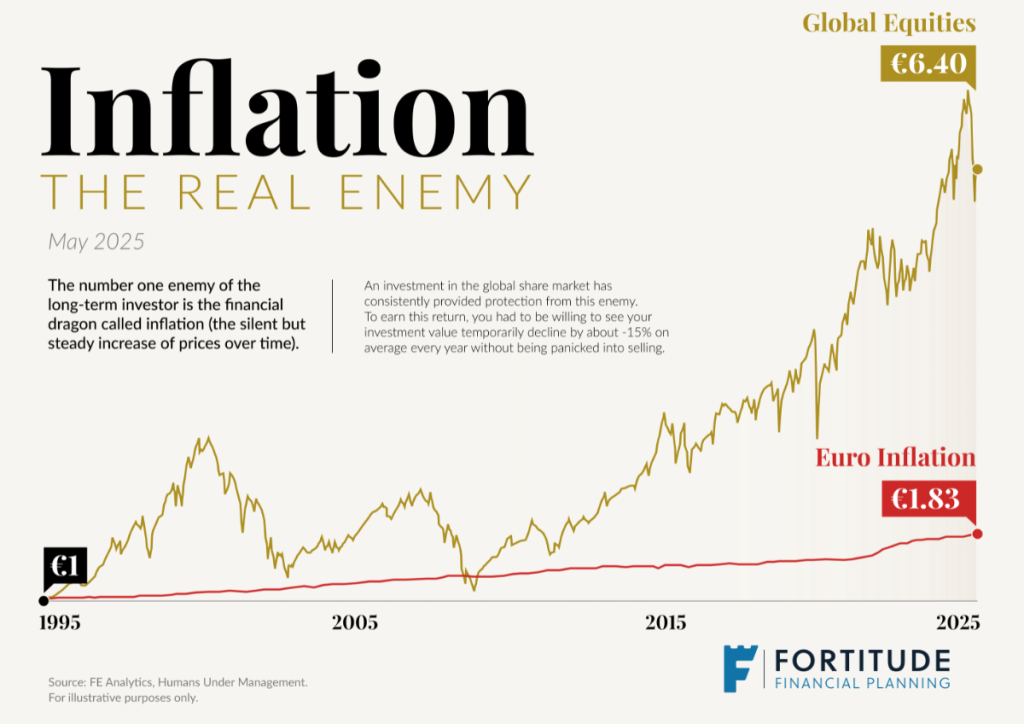

Why Playing It ‘Safe’ Is Actually Risky

We understand that market volatility feels different when you can’t replace temporary declines with further contributions.

Your appetite for risk has changed, and those “stable” investments look awfully appealing.

But playing it safe is actually the riskiest thing you can do.

While you’re focused on avoiding short-term fluctuations, inflation is quietly eroding your purchasing power. The things you buy today will cost dramatically more over the decades ahead. Meanwhile, those “safe” investments?

They often can’t keep up with rising prices.

We see this all the time. Portfolios that feel comfortable today often leave people struggling to pay their bills twenty years later.

The answer is not to throw caution to the wind.

However, by understanding your required rate of return and building in a safety net, you can put yourself in a position to invest for the long term with confidence.

As an example, by keeping one to three years of expenses in cash or short-term investments, you’ll never be forced to sell assets at a bad time.

You gain peace of mind, but your remaining funds can still pursue the growth you need.

We know from history that market volatility is temporary. Markets recover. But inflation’s damage is permanent. Long-term investment returns are permanent, too, building wealth for those patient enough to stay invested.

The cash bucket lets you ignore the temporary whilst capturing the permanent.

Embracing Your True Investment Timeline

We can’t stress this enough: you’re not a retiree managing declining assets. You’re a long-term investor with a multi-decade investment horizon.

Your investment strategy and asset allocation should reflect this reality.

We encourage you to review your current approach with this extended timeline in mind. Ask yourself: “Is my portfolio designed for a 30-year journey?”

If not, it may be time to align your investment strategy with the reality of modern retirement.

We understand that maintaining growth-oriented portfolios in retirement requires both courage and careful planning.

As your adviser, we recognise that implementing this strategy involves navigating complex trade-offs between your changing risk tolerance and your unchanging need for long-term returns.

Your financial independence over the coming decades depends on striking the right balance.

We’re here to help you navigate this transition with confidence, ensuring your assets work as effectively in retirement as they did during your accumulation years.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production